Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

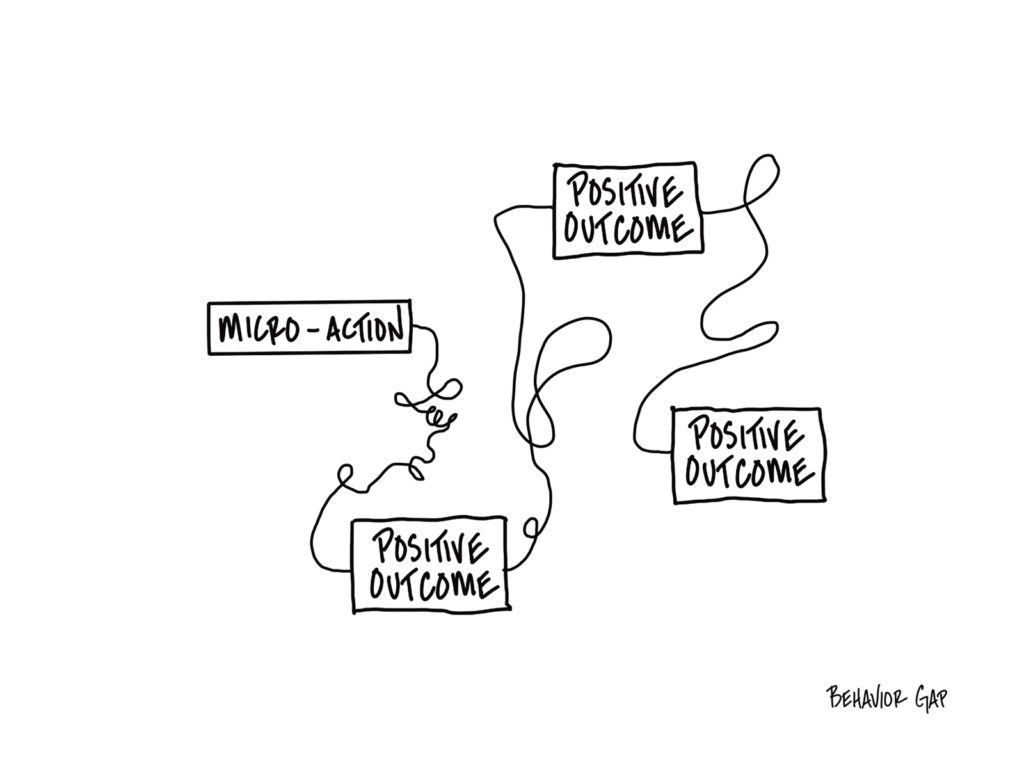

Image of the Month

When tackling big, audacious goals, you don’t need big, audacious actions. All you need is the contagious magic of micro-actions.

Let me give you an example.

When I travel, I often don’t feel like exercising, even though I know I’ll feel way better if I

do. So, in the morning, I don’t commit to a program to lose 12 pounds in twelve days or promise myself to run for 40 minutes. I just put on my gym clothes.

That’s it.

And then, since my gym clothes are on, I almost always decide to just walk to the gym and take a look.

What happens next is what almost always happens when I step into a gym: I see the bikes and think, “I bet it will feel good to get on one of those for a few minutes.” So I do.

And other exercises naturally follow that.

After I exercise, I think, “Man, it would feel great to stretch,” so I do that, too. And then, since I’m on a roll, I decide to eat a healthy breakfast instead of sugary garbage. Later at work, I’m extra productive since my body feels great.

See what I mean about contagious?

There’s a reason 80% of New Year’s Resolutions fail. The problem isn’t the goals, it’s the way we go about trying to tackle them. We try to go big and burn out, forgetting that “slow and steady wins the race.”

The magic here is in breaking down big, hard, sometimes even scary goals into attainable pieces. Find something small and attainable you can do, start there, and let the contagious magic of micro-actions do the rest.

What HIG Predicts in 2022

At the beginning of each year, money managers and financial experts release many predictions around what the forthcoming 12-months will bring from an investing standpoint. But forecasts rarely pan out, particularly in a year as unpredictable as 2021. It is hard, if not impossible, to outguess the market.

So what is the Hill Investment Group take? We expect the US stock market to be up in 2022 between 6-10%. We also predict that the market will most likely not return between 6-10% in 2022.

You probably needed to read that prediction twice, as it seems to contradict itself. Let us explain.

Why do we expect the market to be up between 6-10% in 2022?

