Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Creating a Statement of Financial Purpose

Our good friend (and Matt Hall’s podcast guest) Carl Richards has been discussing a concept that may feel foreign to many people when they think about investing. It’s called a “Statement of Financial Purpose. “

Our good friend (and Matt Hall’s podcast guest) Carl Richards has been discussing a concept that may feel foreign to many people when they think about investing. It’s called a “Statement of Financial Purpose. “

Historically, we’ve talked to clients about goals – we help to set them, work to achieve them, cross them off the list, and move on to the next. A Statement of Financial Purpose is something more profound than just goals. It’s the why behind the goals. This statement is not lengthy; it’s usually a sentence or two and, typically, pretty simple, but it’s not easy.

We have introduced this concept to clients over the last year, and the reception has been very positive. Initially, clients are a bit hesitant when we present the topic, but it has led to some great conversations, and, in certain instances, spouses have uncovered things they didn’t know about the other person! Additionally, we’ve found these conversations especially valuable in guiding the recommendations and decisions we make with our clients.

Please feel free to reach out if you’d like to learn more about creating your Statement of Financial Purpose.

April Showers…and Taxes

If it’s April, taxes are on the minds of most Americans. Based on decisions made throughout the prior calendar year, investors might be caught with a nasty tax surprise and need to write a large check to Uncle Sam. We consider your taxes daily to avoid these surprises at Hill Investment Group. Practices we implement, like tax loss harvesting and asset location (tax-inefficient asset classes in tax-deferred accounts), can meaningfully reduce the taxes an investor may owe annually. However, we are talking about one of the most impactful practices today: investing in ETFs rather than mutual funds.

ETFs and mutual funds are two types of investment vehicles and are simply different ways of holding a group of underlying securities like stocks or bonds. Most investment strategies can use either structure to execute their investment strategy. For example, Dimensional Fund Advisors and Avantis Investors, two companies we invest with, have both a mutual fund and an ETF for their US Small Value strategies. For each firm, the strategies are run the same way. However, they have a different legal structure that, in turn, has different tax consequences.

ETFs rarely distribute capital gains at the end of the year because of the way they rebalance and trade.

On the other hand, mutual funds almost always distribute some capital gains. The table below outlines the capital gain distributions for four specific funds in 2022.

| Vehicle | Ticker | Fund | Capital Gain Distribution (%) | Taxes Owed (%) |

| Fund | DFSVX | Dimensional US Small Cap Value Fund | 5.0% | 1.0% |

| ETF | DFSV | Dimensional US Small Cap Value ETF | 0.0% | 0.0% |

| Fund | AVUVX | Avantis US Small Cap Value Fund | 5.6% | 1.1% |

| ETF | AVUV | Avantis US Small Cap Value ETF | 0.0% | 0.0% |

Both the mutual funds distributed ~5% of their value in capital gains, whereas the ETFs did not distribute any. This means that investors in the mutual fund owed about 1% (assuming a 20% capital gains tax rate) in taxes to the government. For every $100,000 invested in the small value strategy, they owed $1,000 in taxes this April. Investors in the ETF, the same strategy but with a different legal structure, owed $0 in taxes this April.

By investing primarily in ETFs across our models, we avoid capital gain distributions for our clients in those funds and meaningfully reduce their tax bills yearly.

Let me know if you have questions or comments about this or any other investment-related topics by emailing me at: zenz@hillinvestmentgroup.com.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here. Past performance is not indicative of future results.

