Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

People & Pets

Many of our clients, friends, and team members have pets…dogs, cats, horses, fish, and many others. Our family has been blessed with a wide range, including fish, turtles, bearded dragons (Puff & Flame), a rabbit (Thumper), and a European Blue Butt Potbelly pig (Corny)…topping out at 350 pounds plus.

Sadly, last week, we lost our closest and most senior family pet, Teddy the Miracle Yorkie, after 15 amazing years of love and companionship. Teddy was a miracle because I’m allergic to almost every dog…except Teddy! We populated many of our friends’ homes with our six prior attempts at living with a dog. Jeana is a true Master Trainer, and she bore most of the pain as these dogs brought joy to others. Most of them lived long, wonderful lives with their ultimate family, and we had the opportunity to see them regularly…just not under our roof.

Teddy remains the best birthday present my wife, Jeana has ever received, and Teddy was a blessing to all of our kids. I could go on about his gentle nature and soul, his warm and friendly demeanor, and his ability to bark like a dog ten times larger than his 9-pound frame. If I continue, I will cry more than I am now. So, I will turn you over to a friend of our firm who you’ve heard from before, John Jennings, who also recently lost a dog, Dylan. John eloquently shares ”Six Life Lessons from Dogs,” which he originally wrote in 2022.

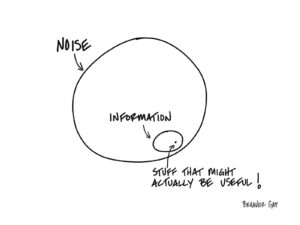

Noise Info Wisdom

Do me a favor.

Try to remember a time when you read or heard something about money in the news, you acted on it, and then, with the benefit of hindsight, you were glad you did.

This could include any number of things: the latest IPO, bear markets, bull markets, mergers, market collapses.

Go ahead, I’ll wait. Close your eyes and think about it.

I’ve done this experiment hundreds of times around the world, and I’ve only had one person come up with a valid example. It was news about a change in the tax law.

That’s it.

Isn’t that interesting?

Think of all the financial pornography out there, think of all the dental offices that have CNBC playing in the background, think of the USA Today Money section. Almost all of it is noise. Almost none of it is actionable.

Sure, every once in a while, there is this little teeny tiny speck of information that might be useful. But you sure have to wade through a lot of garbage to get to it.

This leads to one obvious question: Why are we paying attention to the noise in the first place?

It might be fun, if you’re into that kind of thing. You know, like going to the circus. But most likely, it’s just a waste of time.

What if, instead of obsessing over the news, you used that time to work on that list you have…

You know, “The List.” The one that has all the really important things you actually want to do with your time.

Doesn’t that sound so much better than spending another hour watching the news?

Matt Hall on Your Television

Congratulations to our own Matt Hall, who is featured in Schwab’s new national ad campaign!

As mentioned in a post back in July, Matt was selected to participate in a series of ads highlighting the advantages independent advisors bring to our clients. Here is the first in a series airing over the next few weeks and months.

In the 30-second spot, Matt and the other advisors zero in on a few of the crucial promises independent advisors make when we work with our clients. Schwab is essential in our ecosystem for safeguarding our clients’ securities and is the leading custodian working with independent advisory firms.

The independent model is superior to the other options available to investors because of its fiduciary standard for clients. We work for you, and only you, and avoid the conflicts that exist with big banks and brokerage firms.

Thanks, Matt, for representing Hill and the broader advisor community genuinely looking to serve others now and in the longer view!