Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Making Friends (& Inviting Them to Parties) Is Our Business!

This year’s Hill Investment Group summer bash celebrated our 19th birthday! In typical fashion, a casual outdoor soirée was hosted by Matt Hall and his wife Lisa at their home in Clayton.

This year’s Hill Investment Group summer bash celebrated our 19th birthday! In typical fashion, a casual outdoor soirée was hosted by Matt Hall and his wife Lisa at their home in Clayton.

While we enjoyed a delicious and unique meal provided by Kirk’s Traveling Kitchen, The Gaslight Squares provided an upbeat musical atmosphere. To close out their set, our Sherrie Dickson serenaded the team with her beautiful rendition of Moon River!

This year, we also had a few new faces at the party and a very special guest – Miss Saronda Summerland, our beloved mail carrier and friend (pictured above, along with Anna Farrell, Matt Hall, and me). Saronda has always gone the extra mile for Hill Investment Group, and we will miss seeing her every day now that the St. Louis office has moved into our new space. Yes, we tried to get her to switch her route, but she sadly declined.

Thankfully – we’ve already planned several ways to keep in touch because her sense of humor, candid communication, and comedic genius put a smile on our faces whenever she’s around.

Making friends is still, and always will be our business.

July Newsletter Intro

The Power of Personal Service

At Hill Investment Group, exceptional service is more than just a hallmark of our brand— it is the foundation upon which we have built our firm. While “service” can often be ambiguous, we have made it our mission to define, hire for, and reward this essential aspect of our business. Like all organizations, we are not perfect. Still, we strive to be intentional in building on our core service values: fast (be available), friendly (be warm and upbeat), and ownership (take responsibility).

Fast: Be Available

In today’s fast-paced world, being available and responsive is crucial. One small example: when you call our offices during regular business hours, a human being will answer the phone in two rings or less. Our entire team is committed to being accessible and ensuring that we provide timely and practical support when you need us. This level of availability is not just about promptly answering calls or emails; it’s about anticipating and proactively addressing your needs.

Friendly: Be Warm and Upbeat

A friendly demeanor goes a long way in building trust and long-lasting relationships. At Hill Investment Group, we hire individuals who naturally exude warmth and positivity. A welcoming attitude can make all the difference, especially during moments of uncertainty or stress. We aim to create an environment where you feel comfortable and valued, knowing we genuinely care about your financial well-being. For example, if you could see how our team reacts to the milestones and occasional setbacks that impact clients’ lives, you would see folks who care as if they have your same last name.

Ownership: Take Responsibility

Taking ownership means more than just completing tasks— it’s about seeing them through to successful outcomes. Our team members are encouraged to take personal responsibility for the projects and client interactions they handle. This sense of ownership ensures that we are all committed to delivering the best possible service from start to finish. We take pride in our work and are dedicated to achieving the highest standards for our clients. For example, you should never hear a Hill person say, “I’m not sure; that’s not my department; I’ll have to transfer you.”

A Foundation in Service Training

Early in my career, I had the opportunity to train service team members, which profoundly influenced my understanding of exceptional service. This experience has been meaningful in shaping our approach at Hill Investment Group. A significant part of our service philosophy is informed by Danny Meyer and his concept of enlightened hospitality, which emphasizes the difference between service (the delivery of the thing) and hospitality (how you feel). You can learn more about this philosophy and our conversation in my podcast episode with Danny Meyer.

Learning from Others

While we strive for excellence, we also recognize that there is always room for improvement. Recent discussions around service standards at some of the largest firms in our industry have provided valuable lessons. For example, Vanguard, known for its die-hard customer base, has faced significant challenges with service quality, as highlighted in this Wall Street Journal. Additionally, the classic piece on Goldman Sachs’ focus on sales over service is a cautionary tale about prioritizing client needs above all else. You can read more about it in this New York Times article.

Our Commitment

We are dedicated to continually refining our service standards at Hill Investment Group. We value your feedback and are always looking for ways to enhance your experience with us. By focusing on being fast, friendly, and taking ownership, we aim to provide you with the exceptional service you deserve, and that differentiates us from others.

To our clients and friends of HIG, thank you for entrusting us with your financial journey.

Take the long view,

Matt

“Since the beginning I have always felt a strong sense of relationship with everyone I’ve met and worked with at Hill, “they’re family, they’ve got my back” is the way I describe it to people.”

A recent favorite quote from a client who was kind enough to share an experience with us that wasn’t up to our normal standard. His statement is what we strive for and is a crucial aspect of our culture. Sharing his experience when it wasn’t up to par is the kind of generous relationship we are grateful for at HIG.

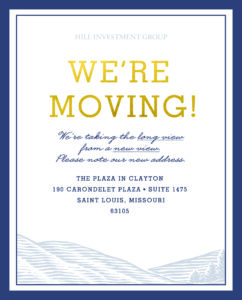

It’s Official…We’ve Moved!

As you read this, the global headquarters of Hill Investment Group has officially relocated to our new home at Carondelet Plaza in Clayton…less than two blocks away from our old home for more than 18 years. While only a few hundred yards away, the difference in the two spaces is dramatic because our landlord has taken the long view to outfit the building with dramatically better parking for our visitors, a wonderful common area, and state-of-the-art technology that will all support your overall client experience! Stay tuned for open house dates later this year. If you can’t wait, come on by! We’d love to show you around.