Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Summer cyber cleanup – email is guilty until proven innocent

In today’s digital landscape, knowing what cyber risks to avoid and which red flags to look for are essential to protect you from evolving cyber threats. We’re sharing our top ways to protect yourself this summer.

3 steps you can take today to protect your email

- Enable two-factor authentication. This is our top bang-for-your-buck recommendation: easy with a big security benefit. Two-factor authentication adds an extra layer of security to protect you even if your password gets compromised. For those of you who use Gmail – here is a link that shows you how to set it up.

- Don’t share private personal information. Opt for a good old-fashioned phone call if you ever need to share passwords, social security numbers, or bank details. Our team can help you create secure links if you need to share these over written communication.

- Have a long, strong, and unique password. We’ve said it before, and we’ll say it again – keeping your email (and banking) passwords ~15 digits long and unique from other passwords are simple ways to protect yourself. Why? Criminals will grab the username and password combinations from retailers and test them at banks and email providers. Unique passwords help prevent this technique from working. Here is an independent review of good password managers that can help you store your info securely.

A discussion of email security would be deficient without a mention of phishing. We think this is so important we’re highlighting three additional tips to help you identify phishing when you encounter it. What is phishing? Email phishing is a cyber-attack where scammers attempt to trick you into revealing your private information through email. They often use a combination of social engineering or malicious links to get you to share information. This is, unfortunately, becoming more common, and it’s important to know how to protect yourself.

3 tips to spot a “phish” in your inbox

- Suspicious email addresses. Phishing emails often mimic legitimate organizations but have slight variations or misspellings in the sender’s address. Check if the email matches the official domain, and be cautious of misspellings or unexpected differences.

- Urgent language and misspelled words. Phishing emails use urgency to create panic and pressure you into immediate action. They may threaten account closure or penalties. Beware statements like “Your account will be deactivated in 24 hours” or “Legal action will be taken if you don’t respond soon.” Misspellings are easy to spot and often indicate a phish.

- Requests for sensitive information, suspicious links, or attachments. Phishing emails ask for sensitive details like passwords or credit card numbers, which legitimate organizations rarely request via email. Avoid sharing personal information through email unless you’ve verified the request independently. When you see an email that you think is a phish, we recommend calling the institution directly to verify (using a phone number you look up instead of the phone number in the suspicious email).

At HIG, we work daily in the background to protect your information by raising awareness within our team, identifying vulnerabilities, evaluating security controls, and fostering a security culture. We have developed a comprehensive cybersecurity program that includes quarterly phishing testing of our team to fortify our internal defenses for your protection. Curious to learn more? Give me a call at 314-448-4023.

Why Not Just Invest in Money Market Funds Currently Yielding 5%?

At Hill Investment Group, we pride ourselves on our steadfast commitment to long-term investing principles. Our philosophy centers around ignoring short-term market noise and focusing on sustainable, enduring strategies. Recent interest rate increases have sparked questions among our clients, particularly regarding money market funds and how to approach fixed-income investing in this evolving interest rate environment. If you have questions, we prepared this data with you in mind.

For over a decade, the Federal Reserve has maintained historically low-interest rates since the financial crisis of 2008. However, more recently, we have witnessed an increase in the federal funds rate (the interest rate at which depository institutions [banks and credit unions] lend reserve balances to other depository institutions overnight on an uncollateralized basis), signaling a departure from the exceptionally low-interest rate environment we have grown accustomed to.

What does this higher interest rate environment mean for investors?

As investors, we have a range of choices, from safe assets like short-term government debt to riskier alternatives such as venture capital. Each investment option carries a distinct level of risk, and investors typically opt for riskier assets only if they offer higher expected returns compared to safer ones. For example, if a 1-Year Treasury bill (US Government Debt) provided a 5% return, no rational investor would buy a 1-Year General Electric bond (a risker bet) paying a 4% return. Therefore, to entice investors to buy its bonds, General Electric would need to offer more than a 5% return.

To determine the riskiness of different investments, we can compare them to the least risky option, which is typically short-term US government debt. This is where the Federal Funds Rate comes in. The Federal Funds Rate acts as a benchmark for determining the interest rates of the least risky assets: short-term US government debt. As of May 15th, 2023, the federal funds rate was 5.08%.

This means an investor in a money market fund should expect a ~5% return for this low-risk investment. Other investment options need to offer returns surpassing this baseline to entice investors.

