Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

The Bumpy Road

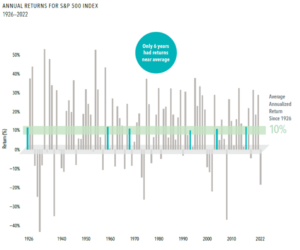

Historically, the US Equity market has returned about 10% annually to investors from 1926 – 2022. Due to this historical rate of return, many investors expect this level of return year over year. However, stock markets are highly volatile. Although the average is 10% per year, it is extremely rare for the market to be up 10% over any given year.

Since 1927, there have only been 6 years where the stock market returned between 8-12%. Thus, even though you should expect the market to give you a 10% return, you should expect the market over any given year to hardly ever give you a 10% return. It is this bumpy road that creates the risk in investing in equities, which is why you are compensated with the 10% annual average return. The key is to take the long view and not look at quarter-to-quarter or year-to-year returns.

People often panic when their expectations don’t match reality. Investors expect a 10% return every year, which will often not materialize. When the market goes down and does not match this 10% expectation, investors tend to panic. Changing your expectations on the range of outcomes of equities while keeping in mind the long-term average can help investors stick to their plan.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in managing a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Hill Investment Group may discuss and display charts, graphs, and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used alone to make investment decisions.

Keep It Simple

At conferences, I often hear experts advocate for private and alternative investments, claiming they’re essential for our largest and most sophisticated clients. They argue that these exclusive opportunities are what the wealthy truly want. These voices are growing louder, and the products they pitch are becoming more prevalent.

At Hill Investment Group, we take a different approach. We continue to value simplicity and transparency, regardless of how much money our clients have. We avoid complex, illiquid, and expensive options, even when others say they’re necessary. Our guiding question is this: once the marginal utility of wealth kicks in—when each additional dollar has less impact on your life—why take on added risks?

You can achieve extraordinary success by embracing what we call a “passive-aggressive” approach:

- Own global capitalism: Invest in broad market ETFs.

- Tilt toward premiums: Focus on factors identified by research to enhance returns.

- Rebalance regularly: Sell what’s done well, buy what’s lagged.

- Tax loss harvest: Capture losses to offset gains.

- Let it compound: Give your investments time to grow.

- Keep investing: Stay committed over the long term.

- Ignore the noise: Focus on your strategy, not the headlines.

By sticking to these principles, you can build and preserve wealth without getting caught up in the complexities that others might push.

Keep it simple!

August Newsletter Intro

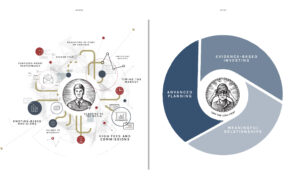

At Hill Investment Group, we’ve always believed that financial success is more than just numbers on a spreadsheet—it’s about creating a life of order, focus, and peace of mind. Years ago, we commissioned a graphic that powerfully encapsulates this transformation. On the left, you see a person overwhelmed by chaotic systems, piles of disorganized papers, and a lack of clear direction—a visual metaphor for the financial stress that many people endure every day. On the right, that same person is calm, collected, and confident, having achieved clarity, order, and control over their financial life. Peace of mind. At last.

This transformation is at the heart of what we do every day for our clients. We help them move from financial chaos to financial freedom by focusing on what we call the 4 C’s, the cornerstones of our advice:

- Competence: Our expertise in evidence-based investing, financial planning, holistic asset allocation, investment selection and monitoring, and risk management ensures that every decision is informed and every strategy is sound.

- Coaching: We guide our clients to set realistic expectations, manage emotions and biases, and stick to their long-term goals, providing objective feedback and a trusted second opinion.

- Convenience: We save our clients time with personalized service, coordinated efforts with trusted professionals, and secure technology that integrates every aspect of their financial life.

- Continuity: Our approach is designed to support clients through life’s transitions, ensuring that their plans are adaptable and their legacy is preserved across generations.

At Hill Investment Group, we believe in helping you take the long view—transforming the complexities of your financial life into something simple, clear, and manageable. We strive to replace stress with confidence, uncertainty with clarity, and disorder with harmony.

This before-and-after image isn’t just a reflection of what we do—it’s a reminder of the peace of mind that comes with working with a firm that’s committed to your financial well-being, both now and in the future.