Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Welcome, Michael Kafoglis!

We’ve added an incredible new team member, and you may recognize his last name. Michael Kafoglis joins our Client Service team as an advisor and CFP based out of our Houston Office. Michael will work closely with John Reagan, servicing our Hill and Hilltop clients. Michael comes to Hill Investment Group with seven years of experience at one of the largest investment institutions in the country, where he served as an advisor to high-net-worth families.

We’ve added an incredible new team member, and you may recognize his last name. Michael Kafoglis joins our Client Service team as an advisor and CFP based out of our Houston Office. Michael will work closely with John Reagan, servicing our Hill and Hilltop clients. Michael comes to Hill Investment Group with seven years of experience at one of the largest investment institutions in the country, where he served as an advisor to high-net-worth families.

As the son of a consultant turned teacher turned financial planner, he has a unique view of investing. Although he was taught concepts of compounding, diversification, and patience at a young age, when he became an advisor, he discovered his financial education was not the norm but the exception. Michael has made it his goal to educate clients and simplify their financial lives so they can focus on what they care about. Needless to say, he will fit right in at Hill Investment Group.

If his name sounds familiar, Michael is following in the footsteps of his dad, Charles Kafoglis, as he joins our team out of Houston. We are referring to them as the Kafogli and are already enjoying the camaraderie and banter they bring to the team. Stay tuned, as his complete bio will hit our site later next month.

Welcome, Michael!

Please Hold – Listen to This

Hill Investment Group prides itself on always having a team member, not a machine, answer our phones within two rings. We’ll never have an auto attendant answering system (during office hours) – but this means you will have to be placed on hold occasionally. Most hold music ranges from loud and irritating to the nonexistent ‘Is anyone still on the other end?’.

You’ve likely been placed on hold at Hill Investment Group, and we try to make that experience as pleasant as possible. Whether it’s an interview clip with one of our team members or jazzy holiday tunes – we aim to entertain or educate you while we connect you.

We’re excited to share our latest and coolest hold music, this time from one of our clients, Mr. Clint Willis. If, in 2016, you happened to be at the St. Louis launch party for Matt’s book Odds On:The Making of an Evidence-Based Investor, you might recall Clint’s soulful performance that served as a fantastic introduction (see photo).

During a recent interaction, and because Clint is such a creative person – I couldn’t help but wonder if he could create a mellow tune for our friends to enjoy while they’re on hold – and boy did he deliver! We hope you’ll enjoy our latest hold tune the next time you call or by clicking play above!

Wisdom of Crowds

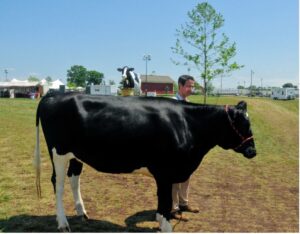

In the heart of a bustling county fair, an extraordinary experiment unfolded, showcasing the incredible power of collective intelligence. A seemingly whimsical challenge emerged: Guess the weight of a cow on display. What initially appeared as a playful game soon transformed into a stunning demonstration of the “wisdom of crowds.”

A diverse group of fairgoers, each with varying degrees of knowledge and intuition, were asked two simple questions: How much does this cow weigh? Do you have any experience with the weight of cows? The goal was to see if anyone in the crowd could guess the correct weight and if experts would be superior to the average individual.

A fascinating phenomenon began to unfold. Although individual estimates ranged wildly, the average of all these guesses astonishingly approached the actual weight of the cow. In the end, the average guess for the non-experts was 1,287 pounds compared to the actual weight of 1,355 pounds. A difference of only 68 pounds. A bigger surprise: the expert’s average guess was less accurate at 1,272 pounds, a difference of 83 pounds.

The genius of this collective average lay in its ability to filter out errors and biases inherent in individual guesses. High estimates countered low ones, and the middle-ground approximations formed a consensus that defied the odds. This experiment showcased the concept of the “wisdom of crowds” that a diverse group’s collective knowledge can outperform the insights of any individual expert.

Translating this concept to the realm of financial markets, where stocks are traded and their prices determined, demonstrates a similar effect. The market comprises countless participants, each with their own insights, analyses, and biases. When these factors converge, the resulting stock prices tend to reflect the most accurate estimate of a company’s value at a given point in time.

This phenomenon finds its backbone in the Efficient Market Hypothesis (EMH), which proposes that stock prices encapsulate all available information. Much like the cow guessing average, EMH posits that the combined insights of countless individuals lead to fair and accurate valuations, making it incredibly challenging to outguess the market consistently. Financial markets react to new information quickly, updating prices to reflect the most up-to-date information and risks fairly. Rather than trying to outguess market prices, causing turnover, high fees, and trading costs, one is better off accepting and using market prices to your advantage. Invest in global capitalism rather than trying to outguess it.

From guessing the weight of a cow to the intricate world of financial markets, the wisdom of crowds continues to shape our understanding of collective intelligence. Just as a diverse group of fairgoers could accurately estimate the cow’s weight, the multitude of participants in financial markets work together to create prices that reflect a collective estimate of a company’s value. The efficient market hypothesis stands as a testament to the power of this concept, reminding us that while individual expertise is valuable, the aggregated insights of many can often lead to more accurate and reliable outcomes. As we navigate the complexities of the modern world, embracing the wisdom of crowds can lead to better decision-making and a higher likelihood of financial success.