For instance, one of the corporate bond funds we like to invest in, Avantis Core Fixed Income ETF (AVIG), has a yield to maturity or expected return of 4.5%. That doesn’t look alluring compared to a money market yielding 5%. Why would any investor choose to invest in AVIG over a money market fund?

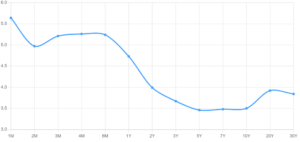

This is where the duration or timeline of the investment comes into play. The Federal Funds Rate is reset eight times a year, potentially causing fluctuating returns for money market accounts. For example, over the last year and a half, the return of money market accounts has increased from 0% to 5%. Over the next year and a half, it could return to 0% or rise even higher. No one knows what the Fed will do in the future, but Investors have expectations and use their expectations to invest in bond markets. Their investment sets market prices. A yield curve depicts the aggregate expectations of all investors for how interest rates will change in the future.

Looking at the current yield curve, investors can gauge the return they should anticipate for different investment durations, i.e. holding periods.

US Treasuries Yield Curve

5/15/2023

While market predictions are often wrong, there is no way of knowing if the market is over or underestimating future rate changes. Numerous financial blogs and media pundits claim they magically “know” where markets are going.

However, this is precisely where the beauty of markets reveals itself. The market aggregates everyone’s opinion on where rates will go, and rather than trying to outguess, we ignore the noise and trust the information embedded in market prices.

This brings us back to answering the question of “where” to invest. Money market funds typically have short durations of around 15 days. Investing in a money market fund, you could expect that 5% return for about 15 days. A month from now, the return could be higher or lower. The yield curve suggests that the market believes rates will decrease as longer-duration bonds have lower yields. For example, AVIG, our corporate bond fund, has a duration of 6 years. Looking at the yield curve, 6-year treasuries have an expected return of 3.5%. Thus, comparing 4.5% to 3.5%, you are being compensated with about 1% extra return for taking credit risk in AVIG compared to treasuries.

Interest rate changes are like rising or receding tides that lift or lower all boats. As interest rates fluctuate, we adhere to a consistent investment strategy. We understand that the risk/return tradeoffs are linked, and we do not attempt to time interest rate movements. This is why we do not recommend shifting your fixed-income investments to money market funds. We simply don’t know how long those relatively high, short-term rates will exist. The price of the funds we buy already incorporates the odds and risks of rates going up, down, or staying flat.

Instead, we focus on your long-term investment objectives and individual risk tolerances. We create a plan that meets your needs regardless of whether interest rates are rising or falling. Ultimately, all expected future interest rate changes are already factored into market prices, and it is not worth trying to outguess them.

That does not mean there are no appropriate use cases to invest in money market funds though. For example, if you are about to buy a home, it may make sense to invest the down payment in a money market fund to earn some interest with low risk.

We are here for you to review the different investment options and find a financial plan that works for your needs, with the goal of putting the odds of financial success in your favor.

Legend in Investing – Charles Ellis

Do you want to see and hear an investment legend interviewed by two of the nicest and smartest advisors I know? Tune into this episode of the Rational Reminder podcast with guest Charles Ellis, famous author, investing authority, and a top-notch communicator.

Cameron Passmore cohosts the Rational Reminder and is someone I consider a friend. He and his talented partner, Ben Felix, run one of the best podcasts related to investing. If you like this episode I suggest subscribing to their channel.

Here’s the rundown of what’s covered:

0:00 Intro

4:18 Charley defines a “Loser’s Game”

8:21 Why money management is a loser’s game

11:38 How the market has changed since writing about the loser’s game

19:09 Whether or not the sentiment toward active management is negative

22:03 Types of investor who should not invest in low-cost index funds

30:27 What investors and their advisors should be focused on

37:25 The importance of a well-defined investment policy statement

39:01 What investors can do to protect themselves from themselves

40:43 The most under-appreciated action investors can take to be more successful

50:16 Charley’s opinion on Vanguard’s entry into private equity

55:27 Where Charley sees the biggest future opportunities in the field of investment

1:00:15 What has made Vanguard successful as a company

1:08:14 What Charley has learned about personal motivation and productivity

1:12:04 Charley defines success in his life

1:14:12 Outtake

If you’d rather listen to the episode instead of watching on YouTube here is a link via Apple Podcasts.