Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

2 Minute Video: HIG and Focus In Our Own Words

Want to hear what we really think about our partnership with Focus? Get it here from Nell, Matt, Katie, PJ, John, and me in just over two minutes. Our new video captures in our own words what this next chapter means for our clients and team.

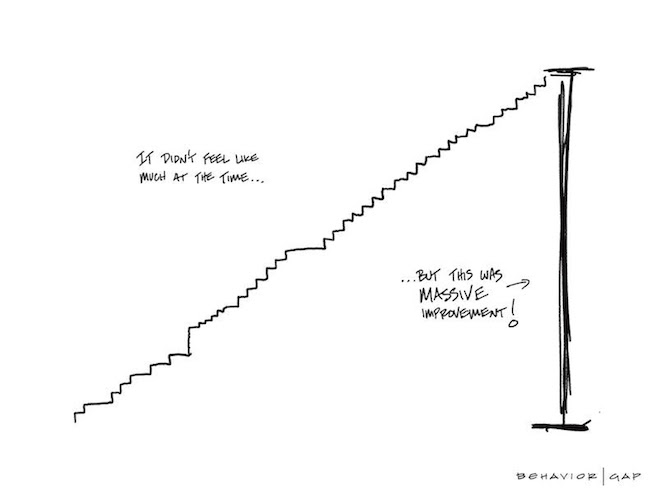

The Magic of Incremental Change

HIG friend, podcast guest, and NYT columnist, Carl Richards, shared the following story about how incremental change adds up if you take the long view. Keep reading for the story behind the sketch.

The Magic of Incremental Change

Back when I lived in Las Vegas, I used to ride road bikes with a semi-competitive group of riders. I remember when I first joined the group, it felt like a big victory if I could just keep up with them for the first 15 minutes. After a while, that became the first half-hour. Then an hour. One day, almost without even noticing it, I was suddenly able to stick with the pack for the entire ride.

It felt sudden at the time, but of course, it wasn’t. And although I was surprised, nobody else was, because they had all seen it before with other riders or experienced it themselves.

This is the sneaky power of incremental change.

Each day, you make a small improvement. Then, that becomes the new normal, and you get used to it. You make a small improvement again, and then that becomes the new normal. This happens over and over, slowly but surely. We barely notice we are getting closer to our goal, and then (again, seemingly “all of a sudden”) we’re there!

I didn’t feel a lot faster because I wasn’t a lot faster… compared to yesterday or even last week. In fact, I was just a little faster than I was last month. But month after month, ride after ride, it all added up. All those little bits of “faster” started to compound on top of one another.

Of course, this doesn’t just apply to riding bikes. I’ve had times in my career where I wondered if I was accomplishing anything. I specifically recall a time when I was working remotely for a large company. I got very little feedback on my work and was largely left alone. I loved the independence, but I also struggled because I had no idea if what I was doing was valued by the people I worked for.

To deal with this struggle, I started reviewing each week and noting what I had done. It felt weird at first because I didn’t want it to be seen as taking credit for things, but as the weeks added up and the list got longer, it felt good. I was doing stuff, and that stuff was making a difference, for sure.

No one else needed to see the list. It still felt good. It helped me to see, in real-time, how incremental changes add up.

If you build a process of reflecting every quarter, month, and year, you’ll never feel like you’re not accomplishing anything again. And while that may spoil some of the surprise of suddenly and unexpectedly arriving at your goal one day, I promise it will be worth it to feel much better along the way.

-Carl Richards

Celebrations

This month we celebrated the work anniversaries of Buddy Reisinger (12 years) and Katie Ackerman (6 years).

This month we celebrated the work anniversaries of Buddy Reisinger (12 years) and Katie Ackerman (6 years).

Buddy’s decade-plus with HIG makes him a truly committed member of the team. He’s known not just for his tenure at the firm but also for his fun-loving personality and 24/7 access. The “Bud Man” is an original, and we love him.

Katie is the first voice our clients hear on the phone and is as thoughtful in serving our team as she is with our clients. Her sense of humor, hospitality, and witty teasing are some of the essential ingredients that make HIG feel like “Cheers.”

We appreciate all their hard work and dedication!