Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Financial planning

Why Not Just Invest in Money Market Funds Currently Yielding 5%?

At Hill Investment Group, we pride ourselves on our steadfast commitment to long-term investing principles. Our philosophy centers around ignoring short-term market noise and focusing on sustainable, enduring strategies. Recent interest rate increases have sparked questions among our clients, particularly regarding money market funds and how to approach fixed-income investing in this evolving interest rate environment. If you have questions, we prepared this data with you in mind.

For over a decade, the Federal Reserve has maintained historically low-interest rates since the financial crisis of 2008. However, more recently, we have witnessed an increase in the federal funds rate (the interest rate at which depository institutions [banks and credit unions] lend reserve balances to other depository institutions overnight on an uncollateralized basis), signaling a departure from the exceptionally low-interest rate environment we have grown accustomed to.

What does this higher interest rate environment mean for investors?

As investors, we have a range of choices, from safe assets like short-term government debt to riskier alternatives such as venture capital. Each investment option carries a distinct level of risk, and investors typically opt for riskier assets only if they offer higher expected returns compared to safer ones. For example, if a 1-Year Treasury bill (US Government Debt) provided a 5% return, no rational investor would buy a 1-Year General Electric bond (a risker bet) paying a 4% return. Therefore, to entice investors to buy its bonds, General Electric would need to offer more than a 5% return.

To determine the riskiness of different investments, we can compare them to the least risky option, which is typically short-term US government debt. This is where the Federal Funds Rate comes in. The Federal Funds Rate acts as a benchmark for determining the interest rates of the least risky assets: short-term US government debt. As of May 15th, 2023, the federal funds rate was 5.08%.

This means an investor in a money market fund should expect a ~5% return for this low-risk investment. Other investment options need to offer returns surpassing this baseline to entice investors.

For instance, one of the corporate bond funds we like to invest in, Avantis Core Fixed Income ETF (AVIG), has a yield to maturity or expected return of 4.5%. That doesn’t look alluring compared to a money market yielding 5%. Why would any investor choose to invest in AVIG over a money market fund?

This is where the duration or timeline of the investment comes into play. The Federal Funds Rate is reset eight times a year, potentially causing fluctuating returns for money market accounts. For example, over the last year and a half, the return of money market accounts has increased from 0% to 5%. Over the next year and a half, it could return to 0% or rise even higher. No one knows what the Fed will do in the future, but Investors have expectations and use their expectations to invest in bond markets. Their investment sets market prices. A yield curve depicts the aggregate expectations of all investors for how interest rates will change in the future.

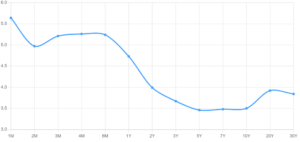

Looking at the current yield curve, investors can gauge the return they should anticipate for different investment durations, i.e. holding periods.

US Treasuries Yield Curve

5/15/2023

While market predictions are often wrong, there is no way of knowing if the market is over or underestimating future rate changes. Numerous financial blogs and media pundits claim they magically “know” where markets are going.

However, this is precisely where the beauty of markets reveals itself. The market aggregates everyone’s opinion on where rates will go, and rather than trying to outguess, we ignore the noise and trust the information embedded in market prices.

This brings us back to answering the question of “where” to invest. Money market funds typically have short durations of around 15 days. Investing in a money market fund, you could expect that 5% return for about 15 days. A month from now, the return could be higher or lower. The yield curve suggests that the market believes rates will decrease as longer-duration bonds have lower yields. For example, AVIG, our corporate bond fund, has a duration of 6 years. Looking at the yield curve, 6-year treasuries have an expected return of 3.5%. Thus, comparing 4.5% to 3.5%, you are being compensated with about 1% extra return for taking credit risk in AVIG compared to treasuries.

Interest rate changes are like rising or receding tides that lift or lower all boats. As interest rates fluctuate, we adhere to a consistent investment strategy. We understand that the risk/return tradeoffs are linked, and we do not attempt to time interest rate movements. This is why we do not recommend shifting your fixed-income investments to money market funds. We simply don’t know how long those relatively high, short-term rates will exist. The price of the funds we buy already incorporates the odds and risks of rates going up, down, or staying flat.

Instead, we focus on your long-term investment objectives and individual risk tolerances. We create a plan that meets your needs regardless of whether interest rates are rising or falling. Ultimately, all expected future interest rate changes are already factored into market prices, and it is not worth trying to outguess them.

That does not mean there are no appropriate use cases to invest in money market funds though. For example, if you are about to buy a home, it may make sense to invest the down payment in a money market fund to earn some interest with low risk.

We are here for you to review the different investment options and find a financial plan that works for your needs, with the goal of putting the odds of financial success in your favor.

The Greatest Double

This month we have one item we are sharing. It’s that important and that good. How do I know? At Hill Investment Group, we’ve been doing a series of morning Zoom calls for a few years now, and this piece from our own Charles Kafoglis is viewed as one of the best we’ve ever had. Charles won’t tell you this because he’s too humble, but his five-minute video is something everyone should see.

Why? It frames the magic of compounding in an easier way to digest and incorporate into your own life. Whether you are building towards financial independence or already there, I encourage you to watch our natural teacher, Charles Kafoglis, and his talk on “The Greatest Double.”

Summary of Topics:

- Example of doubling from one of Charles’s favorite teachers

- What it looks like to double every ten years

- Phases of life – learn, earn, adjourn

- The impact of the last double

- Do you have 3, 4, or more doubles?

2022 Investment Performance

It’s no secret that 2022 was challenging for both the stock and bond markets. Stocks ended the year down 18%*, while bonds were down 13%**. How did we do in 2022? Thanks to our compliance group, all we can say here is that our strategy of investing in low-cost, diversified strategies that tilt toward small, value, more profitable stocks meaningfully outperformed the S&P500 index in 2022.

As much as I would like to pat our firm on the back, you know our refrain: one year is essentially meaningless when it comes to investing. Due to the volatility and randomness of markets, any strategy can outperform or underperform in any given year. Our strategy certainly does not outperform every year and can even underperform several years in a row. To have real confidence in an investment strategy’s reliability, investors must look at how it performs over decades, not just years.

To see how we measure up over the long haul, we go back as far as we can, looking at the investments we recommended each year (and own ourselves) to see how our philosophy has held up over time. Our favorite chart compares the value of a hypothetical $1 invested in the year 2000 to 2022. Some of you may be familiar with Paul Harvey’s famous line regarding “the rest of the story.” Shoot me a note at zenz@hillinvestmentgroup.com for the details and the rest of the returns story. We can share how our recommended equity strategy has performed over time and the magnitude of the benefit of taking the long view.

If you have been a client for a while, you have likely seen the benefit of a long-term, evidence-based strategy show up in your portfolio. If you’re not a client, ask yourself why. Then pick up the phone and call us. You can schedule a call with me anytime here.