Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Timely Topic

Marginal Utility and Diminishing Return

We don’t know when to stop.

At least, I sure don’t.

Sometimes, on the way home from work, I’ll swing by the grocery store, buy a pint of ice cream, and eat it.

That’s right. The whole thing.

Yes, I know. That’s a LOT of ice cream.

I’ve noticed that a very interesting thing happens when I do this:

Bite 1: Best thing in the world, ever.

Bites 2-10: Really good.

Bites 11-15: Good.

Bites 16-20: Meh.

Bites 21+: OK, now I’m sick.

I learned this lesson the first time I ate a pint of ice cream in a single sitting.

And yet, for some reason, I still occasionally repeat the experiment.

Of course, this phenomenon doesn’t only occur with ice cream. This is a well-documented economic principle called Marginal Utility, and, you guessed it, it applies to money, too.

Beyond a certain point, having more money will not lead to more security, freedom, and happiness.

Because security, freedom, and happiness do not come from more money (at least, not beyond a certain point). They come from knowing when to stop.

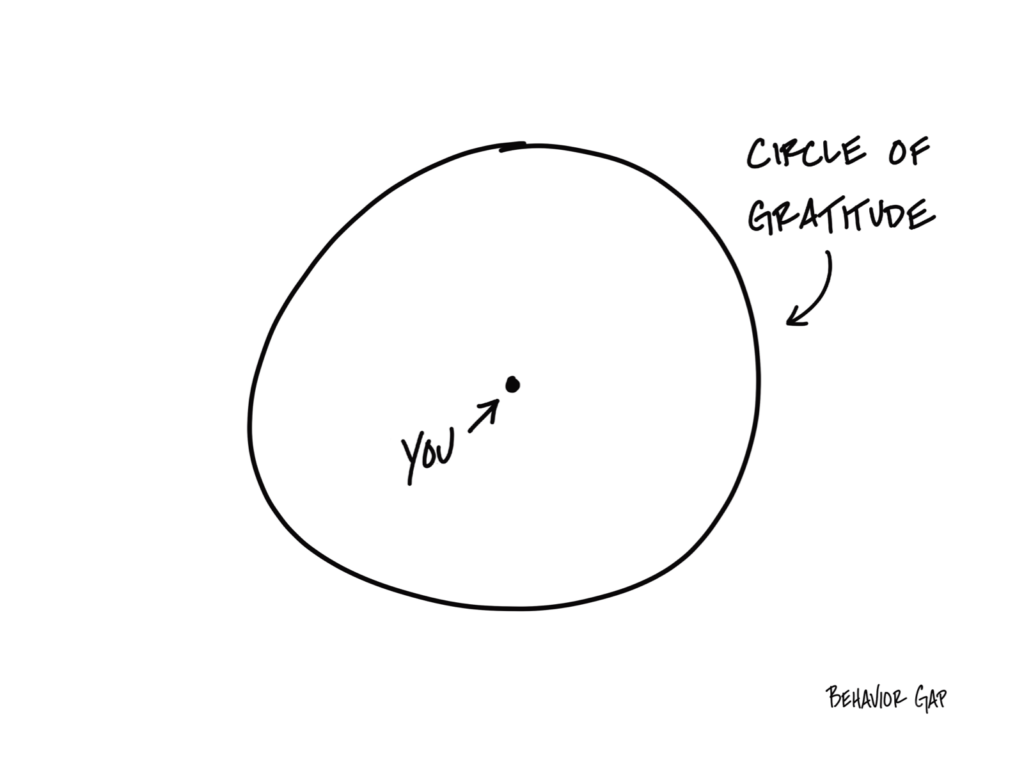

Image of the Month

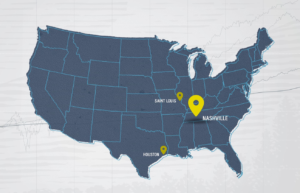

Nashville, Here we come!

I have exciting news to share. We are expanding our team and geographic reach with a new partner in Nashville, Tennessee. Read the press release here.

We are honored and excited to join forces with Malissia Johnson and her team at Emerald Spectrum, based in Brentwood, Tennessee. From the first time we met Malissia (President and Founder), we knew we were talking to our kind of person, someone we’d like to work with in the future. What did we notice?

They care about serving clients in an unusual way.

They care about clients more than their own interests.

They care beyond a spreadsheet and a quarterly performance report.

They care the way we care at Hill Investment Group.

I know a lot of financial planners and advisors, but few have the character and dedication we see in Malissia’s team. Malissia has helped her clients plan for their ideal future, and we’re thrilled to be a part of her plan for her next chapter.

I’m confident we’ll be better together.

For our current clients, you can be excited about this announcement too, as we are incredibly sensitive and careful with growth. The shareholders of Hill Investment Group will always prioritize our clients over profits. Planned and controlled growth is a critical element of what keeps and attracts top team members at all world-class organizations. Maintaining our values and team culture are equally important. As I’ve previously mentioned, because of our partnership with Focus Financial, we have institutional resources and leverage to bring to our team and clients. A boutique firm with big resources is a winner for our clients and us!

With the addition of any new team members, we always look to enhance our capabilities for you, and we believe the skills that Malissia and her team bring will directly benefit you. In addition to enhancing our existing team, Malissia’s team adds services that were missing in our current offering, including enhanced wealth planning. Stay tuned.

Finally, here’s Malissia in her own words:

“My favorite part of the wealth management business is the deep, uniquely personal relationships I have with my clients,” said Malissia Johnson. “As I got to know the Hill team, I found that they had a similar sense of care and an uncompromising fiduciary commitment to their clients, truly living by their mantra “take the long view.” Our shared ethos gave me great comfort that joining Hill was the right next step for my clients and team, allowing them to benefit from Hill’s robust resources and ensuring that they will be well served for generations to come.”

That’s a perfect fit.

Music City, here we come!

Matt