Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

August Newsletter Intro

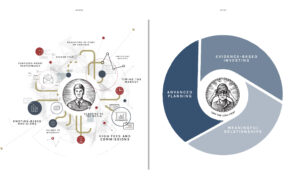

At Hill Investment Group, we’ve always believed that financial success is more than just numbers on a spreadsheet—it’s about creating a life of order, focus, and peace of mind. Years ago, we commissioned a graphic that powerfully encapsulates this transformation. On the left, you see a person overwhelmed by chaotic systems, piles of disorganized papers, and a lack of clear direction—a visual metaphor for the financial stress that many people endure every day. On the right, that same person is calm, collected, and confident, having achieved clarity, order, and control over their financial life. Peace of mind. At last.

This transformation is at the heart of what we do every day for our clients. We help them move from financial chaos to financial freedom by focusing on what we call the 4 C’s, the cornerstones of our advice:

- Competence: Our expertise in evidence-based investing, financial planning, holistic asset allocation, investment selection and monitoring, and risk management ensures that every decision is informed and every strategy is sound.

- Coaching: We guide our clients to set realistic expectations, manage emotions and biases, and stick to their long-term goals, providing objective feedback and a trusted second opinion.

- Convenience: We save our clients time with personalized service, coordinated efforts with trusted professionals, and secure technology that integrates every aspect of their financial life.

- Continuity: Our approach is designed to support clients through life’s transitions, ensuring that their plans are adaptable and their legacy is preserved across generations.

At Hill Investment Group, we believe in helping you take the long view—transforming the complexities of your financial life into something simple, clear, and manageable. We strive to replace stress with confidence, uncertainty with clarity, and disorder with harmony.

This before-and-after image isn’t just a reflection of what we do—it’s a reminder of the peace of mind that comes with working with a firm that’s committed to your financial well-being, both now and in the future.

What We’re Reading

Want to know what else we’re reading? Check out this piece on quiet compounding by Morgan Housel, which has a simple view on taking the long view and consider this thought-provoking take on retirement from The New York Times.

Want to know what else we’re reading? Check out this piece on quiet compounding by Morgan Housel, which has a simple view on taking the long view and consider this thought-provoking take on retirement from The New York Times.

Stock Pickers Are Losing

WSJ columnist Jason Zweig elegantly analyzes and answers a current phenomenon: “It’s a stock picker’s market. So why aren’t more stock pickers doing better?”

Would you consider your own portfolio “diversified” if only three stocks accounted for more than 20% of the value of the portfolio? You might be excited at a cocktail party, but how well would you sleep if only one stock (Nvidia) accounted for more than 30% of the year-to-date return of the S&P 500?

Read on to learn more about how correlation and concentration are confounding stockpickers while following an evidence-based, long-view approach ignores the noise and chugs along.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.