Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Philosophy

Cheers! Image of the Month

Earlier this month, the entire Hill Investment Group team spent an inspiring afternoon touring the world-famous Anheuser-Busch (AB) brewery in St. Louis. Why? We are always learning and have drawn myriad lessons from the way AB continues to set the bar for excellence – for product craftsmanship, knowing their client, and being a pillar of the community. Did we mention the attention to detail, timeliness, reliability, data and evidence, and hospitality? And, fun fact, both Rick Hill and Buddy Reisinger are former “Miller killers” themselves.

When Rick and I set out to form a brand new firm more than 15 years ago, we drew inspiration from AB, as well as other examples of excellence. Some of our clients may catch the subtle nod in the photo above to our founders’ vision: that Hill Investment Group should feel to clients like a combination of The Four Seasons Hotel and Cheers!… where everybody knows your name.

If you’ve never been to our world headquarters in St. Louis, we’d love to host you on a tour of our offices…yes, we’re open…and invite you to experience our hospitality!

Surrendering to the Speed of Reality

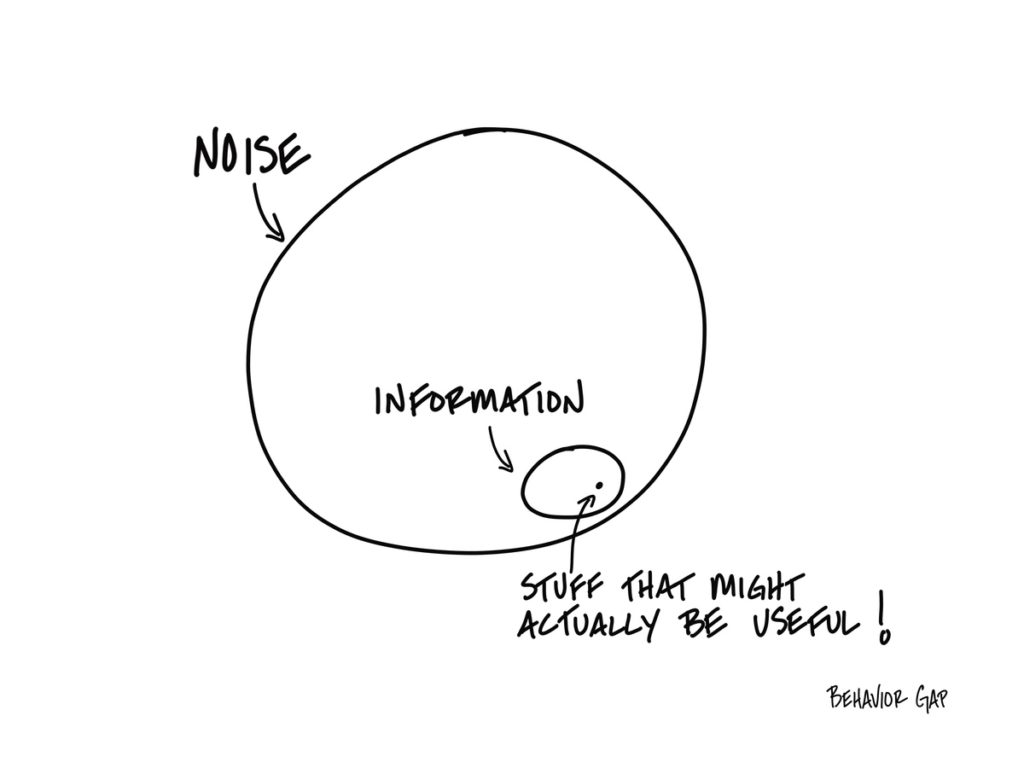

News outlets keep us informed which, in turn, gives us an intellectual edge over everybody else—so the theory goes. But what if the key to making better decisions was tuning out, rather than tuning in?

Maybe you’ve noticed this paradox: the more news you consume, the less informed you feel. That’s because news is, by definition, temporary. As soon as you form an opinion, a new headline comes along to cast doubt, and the cycle repeats.

This is especially true with financial news which plays on our fear of losing money, whether that’s missing the latest crypto trend or failing to hedge against inflation.

There’s a reason sensationalism goes viral. As Jason Gay noted in The Wall Street Journal, “Nobody gets clicks and famous for taking a long view; hell has to be served in a handbasket, preferably with a clever baiting headline.”

We’re not here to pick on financial writers; we’re here to point out how alarmist financial news chips away at our sanity. Finding and buying the latest hot stock offers an intoxicating thrill, like a lucky roll of the dice at a casino. But as a strategy to achieve long-term peace of mind, it’s doomed to fail.

Frantically refreshing your newsfeed to inform your investing strategy isn’t just inefficient, it’s exhausting. Human beings have a finite supply of mental energy, and trying to time the market day after day quickly zaps it. But once you get fed up with paying the biological (and monetary) price of attempting to outwit global capitalism, something clicks. At least it does for our clients who can take solace in the fact that they no longer have to pray that they uncover the needle in the haystack—they simply own the haystack…which already includes those needles!

In our world, we call this a “Long View Moment,” or as the writer, Oliver Burkeman says, “surrendering to the speed of reality.” It’s the sense of freedom when you realize that you don’t need to watch Squawk Box or jerk your head when you see a stock ticker.

When we let fantasies crumble (like the idea that you can “outsmart” the market), it clears the path for a new way of thinking where we embrace our limits instead of fighting them. Psychotherapists call this a “second-order change,” meaning it’s not just a behavioral tweak, but a change in perspective that reframes everything.

A change in perspective: that’s been the purpose of our newsletters, my podcast, and Hill Investment Group as a whole for years. We want to spread the word that building wealth doesn’t require tons of tiny decisions, but rather one big decision: to let go.

Once you abandon your attempt to manage the unmanageable, you can get to work on what really matters in life: spending time with loved ones, cultivating meaningful experiences, doing deep work.

Burkeman sums up this idea nicely in his book Four Thousand Weeks: Time Management for Mortals.

“When you finally face the truth that you can’t dictate how fast things go…you breathe a sigh of relief and begin to acquire what has become the least fashionable but perhaps most consequential superpower: patience.”

A Moment of Reflection: Something to Celebrate

This time of year, people are buzzing about New Year’s resolutions, guessing what the tax changes will be, and all sorts of anxiety-provoking topics.

But you, you’re different. Give yourself a huge pat on the back. You can congratulate yourself on checking the box on most, if not all, of your financial resolutions – for this year and next! Why?

You’re a Hill Investment Group client. With that single decision, you get to delegate your worry to us, benefitting from:

- A long-term, low-cost, tax-efficient, and globally diversified investment portfolio

- A financial plan grounded in your personal goals, your family, the causes, and organizations that you genuinely care about

- A disciplined, evidence-based investment strategy

- Tax-aware investment moves made throughout the year

- Planning strategies that maximize the value of vehicles and benefits available to you

- Proactive strategies that guide you towards the legacy you hope to leave

- And the list goes on!

So. Now what? By checking off all of the above, take a few minutes and think about those long-term goals, your family, your health. What will you resolve to start doing or stop doing with this freedom? What can you do that will enhance your health span, your relationships, the odds that you’ll check off some bucket list items. Do that.

And while you do that, the Hill Investment Group team will continue to do our part to eliminate worry and deliver peace of mind. Our mission is to walk you towards a higher level of financial freedom. We thank you for making us part of your family. It’s great company to be in!

If you’re not a client and want to check off a few items on your New Year’s resolution list, call us or set up a time to get together…face to face or virtually. Cheers!