Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Uncategorized

So long! Farewell! Until Next Time…

Holidays at HIG: Office Hours

Our team will take a short break on December 25th, December 26th, and January 1st to celebrate with loved ones.

Our team will take a short break on December 25th, December 26th, and January 1st to celebrate with loved ones.

During the remaining days, we’re ready and excited to provide top-notch service as we head into the new year. Whether you have questions, need assistance, or simply want to share some holiday cheer, our team is here for you.

Here’s a quick rundown of our holiday hours:

- Monday, December 25th: Closed for the day

- Tuesday, December 26th: Closed for the day

- Monday, January 1st: Closed for the day

Wishing you a joyous holiday season filled with laughter, warmth, and celebration.

Your team at Hill

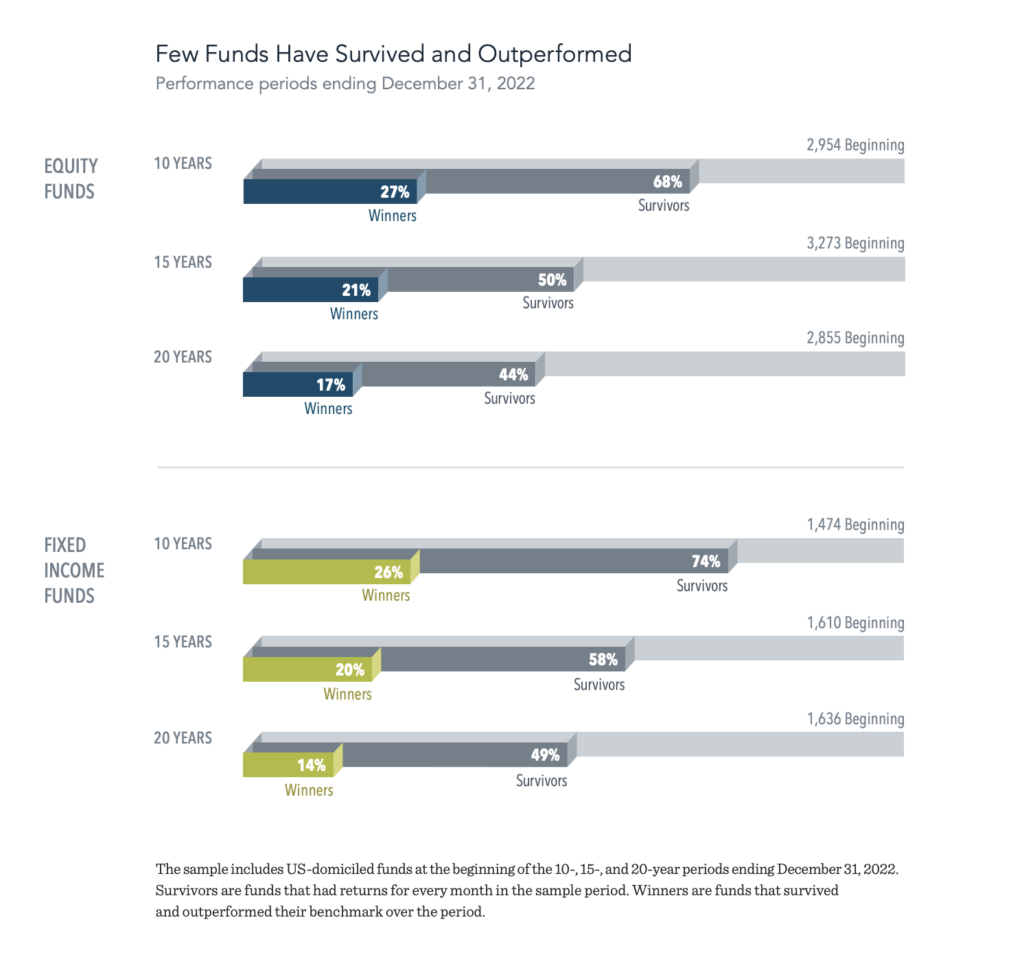

Image of the Month

Each year, Dimensional analyzes investment returns from a large sample of US-domiciled funds (over 4,000). This year’s study updates results through 2022 and includes returns from mutual funds and exchange-traded funds (ETFs) domiciled in the US. The evidence shows that a majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. We believe that the results of this research provide a strong case for relying on market prices when making investment decisions.