Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: take the long view

Waiting Patiently in 2023

Clients and long-time followers already know one year of performance is really a nano-second of investing time. However, it’s instructive to look back on 2023 to see what happened in that snapshot of time. The US stock market was up 26.1%1 for the year. Not bad. If you invested $1,000,000 in the US market on January 1st, 2023, fell asleep, and woke up on January 1st, 2024, your account would have a value of $1,261,000. This would have been quite a pleasant surprise to wake up to. However, if you checked your account every month, your experience (mental and financial) was very different. Your portfolio would have lost value in February, August, September, and October. One-third of the months, you would have been frustrated with the returns. From August through October, your portfolio would been down 9.1%! Seeing $1,000,000 fall to $909,000 in a short three-month period may have freaked you out. In October, we got a few calls from newer clients worried about the market and wondering if we should take action.

Then November and December happened. The market ended up returning 15.2% over those two months. 58% of the gain for the year occurred in November and December. If you had sold after the 9.1% market decline, you would have missed over half the entire market premium for the year. Bouncing in and out of the market is a loser’s game. Let me repeat: bouncing in and out of the market is a loser’s game. Staying committed to the long view is a winning strategy over time.

The market behaves unpredictably every year, but two things remain true. First, markets are volatile and can go up and down very quickly. Second, investors are compensated with higher returns by staying invested in the market and observing the risk of volatile equity markets.

Keep in mind that even a one-year time frame is a short period. Equity markets can underperform short-term government bonds for over a decade. Taking the long view means not just staying invested for months or even years, but throughout an investment lifetime.

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy

Swifty vs. Sethy

The charismatic character in the photo above is a marketing genius and a provocative thinker. His name is Seth Godin. Long-time friends know that I’m a Seth Godin Superfan. Call me a “Sethy.” Much of his writing reflects his strong belief in taking the long view.

The charismatic character in the photo above is a marketing genius and a provocative thinker. His name is Seth Godin. Long-time friends know that I’m a Seth Godin Superfan. Call me a “Sethy.” Much of his writing reflects his strong belief in taking the long view.

Seth often says, “People like us do things like this” when fellow tribe members connect their values with how they live their lives. In particular, Seth sounds like us…clients, team members, and other evidence-based investors in this recent post. See if you agree.

If you don’t quite get the connection and want to learn more, let’s talk! Set up a call or meeting here.

Why Not Just Invest in Money Market Funds Currently Yielding 5%?

At Hill Investment Group, we pride ourselves on our steadfast commitment to long-term investing principles. Our philosophy centers around ignoring short-term market noise and focusing on sustainable, enduring strategies. Recent interest rate increases have sparked questions among our clients, particularly regarding money market funds and how to approach fixed-income investing in this evolving interest rate environment. If you have questions, we prepared this data with you in mind.

For over a decade, the Federal Reserve has maintained historically low-interest rates since the financial crisis of 2008. However, more recently, we have witnessed an increase in the federal funds rate (the interest rate at which depository institutions [banks and credit unions] lend reserve balances to other depository institutions overnight on an uncollateralized basis), signaling a departure from the exceptionally low-interest rate environment we have grown accustomed to.

What does this higher interest rate environment mean for investors?

As investors, we have a range of choices, from safe assets like short-term government debt to riskier alternatives such as venture capital. Each investment option carries a distinct level of risk, and investors typically opt for riskier assets only if they offer higher expected returns compared to safer ones. For example, if a 1-Year Treasury bill (US Government Debt) provided a 5% return, no rational investor would buy a 1-Year General Electric bond (a risker bet) paying a 4% return. Therefore, to entice investors to buy its bonds, General Electric would need to offer more than a 5% return.

To determine the riskiness of different investments, we can compare them to the least risky option, which is typically short-term US government debt. This is where the Federal Funds Rate comes in. The Federal Funds Rate acts as a benchmark for determining the interest rates of the least risky assets: short-term US government debt. As of May 15th, 2023, the federal funds rate was 5.08%.

This means an investor in a money market fund should expect a ~5% return for this low-risk investment. Other investment options need to offer returns surpassing this baseline to entice investors.

For instance, one of the corporate bond funds we like to invest in, Avantis Core Fixed Income ETF (AVIG), has a yield to maturity or expected return of 4.5%. That doesn’t look alluring compared to a money market yielding 5%. Why would any investor choose to invest in AVIG over a money market fund?

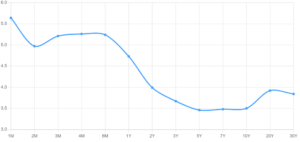

This is where the duration or timeline of the investment comes into play. The Federal Funds Rate is reset eight times a year, potentially causing fluctuating returns for money market accounts. For example, over the last year and a half, the return of money market accounts has increased from 0% to 5%. Over the next year and a half, it could return to 0% or rise even higher. No one knows what the Fed will do in the future, but Investors have expectations and use their expectations to invest in bond markets. Their investment sets market prices. A yield curve depicts the aggregate expectations of all investors for how interest rates will change in the future.

Looking at the current yield curve, investors can gauge the return they should anticipate for different investment durations, i.e. holding periods.

US Treasuries Yield Curve

5/15/2023

While market predictions are often wrong, there is no way of knowing if the market is over or underestimating future rate changes. Numerous financial blogs and media pundits claim they magically “know” where markets are going.

However, this is precisely where the beauty of markets reveals itself. The market aggregates everyone’s opinion on where rates will go, and rather than trying to outguess, we ignore the noise and trust the information embedded in market prices.

This brings us back to answering the question of “where” to invest. Money market funds typically have short durations of around 15 days. Investing in a money market fund, you could expect that 5% return for about 15 days. A month from now, the return could be higher or lower. The yield curve suggests that the market believes rates will decrease as longer-duration bonds have lower yields. For example, AVIG, our corporate bond fund, has a duration of 6 years. Looking at the yield curve, 6-year treasuries have an expected return of 3.5%. Thus, comparing 4.5% to 3.5%, you are being compensated with about 1% extra return for taking credit risk in AVIG compared to treasuries.

Interest rate changes are like rising or receding tides that lift or lower all boats. As interest rates fluctuate, we adhere to a consistent investment strategy. We understand that the risk/return tradeoffs are linked, and we do not attempt to time interest rate movements. This is why we do not recommend shifting your fixed-income investments to money market funds. We simply don’t know how long those relatively high, short-term rates will exist. The price of the funds we buy already incorporates the odds and risks of rates going up, down, or staying flat.

Instead, we focus on your long-term investment objectives and individual risk tolerances. We create a plan that meets your needs regardless of whether interest rates are rising or falling. Ultimately, all expected future interest rate changes are already factored into market prices, and it is not worth trying to outguess them.

That does not mean there are no appropriate use cases to invest in money market funds though. For example, if you are about to buy a home, it may make sense to invest the down payment in a money market fund to earn some interest with low risk.

We are here for you to review the different investment options and find a financial plan that works for your needs, with the goal of putting the odds of financial success in your favor.