Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Recent Market Volatility

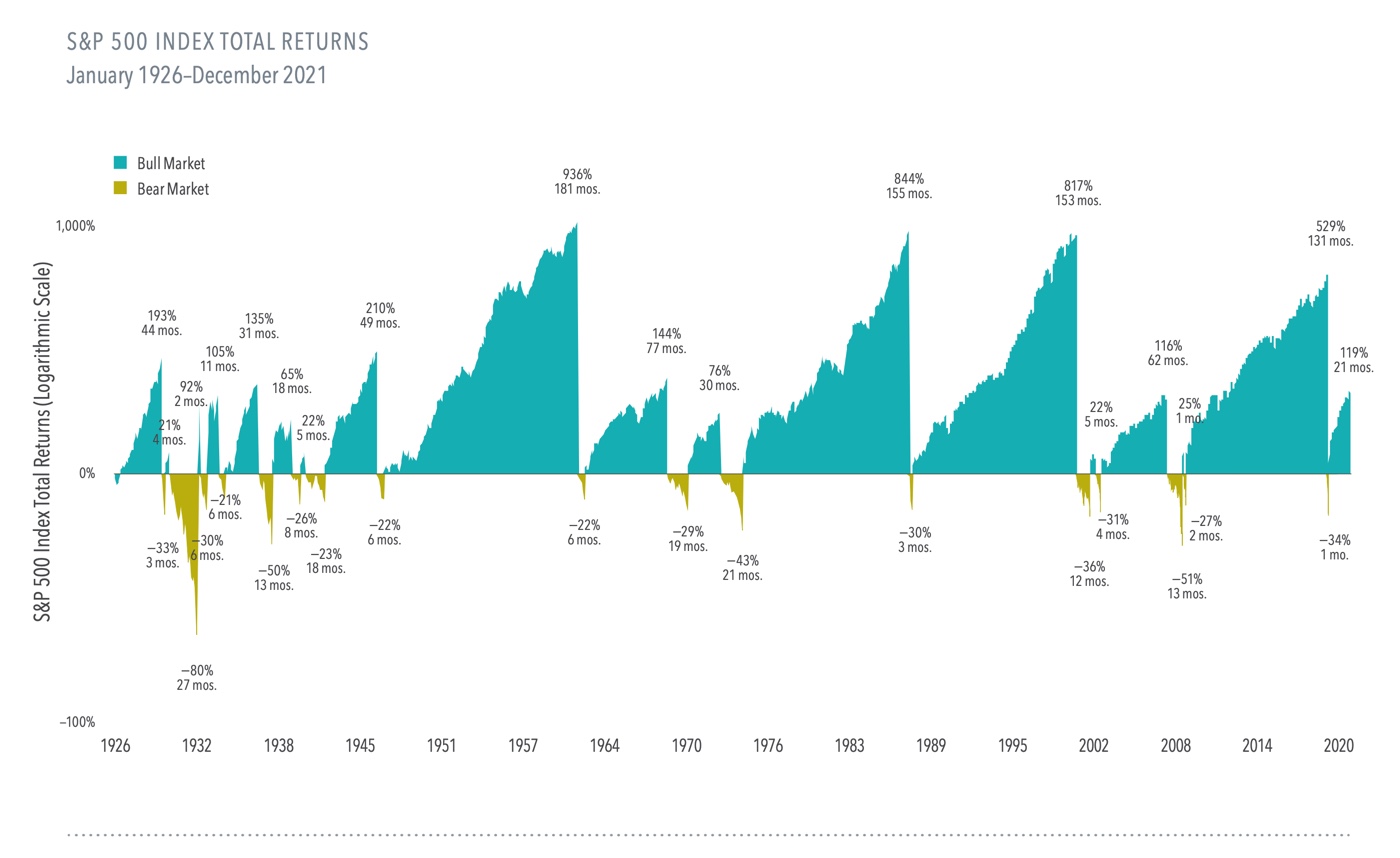

As of May 17th, the S&P 500 is down 14% year to date. Given the apparent negative economic outlook, many investors are concerned about their investments and what they should do. However, before descending down a worry spiral, pause and ask yourself: “Is this normal? Have I seen this before?”

During the 94 calendar years from 1928 to 2021, the US stock market had intra-year, double-digit declines 59 times. That’s almost two of every three years that the US Market experiences a double-digit decline. Yes, two-thirds of the time. So, we can conclude that a drop like the one we are currently seeing is a common event in the stock market. Not only common but good! Why? The reason investors are compensated with positive returns over time from investing in stocks, instead of cash or bonds, is because of the occasional period of negative returns. If there was no risk, investors would not get any reward for bearing that risk. Said differently, market downturns are features, not bugs.

Let’s dive deeper into those 59 years that had double-digit declines. Did the market recover or stay negative at the end of those years? In 58% of those 59 years, the market ended the year with a positive annual return despite the double-digit drop. 40% of those 59 years finished with a double-digit positive return!

What is the economic intuition behind why markets recover more often than not? Markets do a great job of factoring in both positive and negative news about companies and the economic outlook. Investors only invest in the market at current prices if they expect to earn a positive return. If everyone knew that the market would go down, no one would buy stocks at their current prices. Prices would simply fall until they hit a level that gave an investor a commensurate return for the risk they are willing to take. Today’s market prices reflect the current economic outlook. From here, markets might go up or down, but on average, market returns are expected to be positive over time.

That is precisely why we recommend that our clients stick with their well-thought-out investment plans rather than panic out of the market. The risks you may be worried about are already factored into stock prices. You are not alone in your fears, but that doesn’t mean you have to act on them. By selling now, you will miss out on the future positive expected return of stocks. We just can’t predict when those positive returns will happen.

