Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: investment philosophy

Why Presidential Elections Don’t Really Matter for Your Stock Market Return

Every four years, the United States gets consumed by the frenzy of presidential elections. It’s everywhere: TV, social media, and the minds of investors. Whether you’re on Main Street or Wall Street, the speculation about how the market will react to the latest poll or debate is impossible to escape. But there’s a simple truth that often gets lost in the noise—which political party is in office has little effect on the stock market.

For all the headlines and heated debates, historical data tells a clear story: a 60/40 portfolio has delivered average annual returns of around 8%, regardless of which party holds the White House. On top of that, election years are no different from non-election years. Although stock markets can show volatility during election years, and that can be uncomfortable, it doesn’t tell the whole story. Market returns during election years have also historically averaged 8%.

One of the most important lessons for long-term investors is that reacting to short-term political news is rarely a good idea. Trying to time the market based on election outcomes can lead to costly mistakes. Studies consistently show that missing just a few of the market’s best days—many of which often come after periods of volatility—can dramatically reduce your long-term returns.

For example, take this headline from Bloomberg back in 2022 predicting a 100% chance of a US Recession within a year.

For those keeping score the S&P 500 is up 61% as of 9/30/24 since that article came out.

Instead, the better course of action is often to stay invested. The stock market is priced at positive expected returns. In other words, over the long run, stocks are expected to grow in value. The market’s historical average return of 8% reflects this.

If you stay invested through election cycles, avoiding the temptation to sell or make drastic changes based on who wins or loses, you’re more likely to capture those long-term returns.

Whether it’s a blue wave, a red surge, or a contested result, research shows none of it changes the fundamental rules of investing. Stick to your plan, and let time—and the market’s resilience—work in your favor. Presidential elections come and go, but the market’s ability to deliver positive long-term returns remains.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Consult with a qualified financial adviser before implementing any investment or financial planning strategy.

June Newsletter Intro

Dear Friends and Clients,

I know it’s obnoxious to put a big ad of yourself in the introductory comments, but I’m hoping it captured your attention. I’m sharing it because it’s a new print advertisement in which I am featured, along with a sentiment that speaks to the core of our firm. This month, we celebrated our 19th birthday as an organization, a milestone that has been possible because of your unwavering support and trust. It’s a journey that got me thinking about our shared growth and success.

When we contemplated starting Hill Investment Group 20 years ago, our primary question was: What would it be like if we went back to the basics and focused on fewer clients and deeper relationships? Tom Cruise asked the same question in his Academy-nominated performance as Jerry McGuire (here is Jerry’s Mission Statement).

I’m unsure how Jerry’s next twenty years worked out, but the answer has been a steady path of progress and prosperity for us. We’ve built lasting relationships and guided our clients through various market cycles by prioritizing personalized service and evidence-based investing. This is what started us and is who we are today. Your trust and support in taking the long view have been integral to our success.

Here’s to many more years of focusing on what matters most!

Matt

Picking Up Pennies – Volume 7

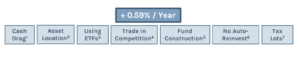

Welcome to the final installment of Picking Up Pennies. Last month, we discussed how understanding the concept of tax lots can optimize an investor’s tax consequences and even create a tax asset via active tax loss harvesting. Over the last six months, we have discussed different strategies we employ to increase returns, reduce costs, and minimize taxes. This final article will summarize the impact of these small decisions on your investment portfolio.

- Volume 1 – Keep Cash Balances Low (Better Chance for Higher Returns)

- Volume 2 – Asset Location (Reduces Taxes)

- Volume 3 – Using ETFs (Reduces Taxes)

- Volume 4 – Trading ETFs in Competition (Reduces Trading Costs)

- Volume 5 – Number of Funds and Not Auto-Reinvesting Dividends (Reduces Trading Costs)

- Volume 6 – Tax Lots and Tax Loss Harvesting (Reduces Taxes)

- Volume 7 – Summary (Total Impact)

Determining the exact impact of each decision is difficult as each strategy will impact every investor differently. For this analysis, we used what we think is a typical investor.

– Allocation is 60% Stocks and 40% Bonds

– Half of the money is in a taxable account, half is in an IRA

– Portfolio turnover is 10%/year

– 25% income tax rate, 15% capital gains tax rate

While the impact of some strategies may be more pronounced than others, it’s important to remember that every penny counts. When you add up all these strategies, you’ll see a significant difference in your investment outcomes. Specifically, about 0.59% per year or 59 basis points in financial industry jargon, which we prefer to avoid. Remember, all else being equal, the higher your tax rate, the more significant your net savings.

As discussed throughout the series, implementing these strategies is more than a one-size-fits-all approach. Each investor and family is unique, and tailoring these strategies to your needs takes time and effort. Our personalized approach is a testament to our commitment to your financial success.

In the first installment, I mentioned that I often ask other money managers how they implement these solutions. Most of the time, the response is, “We are not doing X because… it is too much work, clients don’t know the difference, the benefit is small, etc.” All of these answers are correct except one. It does take a lot of work…clients don’t normally notice the difference…but the benefit is NOT small. When you add all this up, it makes a meaningful difference. As your fiduciary, our obligation is to seek the best solutions we can find for our clients…no matter what.

These benefits are all the small details in your investment implementation. This series does not even include the bigger items that add even more value, like asset allocation, quarterly rebalancing, behavioral coaching, spending strategy, and a low-fee diversified investing strategy. Add it all together and compound these advantages over time, and now you’ve got something to be proud of now and in the long view!

1 Assumes the average investor holds 8% cash across uninvested cash and cash held in funds (5% + 3%). HIG holds 1% cash (0.7% + 0.3%). 60/40 portfolio returns 4% above cash. Impact = 30 bps

2 Assumes 5% bond returns and 10% equity returns. Impact = 20 bps

3 Assumes 3% annual capital gain distributions. Impact = 5 bps

4 Assumes savings of 2 cents per share traded. Impact = 1 bp

5 Assumes 20% additional fund turnover. 0.1% round-trip trading costs. Impact = 2 bps

6 Assumes 4% distributions and 0.1% higher trading costs. Impact = 1 bp

7 Tax benefits would depend on specific market conditions. Impact assumed to be zero for this analysis.