Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

May Newsletter Intro

Dear Clients and Friends,

Dear Clients and Friends,

At Hill Investment Group, we believe change is inevitable and essential for growth. Like nature’s evolution, we see change as an opportunity to enhance and sharpen our commitment to you.

We are excited to share some significant updates:

A New Home for Our St. Louis Office

As mentioned in our prior newsletter, we are moving our St. Louis office to a new, handsome location. This space will better serve our team and, ultimately, you, fostering greater collaboration and innovation. We are officially out of the space that served us well for nineteen years, and the St. Louis team will be working remotely or on a communal floor in the new Plaza building.

*Did you know our 14 team members are currently spread between Austin, Houston, Nashville, St. Louis, and New York?

Welcoming Matt Zenz as a New Partner

As you’ll read below, we are delighted to welcome Matt Zenz as our newest partner. His dedication and expertise align perfectly with our evidence-based approach, strengthening our leadership team. Matt is the kind of person you want on your side (see his Picking up Pennies series on our site to know precisely what I mean.)

Commitment to Our Boutique Approach

While embracing these changes, we remain committed to staying small and boutique in size. This allows us to deliver the best evidence-based value in the independent RIA world, ensuring your unique needs are our top priority. Please hold us accountable if you ever see something that could be improved. Our team is fiercely committed to improving every day as we strive to be known as one of the country’s premier boutique, evidence-based advisors!

Thank you for being a part of our journey and for your continued trust and support.

Take the long view,

Matt Hall

Hill Investment Group

New Feature: “Hey Hill, how can I…”

Addressing Common Client Questions

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that many more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. The goal is to address what’s top of mind for our clients. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

This month, we’ll debut our first frequently asked question:

“Hey Hill, how can I secure a high rate of return for my cash savings?”

Understanding Cash Savings:

Every investor has to hold on to some amount of cash. We all have daily bills and expenses, something big we’re saving for, or just want something set aside for emergencies. This is money you want to keep safe. As you’ve likely noticed, cash sitting in your bank account earns very little and it may feel like you’re missing out on potential earnings. The great news? You have options at your fingertips, that we can help you take advantage of.

Why does this matter? Ensuring cash is managed effectively is one of the best ways we can help you “pick up the pennies” of extra return around the edges of your portfolio.

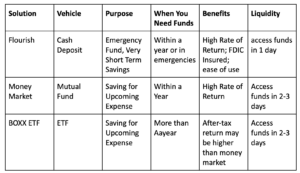

For earning a return on cash, we recommend three options, tailored to your specific situation:

- Money Market Funds

Money market funds invest in highly liquid, short-term debt instruments like US Treasury bills. These funds offer high liquidity and very low risk, making them a secure option. Investors in money market funds can expect a positive return, currently around 5%, matching the returns on short-term US government debt. We recommend money market funds for cash you plan to use within the next year. We can manage this investment for you, ensuring your cash earns the highest return with minimal risk.

- BOXX ETF

BOXX is an ETF providing money market-like returns but in an ETF format. This means returns are reflected in the increasing price of the ETF rather than as income. Since capital gains are taxed at a lower rate than income, holding BOXX for over a year could significantly enhance your after-tax return.

We recommend BOXX for cash that you plan to hold for more than a year. We can manage this investment and monitor the holding period to maximize your after-tax return.

- Flourish – New Service Announcement!

We are excited to introduce Flourish, a new service for Hill Investment Group clients. Flourish removes the hassle of hunting for the highest savings account rate by partnering with over a dozen FDIC-member program banks to ensure you always receive the highest savings rate. Flourish links to your personal checking or business account and offers money market-like returns and up to $10 million in FDIC insurance. This all comes with no fees or minimums and a clean, user-friendly interface.

We recommend Flourish as your high-yield savings account solution for cash held in personal accounts. We can help you set up Flourish to talk to your personal accounts hassle-free so you know you are getting the most out of your cash at all times.

We’ll be rolling out this service over the coming months, but if you are curious to dive deeper – Check out this 5-minute video. If you’re eager to start using Flourish now, email us, and we’ll send you an invite so you can start benefiting immediately.

We’re here to ensure your cash works as hard as you do. Let us help you maximize your returns with minimal risk.

Summary

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Welcoming Matt Zenz as a New Partner

We are thrilled to announce that our CIO, Matt Zenz, is officially joining our leadership team and becoming a partner. Matt’s extensive experience in our evidence-based approach to investing makes him an invaluable addition to our leadership team.

Matt has an impressive background in systematically managing assets across multiple strategies. His career includes significant roles such as Chief Investment Officer at Hill Investment Group (past 3 years), Product Specialist at Stone Ridge Asset Management, and Portfolio Manager at Dimensional Fund Advisors, where he managed over $80 billion in U.S. small and mid-cap equity assets.

Matt holds an MBA from Harvard Business School, a Master’s in Electrical Engineering from the Ohio State University, and graduated Magna Cum Laude from the University of Notre Dame with a Bachelor’s degree in both Electrical and Mechanical Engineering. His academic accomplishments are bolstered by his practical experience in and deep knowledge of multi-factor investing and asset pricing.

Throughout his career, Matt has been dedicated to engaging with clients, ranging from sophisticated institutional investors to families and individuals. His ability to clearly communicate and implement our research-based approach has been instrumental in building strong client relationships with clients and HIG teammates.

When asked about why Matt loves his work and what it means to him he said “I care about and seek truth in all things – I just happen to love doing that most within investing. Helping clients find that truth about their financial situation brings me great satisfaction.”

Matt will continue to leverage his extensive expertise and leadership skills as a partner to drive our firm’s mission of delivering exceptional evidence-based investment solutions. His addition as partner marks not just a new chapter but a potential turning point for Hill Investment Group as we strive to enhance the quality of our services and help achieve your long-term goals.

Please join us in celebrating Matt Zenz as our third partner!

(Matt Hall and Nell Schiffer are the other firm leaders and owners)

Stay tuned for more updates and insights from Matt and the rest of our team as we strive to excel in serving our clients and the broader financial community!