Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Effective and Efficient Charitable Giving

Numerous studies have tried to measure the psychological benefits of giving to others. Whether giving to another person or organization or helping a friend with a project, the donor’s psychological benefits are typically even more significant than the recipients. In that light, let’s discuss three of the most common ways to give money to various charitable organizations and their respective benefits.

Cash: The most common method is to write a check from one’s checking or investment account. Then, you accumulate all of your documentation of charitable giving throughout the year, and you may get a tax deduction. We say “may” because you will only receive a tax deduction for your charitable giving if all your itemized deductions exceed the standard deduction.

Qualified Charitable Distribution: Another option is to make a charitable contribution directly from your IRA. This option is only available for those over 70.5, and the maximum amount is $100k/year. There is no tax on the IRA withdrawal and no deduction on the tax return. This option is attractive for those whose standard deduction is larger than one’s total individual deductions.

Additionally, for those 72 and older, the withdrawal from their IRA will count toward their required minimum distribution for that year. Not having the full required minimum distribution amount count as income will lower one’s taxable income, which may have other benefits such as lower the Medicare surcharge on Social Security.

Donor-Advised Fund: A third option is to establish a Donor Advised Fund (DAF) and contribute taxable assets to the fund that will supply several years of future donations (we suggest 5-10 years of one’s annual contributions). We typically recommend clients contribute appreciated securities that they have held for over one year to the fund to avoid realizing the gain on the position. You will take a tax deduction within the year you fund your DAF. You can make contributions at any point in the future or bequeath the fund to specific organizations at your death. There is no additional tax deduction when you grant the money to charities, and there is no need to track the donations. Additionally, because the money inside the fund is invested, it can continue to grow and allow you to give more to charitable organizations that are important to you.

These are just three of the many ways to give to charitable organizations important to you. For more information on methods of charitable giving please reach out to us.

New Podcast Episode

Who’s in control? You. No one else. In the latest podcast episode, Matt Hall reminds listeners that they are 100% in charge of what they focus on. Also, hear Matt’s all-time favorite personal finance story told by Morgan Housel, past podcast guest, and best-selling author. Listen to the episode on Apple or below.

To get a copy of Morgan’s book, email Matt (matt@hillinvestmentgroup.com)

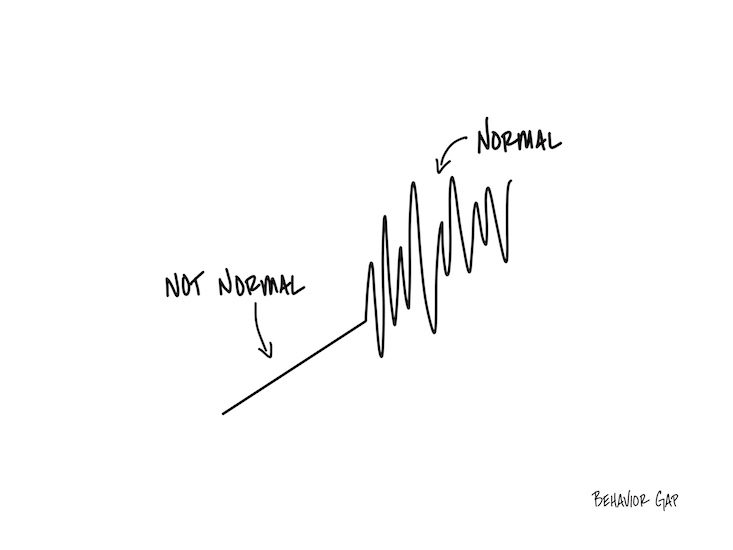

Normal Volatility

Imagine it’s a very still day, and you’re in a boat on the ocean.

There’s no wind.

No swell.

The water is as flat as a mirror.

The calm goes on just long enough for you to start to feel like it’s normal.

When a small wave finally comes… it feels big. When a regular wave comes… it feels huge.

As scary as it might feel, it’s important to remember that waves are normal.

In fact, occasional storms are normal.

And the last thing you want to do when you get into a storm is abandon ship.