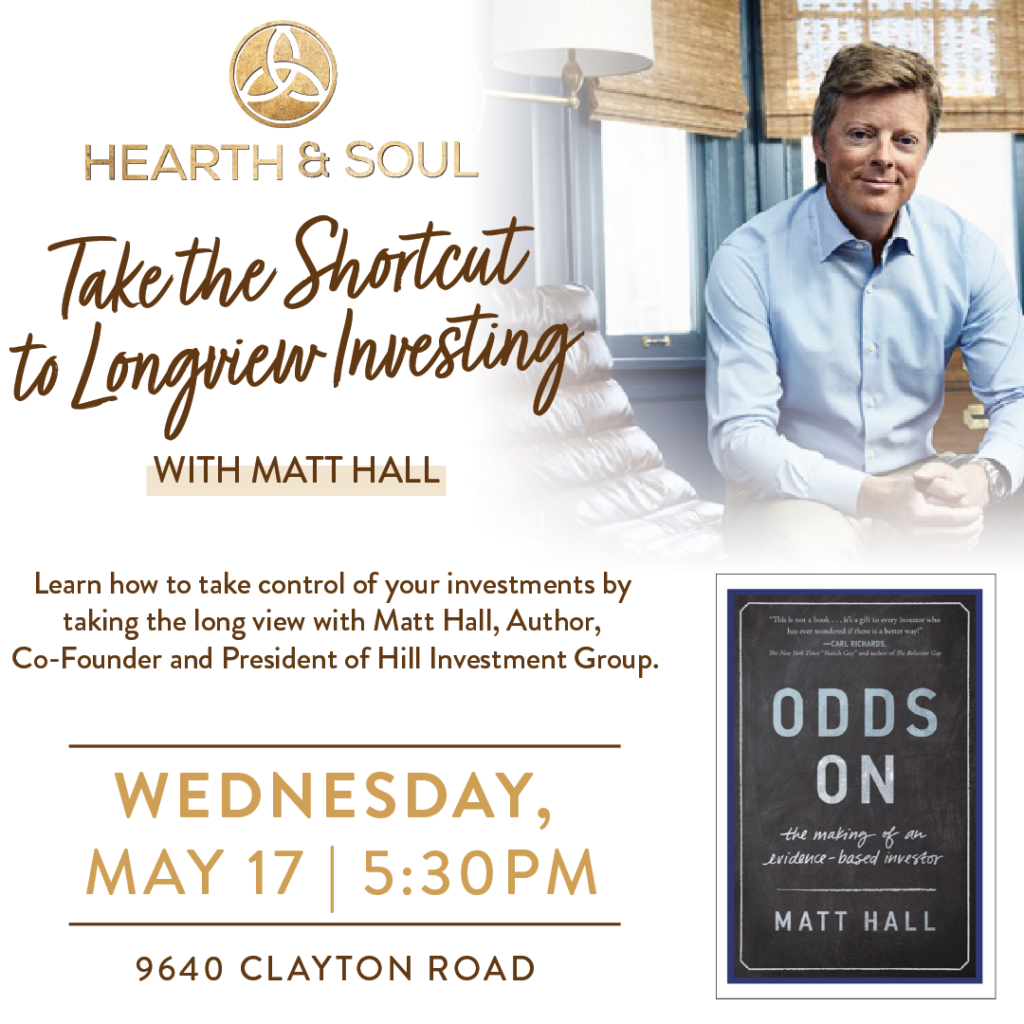

You’re Invited to a Special Event

We love it when good people and good ideas come together. Consider joining us on May 17th at Hearth & Soul for an event focused on financial education with our Matt Hall. If you have yet to hear, Hearth and Soul is the vision of the businesswoman, mom, volunteer, and friend Susie Busch Transou. Susie’s love of hospitality, blended with the desire to enrich the lives of others, has come together to make Hearth and Soul a special place in St. Louis.

And as long-time clients and friends know, Matt Hall’s book Odds On came out seven years ago and is still making waves. The book has taken Matt from the Netherlands (Odds On has been converted to Dutch) all the way to North Dakota (where Matt spoke to a university investment group). Matt’s unique ability will be on full display during this event as he boils down the lessons learned over his successful career, helping others improve their odds of success.

Add the Hearth & Soul with Matt Hall Event to your Apple Calendar