Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

What is a SPAC?

Have you heard about special purpose acquisition companies (SPAC)? Former NBA champion Shaquille O’Neal, former Speaker of the House Paul Ryan, hedge fund manager Bill Ackman, tennis legend Serena Williams, and former MLB player Alex Rodriguez all have one thing in common – they are all involved with SPACs. The hot new craze has caught Wall Street and celebrities buzzing, but should you care?

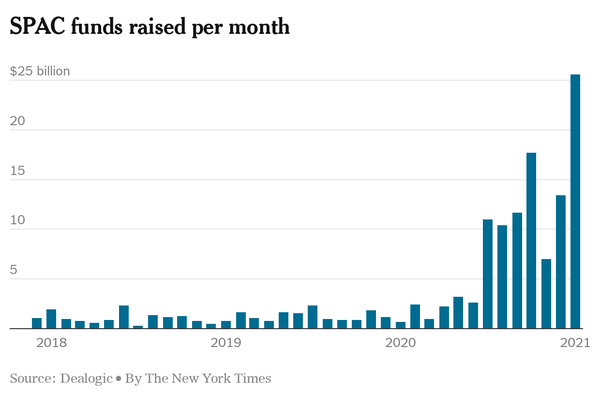

In 2020 we saw a resurgence in SPACs, as 248 new SPACs raised roughly $82 billion throughout the year, eclipsing the level from the previous decade. The SPAC boom has showed no signs of slowing down in 2021, as sponsors have raised nearly $26 billion in January alone, a monthly record.

SPACs, short for “special purpose acquisition companies”, are also sometimes known as “blank-check companies”. These companies are designed to raise funds through an initial public offering (IPO) in order to finance an acquisition, merger, or similar business combination with a private company. They often have no operating history of their own.

So, how do SPACs differ from traditional IPOs, the method in which many investors may be familiar with how companies go public? We can think of a traditional IPO as a company looking for money while a SPAC is money looking for a company.

SPACs tend to be quicker to market than traditional IPOs, as the process can take a few months, much shorter than the 24-36 month process for a traditional IPO. In addition to the benefit of speed, SPACs provide retail investors with early access, something not generally available in traditional IPOs, as shares are reserved for certain clients of the underwriting banks. For many SPACs, the sponsors/founders receive a 20% allocation, leading to a dilution in the company and potentially misaligned incentives. Because SPACs generally must use the money they’ve raised within two years or return it, they may be incentivized to get any deal done, regardless if it’s a good one.

What’s the bottom line? SPACs are simply another way for companies to raise capital and the public should be aware of the inherent pros and cons. Rather than being worried about missing out on the newest investment fad, most investors should work with their advisors to build a long-term plan that will help them achieve their financial goals. In other words, keep taking the long view.

March Madness Redefined

March has been a great month for Abby Crimmins. She was recently promoted to Associate Advisor and, after passing with flying colors, is now Hill’s newest CERTIFIED FINANCIAL PLANNER™. Days later, the celebrations continued when her longtime boyfriend, Joe Wiss, proposed to her! Their special moment was shared with close family and friends who traveled to St. Louis to celebrate with the newly engaged couple. Now that’s real March Madness!

Image of the Month – Get 2.5 years back!

We love images that capture the benefits of “taking the long view.” Here is Rick Hill, our Co-Founder, on a family hike in Palm Desert. Rick knows that by removing the stress of investing out of our client’s lives, they can spend more time doing the things they love. Rick and Lynn Hill, who of course are clients themselves, estimate that they’ve saved six weeks per year by adopting an evidence-based approach. That’s 2.5 + years going back to 1998! Now start to compound the value of that time saved and the results become even more satisfying.

*Rick’s time-saving story was captured in Larry Swedroe’s books, most recently in Playing the Winner’s Game.

Like this? Follow us on Instagram and check out our team living the benefits of “taking the long view,” then send us your own example!