That probably seems too simple of a claim given the current market environment. As of the writing of this post, the total US market is at an all-time high; Omicron is spreading rapidly throughout the US, inflation expectations are higher than they have been in decades. Historically, the market has been up, on average, between 6-10% annually. Clearly, with all of these unique circumstances, we can’t expect this year to be like previous years, right?

That is the beauty of the market. Every year is different, and every year the market takes all of these factors into consideration when setting prices. Investors know all of the risks mentioned above, and the current price reflects a fair price for taking on those risks. No matter how you slice the historical data, the market is up about two-thirds of the time, usually between 6-10%. Whether you look at what political party is in office, what inflation expectations are, whether the market had a positive return the previous year, or even if the St. Louis Cardinals made the playoffs…These factors are incorporated into the current price and usually provide investors an expected return roughly between 6-10% over the long term for taking the risk of investing in the equity markets.

Why do we predict that the market most likely will not return between 6-10%?

Although the market, on average over the last roughly 100 years, has returned between 6-10% annually, it rarely returns within that range in any single year. About 1/3rd of the time, the market has had a negative return, about 1/3rd of the time a return between 0-20%, and about 1/3rd of the time a return above 20%. Dating back to 1928, the market has only had a return within two percent of the long-run average four times! Yes…only four times in nearly a century.

This is why we EXPECT the market to return between 6-10% but PREDICT that it most likely will not.

When investing in the stock market, the range of investment returns is much larger than the average return. This is part of what makes investing so hard and why many investors, especially those that choose to do it themselves, get scared and leave the market just when they should likely stay in…or vice versa. It is difficult to see the long-run average when dealing with such volatile swings year to year. However, when you take the long view, embrace our relationship, and think in terms of decades rather than years, you will start to see the benefit and ignore the year-to-year noise and volatility.

My First Market Decline – 1969

I still have vivid memories of my first market decline when I was working as a stockbroker. For the first two years of my career, nearly everything I recommended was going up. I was proud of the value I thought I was providing to my clients and impressed with how smart I was.

By 1969, the Dow Jones Industrial Average was getting close to an all-time high of 1,000. Then it started to decline and just kept going down. It eventually dropped almost 40%.

The situation hit me hard. I felt so bad about the losses my clients were experiencing that I couldn’t sleep and had stomach problems. To make things worse, a lot of my early clients were friends of my parents. When I would go home for a visit, I would call ahead and ask my parents to move their car out of the garage so I could park there and close the door behind me. I didn’t want my parents’ neighbors to know I was home because I couldn’t face questions about why their stocks were doing so poorly. I really didn’t know what to say because I didn’t have an answer. It was during this period that I spent one afternoon hiding out in the movie theater watching a Clint Eastwood triple feature!

Eventually, I went to my manager and asked for advice: What can I do? What should I say? He was surprised by my questions and responded bluntly with, “Keep trading stocks.” That was my job, after all. We were brokers, not financial advisors. We were paid to trade stocks because trading created revenue for our firm whether the stocks went up or down in our clients’ accounts.

Then he added something that turned out to be good advice for me. He said that if the market decline was bothering me that much, I should quit my job and go work in a bank trust department. He was right. I wasn’t interested in selling stocks to help a firm make money whether or not my clients won or lost..I left my brokerage job shortly thereafter.

Obviously, I’ve experienced many more market downturns since that fateful time…because that’s simply what the market does. We just can’t accurately predict when. In fact, there have been 10 times when the market declined more than 20% in the past 50 years—with the two most recent happening in 2007-2009 (down 55%) with the financial crisis and in March 2020 (down 35% in 21 days) with the COVID-19 pandemic.

Lesson Learned: Expect that the market will decline and ignore it when it does.

History shows that market declines are inevitable—higher equity returns wouldn’t be possible without the risk of occasional downturns. Also, market declines are temporary. When you remember these two facts, you’re less likely to let your emotions get in the way of your long-term investing strategy. After all, a loss isn’t a loss until you sell your position.

Of course, ignoring market downturns is easier said than done. I admit that I still feel anxious during these periods, and I know that many investors experience the same sleeplessness and pit-in-the-stomach sensations I felt back in 1969. Today, though, I’m not afraid to face my clients when the markets are bad.

Instead, I like to initiate calls during these rough periods just to ask how they’re feeling and to give them better advice than I could have 50 years ago. Instead of recommending new stock trades, I tell them to do nothing – except the occasional rebalance. This downturn, like others before it, will pass.

Also, I’ve learned, and communicated to all that will listen…especially our clients…to focus on what you can control. The market is not controllable. Your investing philosophy, asset allocation, and personal spending and savings are in your control. Focus your attention, energy, and actions there. And leave the rest to us.