Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Rick’s Story…All Together Now

As dedicated readers know, over recent months we’ve published “chapters” of Rick Hill’s 50-plus years in the finance industry, and many of you have asked, “Can we get Rick’s entire story all in one place?” The answer is a resounding “of course!” So here it is…all together…Wharton Business School through founding Hill Investment Group. Stay tuned. Rick isn’t finished adding to his lessons.

Congratulations Katie!

Katie Ackerman is an essential player on our team and just earned a promotion! Hear from Katie in this short video, and then celebrate with us as we announce her new role as Client Service Administrator. Starting in May, Katie will transition to our client service team. It’s a natural fit since she has been consistently available to help with our client’s needs since she joined Hill Investment Group in 2015. You may not hear Katie’s voice on the phone as often, but her time and energy will be more focused on serving you than ever before!

Katie has come a long way since this photo was taken in 2015.

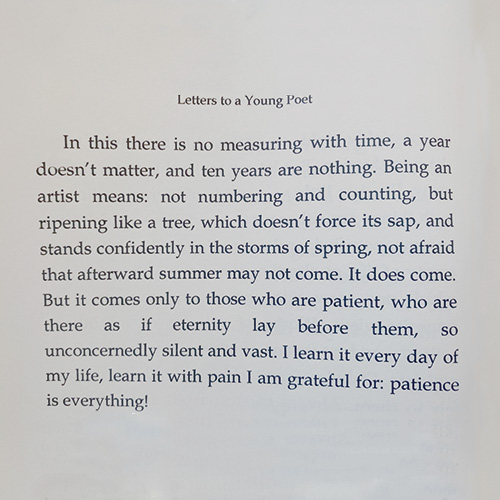

The Poetry of the Long View

How long exactly is the long view? We found the perfect quote from Letters to a Young Poet to help answer that question.

“Ten years are nothing.” You will often hear the team at HIG use this exact phrase. When we say ten years are nothing, we mean that even ten years’ worth of data can be noise. If you look at the last ten years of data alone, you will see the ups and downs of crazy S&P 500 performance.

“Stands confidently in the storms of spring, not afraid that afterward summer may not come.” This line resonates with us because HIG clients have confidence, even in tumultuous times, knowing that taking the long view is the closest thing to certainty in investing. The longer into the future you go, the closer you get to 100% certainty of a positive return.

“Summer…comes only to those who are patient, who are there as if eternity lay before them.” Our clients will tell you that the long view is “longer than your lifetime” because we help them plan for the legacy they will leave that will continue on with those who aren’t even born yet.

“Patience is everything.” We continue to help our clients remain patient and look to the future when they will reap the benefits of remaining steadfast in their long view efforts.