When you look at nearly a century of bull and bear markets, the good times have outshined the bad. While we don’t know how long a bear market will last, staying invested ensures that you capture the bull markets when they do arrive again.

529 Best Practices

If you have children, you have likely added the number, “529” to the list of ubiquitous IRS regulation codes that you know. You might even randomly discuss this IRS code with other parents while watching youth soccer games. While most of the articles on 529s focus on how and where to open accounts, little attention is given to optimizing, accessing, and using the funds. We want to remedy this by sharing some key considerations:

Which Educational Expenses Can be Paid From Your 529?

529 funds can only be used for “qualified” educational expenses. If your student is attending K-12 secondary school, account owners are permitted to use up to $10,000 per year for tuition only. However, once your student heads off to college, the list of qualified expenses expand significantly, including tuition/fees, housing, meal plans, and technology. If your student is fortunate enough to earn scholarships, that can help the funds in your 529 go even further.

What Are “Non-Qualified” Costs?

It’s important to note that many college costs are non-qualified, meaning the account owner cannot use 529 funds to satisfy those expenses. The following are some non-qualified expenses include:

- College application and testing fees

- Travel and transportation costs

- Extracurricular costs like fraternity and sorority dues

- Everyday living expenses

How to Withdraw and Use the 529 Funds

Since it is the account owner’s responsibility to prove that 529 withdrawals are used only for qualified expenses, proper record-keeping is critical. For those larger items such as tuition/fees, housing, and meal plans, it is usually possible to direct your 529 plan to remit payment directly to the school’s finance department which ensures a clean record of withdrawal and usage. If the account owner withdraws funds to the beneficiary (your student), maintain pristine records, such as receipts, for purchases so that there is an audit trail.

Importantly, the academic calendar is different than the annual calendar. Funds withdrawn in one calendar year should be used in that calendar year. Be sure to understand each school’s financial deadlines and plan accordingly. In all cases, make sure the fund manager has at least 10 business days to process a withdrawal request.

Finally, some students have 529 accounts that are owned by their grandparents. If the student is applying for or has accepted financial aid, there are strategies to minimize or eliminate the potential negative impact of withdrawals from the grandparent-owned account.

What if You Need More Funds or Run Out?

One of the great features of 529 accounts is you can roll over funds between the accounts of all your children. If you have three children and three funds, you can rest easy that even if you fund them equally, you can address the fact that all three will have different college expenses. Or, if one student ends up not needing any of their funds, you can change the beneficiary to one of their siblings. If you are in the enviable position that there is money left over, then you have a start on graduate school or an initial contribution for their future children.

Conclusion: When the Time Comes, Learn the Withdrawal Rules

Keeping up with all the college bills can be a challenge. If you take the time to learn the withdrawal rules and processes for your 529 plan before your student heads off to school, you can eliminate the headaches that can be part of paying for all the expenses related to sending your kid to college. You’ll have peace of mind as well as the time to enjoy your student’s new adventure and future successes. As always, you can reach out to our team with any questions.

Giving With a Warm Hand

Have you listened to the latest episode of Take the Long View, our podcast that helps listeners reframe how they think about money, emotion, and time? We’ve had great guests over the years who have helped the podcast receive national recognition, but we especially enjoyed Matt Hall’s most recent conversation with Meir Statman.

Meir is a legend in the field of behavioral finance. He started thinking about how our emotions, biases, and beliefs affect our financial decisions way before it was a common topic. Meir was so far ahead of the curve, the university where he was teaching at the time worried that he was “corrupting” the minds of his students with crazy ideas. Today, he’s the Glenn Klimek Professor of Finance at Santa Clara University. He is recognized as one of the most influential thinkers in the investing world for his books and award-winning research papers.

The conversation touched on many issues related to the importance of taking the long view and putting the odds of long-term success on your side, but it also contained illuminating stories from his own life. Our favorite moment came when Matt asked him whether he sees any differences in the way people think about money in his home country of Israel versus the United States. He immediately offered a view of how families in Israel think about supporting their children financially.

We encourage you to listen for yourself (starting at 11:34 in the episode), but Meir describes a tendency he calls “giving with a warm hand, rather than a cold one.” Essentially, families in Israel emphasize supporting their children financially when it really matters — when they’re young adults who have just finished college or are getting married. As an example, he shared how his parents and his fiancée’s parents met before the wedding to discuss how much money each would contribute so the newlyweds could buy an apartment and start their life together from a solid foundation.

He contrasts that approach to the common tendency among American parents to hold off on giving money to their children early in life, often out of fear that they’ll somehow spoil them or make them work less hard for their own success. Instead, many parents plan to leave their assets to their children after they die, at which point the kids are probably going to be in their 60s and might not need as much support.

In Meir’s mind, this “cold hand” approach misses the value of giving young adults the resources they need to help them find their ambition. Freeing your children from some struggle and stress over money is like a long-term investment in their stability and happiness.

Later in the conversation, Meir emphasized this point by discussing the focus of his latest research—studying what investors really want. Yes, investors want to make money, but he notes that we should never forget what money is actually for. We want money for well-being, which is about family, security, happiness, health, and being true to our values.

We hope this idea sounds familiar because it’s central to the Hill Investment Group philosophy of building your financial plan to focus on what really matters to you. We take the time to listen and understand who you are, what you value, and what you hope to achieve so that we can put your money to work toward that vision and free you to focus on the important things in life.

For most of us, supporting and nurturing others is top of the list. So take a few minutes to listen to Matt’s recent conversation with Meir Statman, and then reach out if you’d like to discuss your giving strategy. We’re here to help you think through how you can fully support your values and beliefs while delivering the greatest long-term benefits to you and your family.