Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: NYT; New York Times

Highlighting the Value of Independent Advice: Our NYT Feature in a Charles Schwab Campaign

I’m excited to share some recent news: Besides the television ads we’ve mentioned, I’ve had the privilege of being featured in a recent New York Times advertising campaign by Charles Schwab, celebrating the work of independent financial advisors. The campaign highlights the unique value we bring to our clients by considering their entire lives when managing their financial futures.

When people see the ad, they often ask, “How did you get selected for this?” It’s a good question, and the answer is simple: Schwab invited me to participate. We’re not paid to be in this ad, and we don’t pay anything to be featured. We chose to be involved because we believe wholeheartedly in the power of independent advice.

My quote in the ad says, “Your dreams deserve more personal attention,” and that’s not just a tagline—it’s core to the philosophy that drives us at Hill Investment Group. Unlike the traditional brokerage firms or wirehouses that are often more focused on sales targets, independent advisors are free to prioritize what truly matters: you and your goals. We’re not just managing portfolios; we’re connecting your investments to your big picture, your dreams, and your life.

We’re honored to be part of this campaign because it gives us an opportunity to share the story of independent advice with a broader audience. It’s a story about how personalized, unbiased guidance can make a real difference in people’s lives and how being independent allows us to align our interests with those of our clients.

Being featured in the campaign is not just about recognition; it’s about raising awareness of the benefits of working with independent advisors. It’s about championing a model that puts clients first, free from the conflicts of interest that can come with sales-driven environments. At Hill Investment Group, we’re proud to be part of this community and to show what’s possible when your dreams truly receive the personal attention they deserve.

If you have any questions about what it means to be an independent advisor or how we connect your portfolio to your life, don’t hesitate to reach out. We’re here to help you dream bigger, plan smarter, and live fully.

Fiduciary or Broker? The Glaring (and costly) Difference.

Sometimes you can’t shake a story because it keeps getting replayed in different forms. You might remember a piece in the NYT written a couple of years ago about a woman who stumbled upon gross misuse of her parent’s retirement money. Her parents’ brokers were mishandling the money for years, to their benefit – one stock had even been sold eight times in the same day, racking up enormous trading fees. It sounds shocking, but unfortunately, it’s an old story that bears repeating. Why? Sometimes we need reminding – employing a fiduciary advisor matters. “Fiduciary” means your advisor is legally bound to work in your best interest. Ask if your broker, or your parent’s broker, is held to this standard. Do you have a fiduciary advisor like Hill Investment Group?

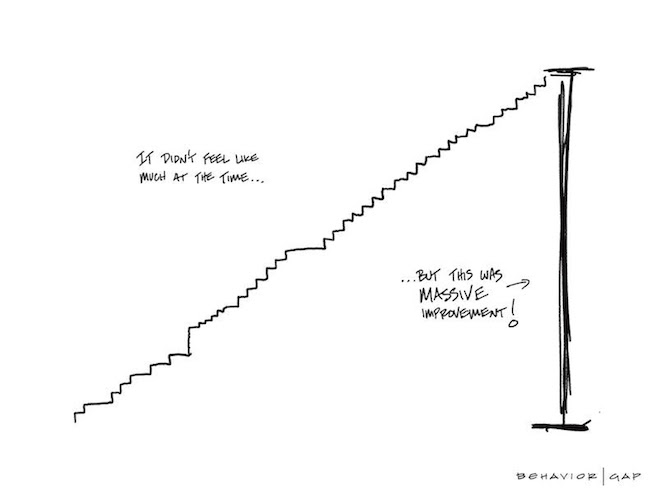

The Magic of Incremental Change

HIG friend, podcast guest, and NYT columnist, Carl Richards, shared the following story about how incremental change adds up if you take the long view. Keep reading for the story behind the sketch.

The Magic of Incremental Change

Back when I lived in Las Vegas, I used to ride road bikes with a semi-competitive group of riders. I remember when I first joined the group, it felt like a big victory if I could just keep up with them for the first 15 minutes. After a while, that became the first half-hour. Then an hour. One day, almost without even noticing it, I was suddenly able to stick with the pack for the entire ride.

It felt sudden at the time, but of course, it wasn’t. And although I was surprised, nobody else was, because they had all seen it before with other riders or experienced it themselves.

This is the sneaky power of incremental change.

Each day, you make a small improvement. Then, that becomes the new normal, and you get used to it. You make a small improvement again, and then that becomes the new normal. This happens over and over, slowly but surely. We barely notice we are getting closer to our goal, and then (again, seemingly “all of a sudden”) we’re there!

I didn’t feel a lot faster because I wasn’t a lot faster… compared to yesterday or even last week. In fact, I was just a little faster than I was last month. But month after month, ride after ride, it all added up. All those little bits of “faster” started to compound on top of one another.

Of course, this doesn’t just apply to riding bikes. I’ve had times in my career where I wondered if I was accomplishing anything. I specifically recall a time when I was working remotely for a large company. I got very little feedback on my work and was largely left alone. I loved the independence, but I also struggled because I had no idea if what I was doing was valued by the people I worked for.

To deal with this struggle, I started reviewing each week and noting what I had done. It felt weird at first because I didn’t want it to be seen as taking credit for things, but as the weeks added up and the list got longer, it felt good. I was doing stuff, and that stuff was making a difference, for sure.

No one else needed to see the list. It still felt good. It helped me to see, in real-time, how incremental changes add up.

If you build a process of reflecting every quarter, month, and year, you’ll never feel like you’re not accomplishing anything again. And while that may spoil some of the surprise of suddenly and unexpectedly arriving at your goal one day, I promise it will be worth it to feel much better along the way.

-Carl Richards