Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: 401(k)

Hey Hill, How Can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com.

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com.

Hey Hill, Is a Pre-Tax or Roth 401(k) Right for Me?

Picture this: you’ve just landed a new job, and you’re ready to dive into your benefits package. You’re at the 401(k) enrollment screen, wondering: “Pre-tax or Roth contributions—which one’s the better long-term choice?” Many of our clients face this same question, and the answer often depends on your financial goals. Here’s a quick breakdown to help you make an informed choice.

Pre-Tax vs. Roth: What’s the Difference?

Think of it like shopping with a choice between a discount today or tax-free shopping later.

- Pre-tax contributions lower your taxable income now, saving you on taxes this year. But you’ll owe taxes on those funds, plus any growth when you withdraw in retirement.

- Roth contributions are taxed upfront, giving you the benefit of tax-free growth and tax-free withdrawals in retirement.

How This Can Look in Dollars:

If you’re in the 24% tax bracket, contributing $10,000 pre-tax saves you $2,400 this year. With Roth, you pay that tax now but enjoy tax-free withdrawals on both the initial amount and any growth in the future.

Key Factors to Consider:

- Current vs. Future Tax Bracket: Are you early in your career and expecting your income to grow? Roth might make sense, letting you lock in today’s lower tax rate. But if you’re in a high-earning phase and expect a lower tax bracket in retirement, pre-tax could be more advantageous.

- Time Horizon: The longer you have until retirement, the more valuable Roth’s tax-free growth can be. Younger savers often benefit from decades of compounding without a tax hit.

- Employer Match: Don’t forget that any employer match is usually pre-tax, giving you a mix of both types, regardless of your choice.

Need Help Deciding?

This choice doesn’t have to be overwhelming. If you want help deciding between pre-tax and Roth contributions—or figuring out how much to save and where to invest—reach out. We’re here to help you get clear on what makes sense for your financial future.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Consult with a qualified financial adviser before implementing any investment or financial planning strategy.

Hey Hill, how can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

Hey Hill, what should I do about 401k accounts with previous employers?

Congratulations! You just started a new job that provides fulfillment, purpose, and great rewards. In your initial weeks, your new employer offers you a new retirement plan with wonderful investment options and a generous company match.

What can you do to maximize the value of your current retirement plan as a part of your overall portfolio? What about the employer retirement plan you left behind with your previous job?

For your current plan:

- We can incorporate your retirement plan assets into your overall plan and portfolio. This helps us stay in line with your goals and can help with after-tax returns. You can find more details here.

For the plan you left behind with your previous job:

You have four basic options:

- Leave the money in your old employer’s plan. (Usually not a great idea.)

- Transfer the funds into your new employer’s plan.

- Transfer the funds into your existing IRA (traditional and/or Roth).

- Cash-out the plan and pay the taxes and penalties, if applicable.

Here are some key factors that may influence your decision:

- Employer plans have a set menu of investment options and associated fees. While you may be satisfied with those options, a rollover IRA will not limit investment options and generally allows you to invest at a lower cost.

- Many who hold on to old employer plans tend to lose track of them; therefore, they are rarely rebalanced as the market changes nor managed as part of their household portfolio.

- Many plans have pre-tax and Roth components, which may or may not align with a new employer’s plan offerings, but they can be easily rolled over to your traditional and Roth IRAs.

- Cashing out of the plan may involve unnecessary penalties and taxes.

- A unique feature of a 401k is that you can borrow money against it but not from an IRA.

- If you utilize a Backdoor Roth strategy, you may prefer to keep your retirement funds in a 401k to avoid the complications of a non-zero balance IRA account.

In the end, the combination of the above factors leads many to roll over their old plan to their individual IRA. This IRA becomes a hub as they move in and out of employers’ plans throughout their careers. On balance, the ability to choose your low-cost investment options in harmony with your other assets makes the option to roll over into an IRA a sound decision.

Anytime you change jobs, we encourage you to discuss your situation with your Hill advisor. One size doesn’t fit all, and your advisor can help you work through your situation. Book a call with us if you have questions!

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in managing a client’s account. Consult with a qualified financial adviser before implementing any investment or financial planning strategy.

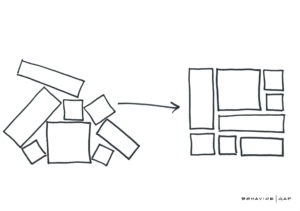

The Big Picture: Integrating all of your Assets at Hill

Integrating Your 401(k) into your Financial Plan

To have the best and most accurate picture of your financial situation, you must look at every asset (and liability). Did you know that you can integrate your 401(k), 403(b), 457, HSA, and variable annuity accounts into your overall plan? And get help managing the investments directly?

We have a new state-of-the-art system that allows for safe and compliant HIG advisor access to all of your accounts – taking the hassle, fiduciary responsibility, and management risk off your plate.

What does this mean for me?

- HIG taking fiduciary responsibility – upon setup, HIG takes on immediate responsibility for managing these assets.

- Combatting volatility with timely trading and rebalancing – ensuring your allocation is in line with your plan, no matter what’s happening in the markets.

- Investing in the right funds for you – full review of the cost and quality of available funds immediately upon setup, repeated quarterly.

- Tax efficiency through asset location – maximizing the value of these vehicles as an important part of your portfolio.

- Cost – the cost for this service is determined according to your regular fee schedule. See more details here.

Why it matters

These accounts shouldn’t be an orphaned part of your financial picture. Let us coach you more effectively and get the peace of mind knowing ALL of your assets are taken care of, no matter what.

Ready to set up your access to this service?

Schedule a call with me here. Setup takes no more than 15 minutes.