Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

Hey Hill, how can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

Hey Hill, how can I reduce my IRA Required Minimum Distributions (RMDs) and related retirement tax liabilities?

Contributing to traditional IRAs and 401(k)s is a great way to save for retirement. You get a current-year tax deduction, and your money grows year in and year out without being hindered by taxes. The IRS never sleeps. You either pay them now or later. Therefore, at some point, when you need to access these tax-deferred funds, whether that’s by choice or because you must begin taking Required Minimum Distributions (RMDs), any withdrawals you make from your IRA will be subject to ordinary income tax rates. Therefore, it’s critical to understand the different ways to plan for this most effectively.

First, what is an RMD? The IRS requires that an individual begin taking systematic withdrawals from their pre-tax/qualified retirement accounts (e.g., 401(k), 403(b), traditional or rollover IRAs, etc.) at age 72, 73, or 75, depending on your date of birth. This annual required mandatory distribution is known as an RMD. You can calculate your projected RMD using the Schwab RMD Calculator.

While we want our pre-tax retirement accounts to grow and be as large as possible, the taxes that will ultimately be due also grow. An investor can use three strategies to optimize this tradeoff between growth and taxes.

ROTH Conversions

One strategy is to convert assets from your traditional or rollover IRA to a Roth IRA before RMDs begin. When investors are in a low tax bracket, there are often many years between retirement and the RMD start date. Therefore, investors can save a lot in taxes by converting assets during a lower income period.

Let’s consider an example to showcase how this strategy works.

Betsy has just retired at 65 and has $500,000 in her traditional IRA. She must begin taking RMDs at age 73. Her projected RMD at 73 is about $30,000 per year. This amount might bump Betsy to a higher tax bracket in the future and may even increase her Medicare premium costs.

Since Betsy is retired, her reduced income level moves her from the 22% tax bracket to the 15% tax bracket. She decides to convert some of her traditional IRA into a Roth IRA. She withdraws $40,000 annually for the next five years from her pre-tax traditional IRA to fund her Roth IRA. Each year, she pays income tax on the $40,000 distribution but at her new, lower tax rate. This is known as a Roth Conversion. Her money has moved from one tax-advantaged account (the Traditional IRA) to another (the Roth IRA), the taxes are “pre-paid” at a lower rate, and her invested money in the Roth will continue to grow and never be taxed again. By age 70, she has successfully reduced her traditional IRA balance by $200,000, and her RMD at 73 is now projected to be only $18,000 rather than $30,000.

QCDs

But there is even more she can do. Starting at age 70.5, the IRS allows you to distribute funds from your IRA without paying taxes if the funds are gifted directly to a qualified charitable organization. Betsy currently gives $10,000 to her church annually by writing a check from her bank account. Instead, she should direct her Hill advisor to make those payments on her behalf from her IRA. This approach takes advantage of the Qualified Charitable Distribution or QCD. If Betsy’s RMD following her Roth Conversion was projected to be $18,000, by donating $10,000 from her IRA, she will only be taxed on $8,000. By planning 8 years into the future, Betsy’s Hill Advisor has reduced her RMD from $30,000 to $8,000, she will pay less in taxes, and she has a growth Roth IRA for her future needs.

Asset Location

Finally, behind the scenes, Hill manages portfolios by locating the higher-growth assets away from pre-tax accounts and locating the income-producing assets within the pre-tax accounts. This asset location strategy helps minimize future retirement taxes across your entire household. By doing this, you reduce the income taxes you pay year to year and ensure that your high-growth assets get taxed at lower capital gains rates rather than higher income rates.

Both the Roth conversion and the QCD approach, along with Hill’s asset location strategy, are not just tax savvy; they are also strategic moves that can enhance your financial security. By taking the long view on your IRA funds, you can minimize the taxes due and maximize the total dollars you have available to you as you enjoy your retirement.

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser or tax professional before implementing any investment or tax strategy.

Honoring Rick Hill’s Legacy

Picking Up Pennies – Volume 7

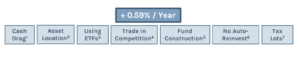

Welcome to the final installment of Picking Up Pennies. Last month, we discussed how understanding the concept of tax lots can optimize an investor’s tax consequences and even create a tax asset via active tax loss harvesting. Over the last six months, we have discussed different strategies we employ to increase returns, reduce costs, and minimize taxes. This final article will summarize the impact of these small decisions on your investment portfolio.

- Volume 1 – Keep Cash Balances Low (Better Chance for Higher Returns)

- Volume 2 – Asset Location (Reduces Taxes)

- Volume 3 – Using ETFs (Reduces Taxes)

- Volume 4 – Trading ETFs in Competition (Reduces Trading Costs)

- Volume 5 – Number of Funds and Not Auto-Reinvesting Dividends (Reduces Trading Costs)

- Volume 6 – Tax Lots and Tax Loss Harvesting (Reduces Taxes)

- Volume 7 – Summary (Total Impact)

Determining the exact impact of each decision is difficult as each strategy will impact every investor differently. For this analysis, we used what we think is a typical investor.

– Allocation is 60% Stocks and 40% Bonds

– Half of the money is in a taxable account, half is in an IRA

– Portfolio turnover is 10%/year

– 25% income tax rate, 15% capital gains tax rate

While the impact of some strategies may be more pronounced than others, it’s important to remember that every penny counts. When you add up all these strategies, you’ll see a significant difference in your investment outcomes. Specifically, about 0.59% per year or 59 basis points in financial industry jargon, which we prefer to avoid. Remember, all else being equal, the higher your tax rate, the more significant your net savings.

As discussed throughout the series, implementing these strategies is more than a one-size-fits-all approach. Each investor and family is unique, and tailoring these strategies to your needs takes time and effort. Our personalized approach is a testament to our commitment to your financial success.

In the first installment, I mentioned that I often ask other money managers how they implement these solutions. Most of the time, the response is, “We are not doing X because… it is too much work, clients don’t know the difference, the benefit is small, etc.” All of these answers are correct except one. It does take a lot of work…clients don’t normally notice the difference…but the benefit is NOT small. When you add all this up, it makes a meaningful difference. As your fiduciary, our obligation is to seek the best solutions we can find for our clients…no matter what.

These benefits are all the small details in your investment implementation. This series does not even include the bigger items that add even more value, like asset allocation, quarterly rebalancing, behavioral coaching, spending strategy, and a low-fee diversified investing strategy. Add it all together and compound these advantages over time, and now you’ve got something to be proud of now and in the long view!

1 Assumes the average investor holds 8% cash across uninvested cash and cash held in funds (5% + 3%). HIG holds 1% cash (0.7% + 0.3%). 60/40 portfolio returns 4% above cash. Impact = 30 bps

2 Assumes 5% bond returns and 10% equity returns. Impact = 20 bps

3 Assumes 3% annual capital gain distributions. Impact = 5 bps

4 Assumes savings of 2 cents per share traded. Impact = 1 bp

5 Assumes 20% additional fund turnover. 0.1% round-trip trading costs. Impact = 2 bps

6 Assumes 4% distributions and 0.1% higher trading costs. Impact = 1 bp

7 Tax benefits would depend on specific market conditions. Impact assumed to be zero for this analysis.