Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Welcoming our Summer Intern

As the summer season approaches, we are thrilled to welcome a new Hill Investment Group family member. Our new intern, Kellen Williams, is excited to spend the summer with us, and we are equally happy to have him on board.

Kellen joins us from Lindenwood University, where he is currently pursuing a degree in Finance, and he is expressing interest in the Chartered Financial Analyst (CFA) program. His passion for finance and investments started when he was only 14 years old after purchasing his first share of stock! Combining his eagerness to learn and contribute with his keen interest in Hill Investment Group makes him a perfect fit for our team.

“I had a very warm welcome from the team during my first week,” Kellen shared. “I’m looking forward to immersing myself in different parts of the business, learning new skills, and assisting in any way I can. I’m especially excited to see how client portfolios are managed and optimized.”

Throughout the summer, Kellen will work closely with our team, gaining hands-on experience in various aspects of our firm. From operational projects to assisting in the backstage service area, he can apply his academic knowledge in real-world scenarios.

At Hill Investment Group, we believe in nurturing young talent and providing a supportive environment for growth and development. Our team is committed to mentoring Kellen and ensuring he gains valuable insights and skills to benefit him in his future career while also serving our most crucial asset…our clients.

Please join us in welcoming Kellen to the Hill Investment Group team. We look forward to a productive summer with him.

Stay tuned for updates on Kellen’s journey with us, and, as always, thank you for your continued trust and partnership.

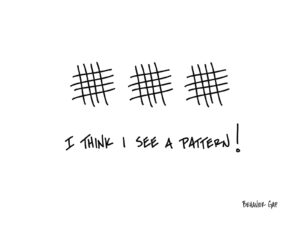

The Only Investing Pattern That Matters Is Behavioral

That’s the thing about most patterns—they don’t predict the future; they just describe the past.

We’re so good at recognizing patterns that we often see them where they don’t even exist.

One of my favorite examples of this is some research done by David J. Leinweber at Caltech. Apparently, he figured out how to predict the stock market using just three variables:

1- Butter production in the United States and Bangladesh.

2- Sheep populations in the United States and Bangladesh.

3- Cheese production in the United States.

Amazing! Right?

It turns out these three variables predicted 99% of the stock market’s movement!

#TimeToStartAHedgeFund.

Just one problem: The joke’s on us.

While well-intentioned, the constant pursuit of patterns is one of the big behavioral mistakes we make time and again. We look for patterns. And guess what, they absolutely exist. Right up until you try to invest your money based on the pattern. Then *Poof!* They vanish into thin air.

We think if something happened a certain way in the past, then it will surely continue into the future. We start to believe—we desperately want to believe—that this pattern will have predictive value.

But it doesn’t. And that’s the thing about most patterns—they don’t predict the future, they just describe the past.

While some of these silly data mining tricks might be interesting to talk about, they don’t actually help us.

Turns out the only thing that does help when it comes to investing success is good behavior. Day in, day out, year after year.

Now that’s a pattern I can endorse.

-Carl Richards (friend of HIG)

So long! Farewell! Until Next Time…