Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

New Regulatory Document CRS

If you’ve been hunting around our website recently, you might have noticed a link to our Client Relationship Summary (Form CRS). This new regulatory document helps investors answer the question, “Is Hill Investment Group the right investment advisor for me?” It’s aimed at anyone who is curious how we can help.

In our opinion, it’s a great move by regulators. It makes important information about advisors and broker-dealers crystal-clear, like fees, services, disciplinary information, and their fiduciary obligation (audio clip). As an existing or prospective client, we encourage you to check it out. You might learn something about us you didn’t know before, maybe even ways in which we can be more helpful to you!

Size Matters

After 10 years of large companies earning record-breaking returns, any reasonable investor would start to wonder, are small companies even worth hanging on to? We argue yes. Why? Because evidence shows owning small companies pays you more over time and helps your portfolio recover better after a downturn, but only if you have the patience to wait.

Higher expected returns. Evidence shows that small companies have historically outperformed large companies over the long-term. The reason? The market perceives small companies as riskier investments. The extra return you get is the market paying you for taking on that risk. If you think about it, this is intuitive. A simple example: would you lend money to the mom-and-pop diner down the street at the same interest rate as you would to McDonald’s? Of course not. You recognize the additional risk inherent in the smaller, less established diner compared to the more stable, global, fast-food chain.

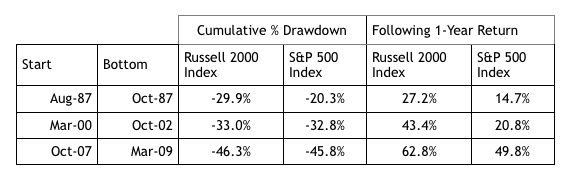

Stronger recovery after a market correction. When the market declines, small companies tend to perform worse than the general market, and investors may start to question if this asset class is one worth hanging on to. The biggest concern we hear is that smaller companies have less capital and cash flow to weather the economic storm thereby making their recovery painfully slow. In reality, small stocks have a tendency to come back stronger and faster after a significant market correction. The data in the table below suggests a healthier small company recovery (Russell 2000) compared to large (S&P 500) over three of the largest market downturns in the last 40 years.

The role of patience. The additional return you get for owning smaller companies can materialize at any time. But we know, especially in times where large has outperformed small for a decade or so, having the patience to wait can feel next to impossible. This is where the role of an advisor is key. It’s only natural after years of underperformance to want to bet on whatever feels like the winning horse. Without having someone to hold our hand any of us, including professionals who know better, have a hard time waiting it out. Our take on all of this: While we see many non-client investors run from small stocks, this as an opportunity for our clients to buy what’s on sale and reap the long-term rewards of remaining disciplined.

5 Steps for Dealing With a Scary Market

The New York Times Sketch Guy, Columnist, and Take the Longview podcast guest Carl Richards, is one of the best in the world at connecting money and emotion. His unique ability is boiling down ideas to their essence so that everyone can relate. In a recent piece, he does it again, clearly outlining a 5-step guide to making it through the ups and downs of the financial market. Check it out here.