Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Charles Schwab

Details Are Part of Our Difference

As our clients know, we seek to eke out every last basis point of potential return for you. So, while we balance the ideal combination of factors to achieve the highest odds of excess return, we also seek to minimize all costs, expenses, and taxes which eat into an investor’s net return. There are a couple of ways this plays out:

Evaluating Asset Managers

When evaluating asset managers, we scrutinize their trading practices to implement their strategies cost-effectively. If they don’t have reasonable trading procedures, their trading costs will be higher and, ultimately, lower the return of your investment.

Reducing Trading Fees

Just like our fund managers, we want to make sure that we are trading cost-effectively to be good stewards of your hard-earned capital. The most recent step in this effort was transitioning much of our recommended portfolio from mutual funds to ETFs, mainly to eliminate fees for trading mutual funds.

At Hill Investment Group, we are not satisfied with just better; we are always working towards finding the best solution we can find for you. The change from mutual funds to ETFs is a savings win, but we were eager to take it one step further.

Eliminating Hidden Costs

You may not know that ETFs have their own unique hidden trading costs. Like stocks, ETFs trade with a bid-ask spread. That means that, for example, market makers may buy an ETF at $9.99 and sell it to another investor for $10.01. The market maker earns a nice $0.02 profit/share, and the buyer and seller pay the cost.

We wanted to make this better. So, for ETF trades of over a certain size, rather than trade on the exchange with a limited short-term supply, we deal directly with the banks. We get the banks to compete for our business and bid against each other. This can shrink and nearly eliminate the market maker’s profit. This competition and direct access yield better prices than we could otherwise get on the exchange.

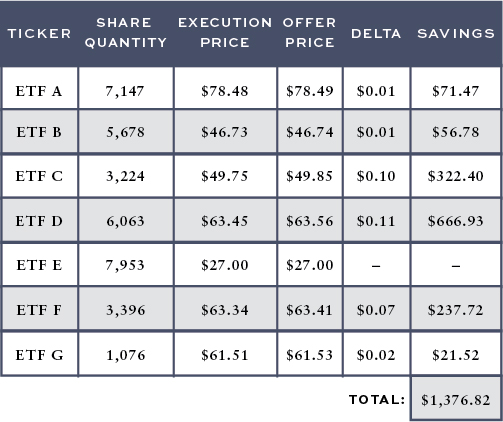

For example, we recently rebalanced one of our clients’ portfolios which resulted in purchases of various ETFs. The table above outlines the ETFs we bought, the price we would have gotten if we went to the market (Offer Price), and the price we executed at (Execution Price).

Conclusion: Details Matter

In just one day, using this trading strategy, we saved this client over $1,300 in trading costs. This one example is just one of many ways we fight for every basis point —the details matter and are part of the HIG difference.

Past results are not indicative of future results, or all client results. There are no implied guarantees or assurances that your target returns or cost savings will be the same as the example shown. Future returns or cost savings may differ significantly from the past due to many different factors. Investments involve risk and the possibility of loss of principal. The values and performance numbers represented in this report do not reflect management fees. The values used in this report were obtained from third-party sources believed to be reliable. Savings numbers were calculated by HIG using the data provided.

In Your Cyber-Corner: Protecting Yourself Against Phishing

Phishing. It can happen to almost anyone. Phishing emails try to trick you into clicking on their fraudulent links or attachments, which can inject your computer with malware or otherwise con you into giving away credit card numbers, login credentials and similar personal information.

Phishing. It can happen to almost anyone. Phishing emails try to trick you into clicking on their fraudulent links or attachments, which can inject your computer with malware or otherwise con you into giving away credit card numbers, login credentials and similar personal information.

For example, there’s been a fake email making the rounds lately, posing as an urgent notice from Schwab, and promising the recipient a “Security Benefits Award.” All you have to do (so they say), is click on the link provided and your account will be credited.

Unfortunately, those who fall for phishing schemes are far more likely to lose money than be credited any. Sheriff Schiffer here, with three solid suggestions on how to avoid getting hooked by a phisher.

- Don’t Click. Your first and strongest line of defense is to never click on any links or open any attachments in a phishing email. If you don’t take their bait, they won’t be able to reel you in.

- Don’t Trust. While it’s too bad we must always be on guard, today’s online environment essentially requires it. Rest assured, if Schwab or any other reputable service provider requires follow up from you, this is NOT how they’ll go about requesting it. Be especially wary of:

- Unsolicited emails arriving out of the blue, even if they’re supposedly from a familiar source

- Enticing offers or scary alerts with a sense of urgency; phishers know people tend to throw caution to the wind when greed or fear takes over; they literally bank on it

- Typos, bad grammar or generic salutations; not all phishing emails contain these, but many do

- Do Verify. Believe me, your family, friends and professional alliances would much rather hear from you directly if anything they have supposedly sent to you seems suspicious. It’s always a good idea to be in touch by calling or sending a separate email (don’t hit “reply”), and asking the alleged sender if they really did send it.

A bonus tip: If an email smells “phishy” to you but you’re not sure either way, you should also be able to reach out to your financial advisor or a similar reputable source, asking for extra input. Here at Hill Investment Group, we’re happy to assist our clients with these sorts of questions. It’s in everyone’s best interest if we all join forces against phishers.

HIG Time-Saving Service at Tax Time

You know all those tax season emails you get from Charles Schwab, informing you that your Form 1099s are ready to download and share with your tax professionals?

You know all those tax season emails you get from Charles Schwab, informing you that your Form 1099s are ready to download and share with your tax professionals?

Hill Investment Group clients can largely disregard those notices, because we take care of this busy-work for them. We aggregate the 1099s for the accounts we manage for them, and send the documents to those who need them, safely, securely and without our clients having to lift a finger. (Unless you count that single click to delete the email notifications.)

This is just one way we strive to simplify our clients’ busy lives, so they can focus on the things that are important to them.