Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Timely Topic

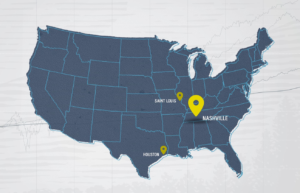

Nashville, Here we come!

I have exciting news to share. We are expanding our team and geographic reach with a new partner in Nashville, Tennessee. Read the press release here.

We are honored and excited to join forces with Malissia Johnson and her team at Emerald Spectrum, based in Brentwood, Tennessee. From the first time we met Malissia (President and Founder), we knew we were talking to our kind of person, someone we’d like to work with in the future. What did we notice?

They care about serving clients in an unusual way.

They care about clients more than their own interests.

They care beyond a spreadsheet and a quarterly performance report.

They care the way we care at Hill Investment Group.

I know a lot of financial planners and advisors, but few have the character and dedication we see in Malissia’s team. Malissia has helped her clients plan for their ideal future, and we’re thrilled to be a part of her plan for her next chapter.

I’m confident we’ll be better together.

For our current clients, you can be excited about this announcement too, as we are incredibly sensitive and careful with growth. The shareholders of Hill Investment Group will always prioritize our clients over profits. Planned and controlled growth is a critical element of what keeps and attracts top team members at all world-class organizations. Maintaining our values and team culture are equally important. As I’ve previously mentioned, because of our partnership with Focus Financial, we have institutional resources and leverage to bring to our team and clients. A boutique firm with big resources is a winner for our clients and us!

With the addition of any new team members, we always look to enhance our capabilities for you, and we believe the skills that Malissia and her team bring will directly benefit you. In addition to enhancing our existing team, Malissia’s team adds services that were missing in our current offering, including enhanced wealth planning. Stay tuned.

Finally, here’s Malissia in her own words:

“My favorite part of the wealth management business is the deep, uniquely personal relationships I have with my clients,” said Malissia Johnson. “As I got to know the Hill team, I found that they had a similar sense of care and an uncompromising fiduciary commitment to their clients, truly living by their mantra “take the long view.” Our shared ethos gave me great comfort that joining Hill was the right next step for my clients and team, allowing them to benefit from Hill’s robust resources and ensuring that they will be well served for generations to come.”

That’s a perfect fit.

Music City, here we come!

Matt

Three Timely Tax Tips

Around this time of year, taxes are near the top of just about everyone’s to-do list. At Hill Investment Group, we think about taxes every day of the year, working to maximize our clients’ after-tax returns. That means we not only try to maximize the returns in our clients’ portfolios but also limit the amount of money they have to pay in taxes.

Some of you may have already filed your taxes, and good for you. For those that have not already filed, below we share a few tips you can use to hopefully reduce the amount you send to Uncle Sam for 2021.

Contribute to your IRA: Saving in a traditional IRA is one of the simplest ways to reduce taxes. You can contribute up to $7,000 to a traditional IRA (if you are over age 50) and count it as a 2021 contribution to potentially reduce your income.

Contribute to a Health Savings Account: If you are covered under a high-deductible healthcare plan, a family can contribute up to $8,200 (if the owner is over age 55) to a Health Savings Account (HSA) and count it as a 2021 contribution. This is an often-missed opportunity. We were told by one CPA that if you can only contribute to your HSA or 401(k), they would pick the HSA for the tax benefits – quite an endorsement.

Charitable Contributions: Married couples can deduct up to $600 of cash charitable contributions even if they take the standard deduction. So, although you may not have other deductions, be sure to keep track of those cash gifts you made in 2021.

As with all tax planning, we recommend you connect with your accountant or CPA to get more information on your specific situation.

With the Recent Events in Ukraine, Should I Make Changes to My Portfolio?

There is no downplaying the news coming from Ukraine and Russia. While Russia makes up a small percentage of the overall global stock market (less than .25% as of February 23), Russia and Ukraine both play considerable roles in producing and supplying commodities such as liquid natural gas, wheat, etc.

What does this mean for you as an investor?

The situation is currently evolving. We know that political leaders from the West condemned Russia’s actions and vowed significant sanctions in response. Markets reacted with increased volatility, and some stocks retreated.

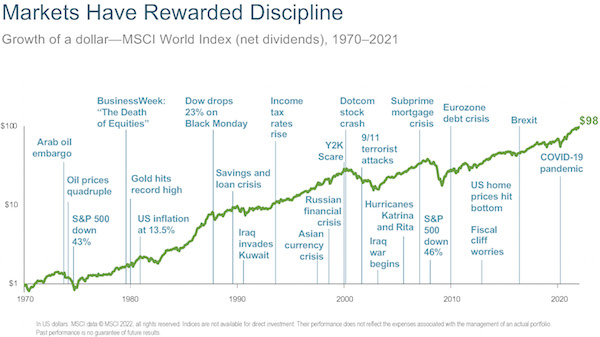

While no two historical events are the same, historical context is often helpful to put current events into context. The chart below illustrates the growth of a dollar invested in global equities alongside past crises. Think back to some of these events- it’s easy to remember how uncertain the future felt. Putting current events into this context helps us take the long view. The chart shows that markets rewarded disciplined investors for their grit. This chart is a good reminder of what it means when you invest for the long term, and the fortitude being demanded of us today.

Takeaways

- It is rarely advisable to mix emotions and investing.

History shows us that a critical ingredient of long-term investing success is having discipline in good times and in difficult periods. Markets have rewarded investors willing to tune out the noise and stick to their plan. So, we advise you to stick with yours. - Your systematic investing approach already adjusts to new information in real-time.

Investors in global equity portfolios inevitably face periods of geopolitical tensions. Sometimes these events lead to restrictions, sanctions, and other types of market disruptions. We cannot predict when these events will occur or exactly what form they will take. However, we can plan for them. We do this for you by managing your diversified portfolios and building flexibility into our investing process. - Staying invested is the winner’s game.

In good times and in bad. A recent report by Morningstar investigated how successful investors are when trying to time markets. Ultimately, the report concluded, “The failure of tactical asset allocation funds suggests investors should not only stay away from funds that follow tactical strategies, but they should also avoid making short-term shifts between asset classes in their own portfolios.” Why? Missing out on a couple of the best-performing days wipes out your returns. And, to time correctly, you must be right twice – both when to get out and when to get back in.* - Diversification is the only free lunch.

This quote attributed to Harry Markowitz as essential now as ever. We believe that the most effective way to mitigate the risk of unexpected events is through broad, global diversification and a flexible investment process. This philosophy allows you to ride the wave through any crisis, such as natural disasters, social unrest, and pandemics, limiting risky overexposure to any particular sector or market. - Take the long view.

We don’t believe that this time it’s different, but instead the apocalypse du jour. You can be confident in your approach, your plan, and your team. We are here for you.