Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Podcast

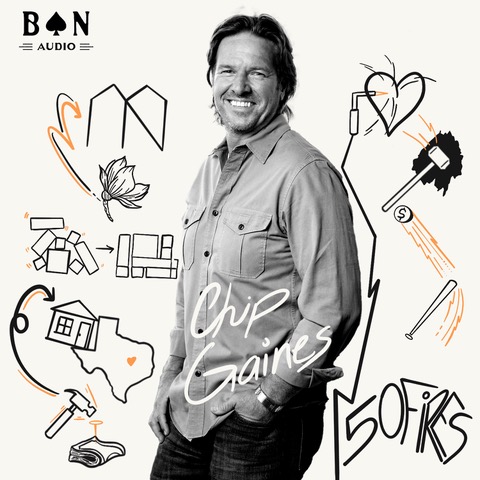

Money As a Tool for Impact with Chip Gaines

If you’re a long-time reader of our content, you recognize the name Carl Richards. Carl is the former New York Times writer and artist known as the “sketch guy.” He’s also an author and hosts two podcasts (plus a great friend). What’s the common thread in all his content: money and meaning. Carl lives and works at that intersection. His latest podcast, called 50 Fires, is intended to explore this connection with various successful and thoughtful friends. Here’s a fun place to start if you’re interested in thinking more deeply about what money means to you and your family.

Legend in Investing – Charles Ellis

Do you want to see and hear an investment legend interviewed by two of the nicest and smartest advisors I know? Tune into this episode of the Rational Reminder podcast with guest Charles Ellis, famous author, investing authority, and a top-notch communicator.

Cameron Passmore cohosts the Rational Reminder and is someone I consider a friend. He and his talented partner, Ben Felix, run one of the best podcasts related to investing. If you like this episode I suggest subscribing to their channel.

Here’s the rundown of what’s covered:

0:00 Intro

4:18 Charley defines a “Loser’s Game”

8:21 Why money management is a loser’s game

11:38 How the market has changed since writing about the loser’s game

19:09 Whether or not the sentiment toward active management is negative

22:03 Types of investor who should not invest in low-cost index funds

30:27 What investors and their advisors should be focused on

37:25 The importance of a well-defined investment policy statement

39:01 What investors can do to protect themselves from themselves

40:43 The most under-appreciated action investors can take to be more successful

50:16 Charley’s opinion on Vanguard’s entry into private equity

55:27 Where Charley sees the biggest future opportunities in the field of investment

1:00:15 What has made Vanguard successful as a company

1:08:14 What Charley has learned about personal motivation and productivity

1:12:04 Charley defines success in his life

1:14:12 Outtake

If you’d rather listen to the episode instead of watching on YouTube here is a link via Apple Podcasts.

New Podcast Episode

Who’s in control? You. No one else. In the latest podcast episode, Matt Hall reminds listeners that they are 100% in charge of what they focus on. Also, hear Matt’s all-time favorite personal finance story told by Morgan Housel, past podcast guest, and best-selling author. Listen to the episode on Apple or below.

To get a copy of Morgan’s book, email Matt (matt@hillinvestmentgroup.com)