Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

The Magic of Incremental Change

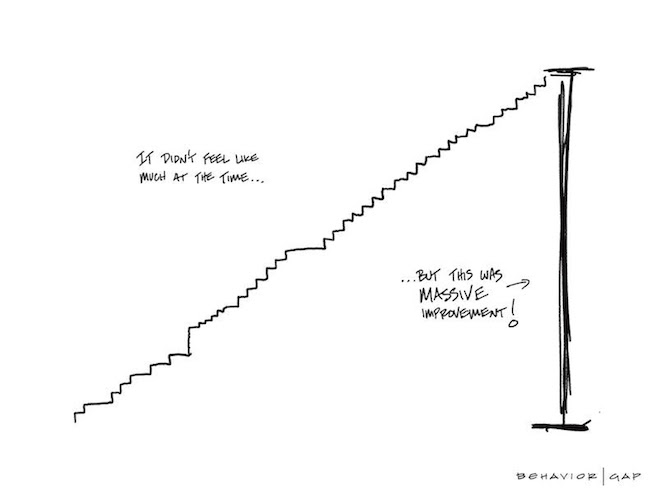

HIG friend, podcast guest, and NYT columnist, Carl Richards, shared the following story about how incremental change adds up if you take the long view. Keep reading for the story behind the sketch.

The Magic of Incremental Change

Back when I lived in Las Vegas, I used to ride road bikes with a semi-competitive group of riders. I remember when I first joined the group, it felt like a big victory if I could just keep up with them for the first 15 minutes. After a while, that became the first half-hour. Then an hour. One day, almost without even noticing it, I was suddenly able to stick with the pack for the entire ride.

It felt sudden at the time, but of course, it wasn’t. And although I was surprised, nobody else was, because they had all seen it before with other riders or experienced it themselves.

This is the sneaky power of incremental change.

Each day, you make a small improvement. Then, that becomes the new normal, and you get used to it. You make a small improvement again, and then that becomes the new normal. This happens over and over, slowly but surely. We barely notice we are getting closer to our goal, and then (again, seemingly “all of a sudden”) we’re there!

I didn’t feel a lot faster because I wasn’t a lot faster… compared to yesterday or even last week. In fact, I was just a little faster than I was last month. But month after month, ride after ride, it all added up. All those little bits of “faster” started to compound on top of one another.

Of course, this doesn’t just apply to riding bikes. I’ve had times in my career where I wondered if I was accomplishing anything. I specifically recall a time when I was working remotely for a large company. I got very little feedback on my work and was largely left alone. I loved the independence, but I also struggled because I had no idea if what I was doing was valued by the people I worked for.

To deal with this struggle, I started reviewing each week and noting what I had done. It felt weird at first because I didn’t want it to be seen as taking credit for things, but as the weeks added up and the list got longer, it felt good. I was doing stuff, and that stuff was making a difference, for sure.

No one else needed to see the list. It still felt good. It helped me to see, in real-time, how incremental changes add up.

If you build a process of reflecting every quarter, month, and year, you’ll never feel like you’re not accomplishing anything again. And while that may spoil some of the surprise of suddenly and unexpectedly arriving at your goal one day, I promise it will be worth it to feel much better along the way.

-Carl Richards

Celebrations

This month we celebrated the work anniversaries of Buddy Reisinger (12 years) and Katie Ackerman (6 years).

This month we celebrated the work anniversaries of Buddy Reisinger (12 years) and Katie Ackerman (6 years).

Buddy’s decade-plus with HIG makes him a truly committed member of the team. He’s known not just for his tenure at the firm but also for his fun-loving personality and 24/7 access. The “Bud Man” is an original, and we love him.

Katie is the first voice our clients hear on the phone and is as thoughtful in serving our team as she is with our clients. Her sense of humor, hospitality, and witty teasing are some of the essential ingredients that make HIG feel like “Cheers.”

We appreciate all their hard work and dedication!

Does Anyone Remember Inflation?

We’re fortunate inflation has been low, but that doesn’t mean we shouldn’t be prepared for its return. What are important ways we look at offsetting inflation for our clients? Our partners at Dimensional have outlined points on best practices. Read below.

Background:

- On Wednesday, January 13th the Labor Department stated that the consumer price index (CPI) increased by 0.4% in December and 1.4% for 2020, which was the smallest yearly gain since 2015 and was a significant deceleration from 2.3% in 2019.1

- However, given the $900 billion pandemic relief plan approved in December and the expectation for more fiscal stimulus, along with the rollout of the COVID-19 vaccine, some economists are forecasting a rise in inflation for the months ahead. As forecasts have moved higher, so too have market measures of inflation expectations. The 10-year breakeven rate, which is derived from prices of inflation-protected government bonds, recently climbed above 2% for the first time since 2018.2

Ways to mitigate the effects of inflation while still growing wealth:

- Commonly, equities are used as the growth asset within a portfolio and can help protect against purchasing power risk. While inflation has averaged about 4% annually over the past 50 years3, stocks (as measured by the S&P 500 Index) have returned around 11% annually during the same period.4 Therefore, the “real” (inflation-adjusted) growth rate for stocks has been around 7% per year, for the period.

- There are also tools within fixed income to hedge inflation risk including Treasury Inflation Protected Securities (TIPS). TIPS deliver the credit quality of the US Treasury, while hedging against unexpected inflation. As inflation (measured by the CPI) rises, so does the par value of TIPS, while the interest rate remains fixed. This means that if inflation unexpectedly rises, the purchasing power of any principal invested in TIPS should also increase. Dimensional’s Inflation Protected Securities Portfolio (DIPSX) launched in 2006 and has been ranked in the top quartile of its Morningstar category over the last 1-,3-,5-, and 10-years, outperforming its benchmark over each of those time periods.5

- When considering future consumption, investors may prefer a strategy that might provide higher expected returns over TIPS by investing in corporate bonds, while tax-sensitive investors may prefer a strategy that provides exposure to municipal bonds in addition to inflation protection.

Bottom Line: The good news…our clients don’t have to keep track of all these tools. That’s why we’re here for you. We stay on the cutting edge of investing and implement the best-in-class solution in an evidence-based investing world on your behalf. Curious how we can help you hedge inflation risk in your portfolio? Schedule a complimentary call with our advisory team by clicking here.