Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Service

Hey Hill, How Can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com.

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com.

Hey Hill, Is a Pre-Tax or Roth 401(k) Right for Me?

Picture this: you’ve just landed a new job, and you’re ready to dive into your benefits package. You’re at the 401(k) enrollment screen, wondering: “Pre-tax or Roth contributions—which one’s the better long-term choice?” Many of our clients face this same question, and the answer often depends on your financial goals. Here’s a quick breakdown to help you make an informed choice.

Pre-Tax vs. Roth: What’s the Difference?

Think of it like shopping with a choice between a discount today or tax-free shopping later.

- Pre-tax contributions lower your taxable income now, saving you on taxes this year. But you’ll owe taxes on those funds, plus any growth when you withdraw in retirement.

- Roth contributions are taxed upfront, giving you the benefit of tax-free growth and tax-free withdrawals in retirement.

How This Can Look in Dollars:

If you’re in the 24% tax bracket, contributing $10,000 pre-tax saves you $2,400 this year. With Roth, you pay that tax now but enjoy tax-free withdrawals on both the initial amount and any growth in the future.

Key Factors to Consider:

- Current vs. Future Tax Bracket: Are you early in your career and expecting your income to grow? Roth might make sense, letting you lock in today’s lower tax rate. But if you’re in a high-earning phase and expect a lower tax bracket in retirement, pre-tax could be more advantageous.

- Time Horizon: The longer you have until retirement, the more valuable Roth’s tax-free growth can be. Younger savers often benefit from decades of compounding without a tax hit.

- Employer Match: Don’t forget that any employer match is usually pre-tax, giving you a mix of both types, regardless of your choice.

Need Help Deciding?

This choice doesn’t have to be overwhelming. If you want help deciding between pre-tax and Roth contributions—or figuring out how much to save and where to invest—reach out. We’re here to help you get clear on what makes sense for your financial future.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Consult with a qualified financial adviser before implementing any investment or financial planning strategy.

August Newsletter Intro

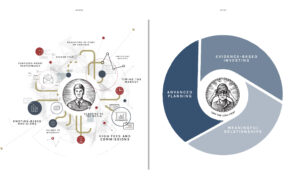

At Hill Investment Group, we’ve always believed that financial success is more than just numbers on a spreadsheet—it’s about creating a life of order, focus, and peace of mind. Years ago, we commissioned a graphic that powerfully encapsulates this transformation. On the left, you see a person overwhelmed by chaotic systems, piles of disorganized papers, and a lack of clear direction—a visual metaphor for the financial stress that many people endure every day. On the right, that same person is calm, collected, and confident, having achieved clarity, order, and control over their financial life. Peace of mind. At last.

This transformation is at the heart of what we do every day for our clients. We help them move from financial chaos to financial freedom by focusing on what we call the 4 C’s, the cornerstones of our advice:

- Competence: Our expertise in evidence-based investing, financial planning, holistic asset allocation, investment selection and monitoring, and risk management ensures that every decision is informed and every strategy is sound.

- Coaching: We guide our clients to set realistic expectations, manage emotions and biases, and stick to their long-term goals, providing objective feedback and a trusted second opinion.

- Convenience: We save our clients time with personalized service, coordinated efforts with trusted professionals, and secure technology that integrates every aspect of their financial life.

- Continuity: Our approach is designed to support clients through life’s transitions, ensuring that their plans are adaptable and their legacy is preserved across generations.

At Hill Investment Group, we believe in helping you take the long view—transforming the complexities of your financial life into something simple, clear, and manageable. We strive to replace stress with confidence, uncertainty with clarity, and disorder with harmony.

This before-and-after image isn’t just a reflection of what we do—it’s a reminder of the peace of mind that comes with working with a firm that’s committed to your financial well-being, both now and in the future.

July Newsletter Intro

The Power of Personal Service

At Hill Investment Group, exceptional service is more than just a hallmark of our brand— it is the foundation upon which we have built our firm. While “service” can often be ambiguous, we have made it our mission to define, hire for, and reward this essential aspect of our business. Like all organizations, we are not perfect. Still, we strive to be intentional in building on our core service values: fast (be available), friendly (be warm and upbeat), and ownership (take responsibility).

Fast: Be Available

In today’s fast-paced world, being available and responsive is crucial. One small example: when you call our offices during regular business hours, a human being will answer the phone in two rings or less. Our entire team is committed to being accessible and ensuring that we provide timely and practical support when you need us. This level of availability is not just about promptly answering calls or emails; it’s about anticipating and proactively addressing your needs.

Friendly: Be Warm and Upbeat

A friendly demeanor goes a long way in building trust and long-lasting relationships. At Hill Investment Group, we hire individuals who naturally exude warmth and positivity. A welcoming attitude can make all the difference, especially during moments of uncertainty or stress. We aim to create an environment where you feel comfortable and valued, knowing we genuinely care about your financial well-being. For example, if you could see how our team reacts to the milestones and occasional setbacks that impact clients’ lives, you would see folks who care as if they have your same last name.

Ownership: Take Responsibility

Taking ownership means more than just completing tasks— it’s about seeing them through to successful outcomes. Our team members are encouraged to take personal responsibility for the projects and client interactions they handle. This sense of ownership ensures that we are all committed to delivering the best possible service from start to finish. We take pride in our work and are dedicated to achieving the highest standards for our clients. For example, you should never hear a Hill person say, “I’m not sure; that’s not my department; I’ll have to transfer you.”

A Foundation in Service Training

Early in my career, I had the opportunity to train service team members, which profoundly influenced my understanding of exceptional service. This experience has been meaningful in shaping our approach at Hill Investment Group. A significant part of our service philosophy is informed by Danny Meyer and his concept of enlightened hospitality, which emphasizes the difference between service (the delivery of the thing) and hospitality (how you feel). You can learn more about this philosophy and our conversation in my podcast episode with Danny Meyer.

Learning from Others

While we strive for excellence, we also recognize that there is always room for improvement. Recent discussions around service standards at some of the largest firms in our industry have provided valuable lessons. For example, Vanguard, known for its die-hard customer base, has faced significant challenges with service quality, as highlighted in this Wall Street Journal. Additionally, the classic piece on Goldman Sachs’ focus on sales over service is a cautionary tale about prioritizing client needs above all else. You can read more about it in this New York Times article.

Our Commitment

We are dedicated to continually refining our service standards at Hill Investment Group. We value your feedback and are always looking for ways to enhance your experience with us. By focusing on being fast, friendly, and taking ownership, we aim to provide you with the exceptional service you deserve, and that differentiates us from others.

To our clients and friends of HIG, thank you for entrusting us with your financial journey.

Take the long view,

Matt

“Since the beginning I have always felt a strong sense of relationship with everyone I’ve met and worked with at Hill, “they’re family, they’ve got my back” is the way I describe it to people.”

A recent favorite quote from a client who was kind enough to share an experience with us that wasn’t up to our normal standard. His statement is what we strive for and is a crucial aspect of our culture. Sharing his experience when it wasn’t up to par is the kind of generous relationship we are grateful for at HIG.