Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

Founding Hill Investment Group – 2005

This is the latest in a series of posts from Rick. To see prior entries click here.

Once I’d experienced the benefits of an evidence-based investing approach myself, I started thinking about my clients back at the brokerage firm in 1967. How much better off would they have been if these tools were available to me, and in turn, them? With my newfound knowledge on how to truly help people, I decided to take the first step in realizing a dream. I left Anheuser-Busch in 1997, started earning my Certified Financial Planner (CFP) designation, and became a financial advisor at Buckingham Asset Management in St. Louis, Missouri

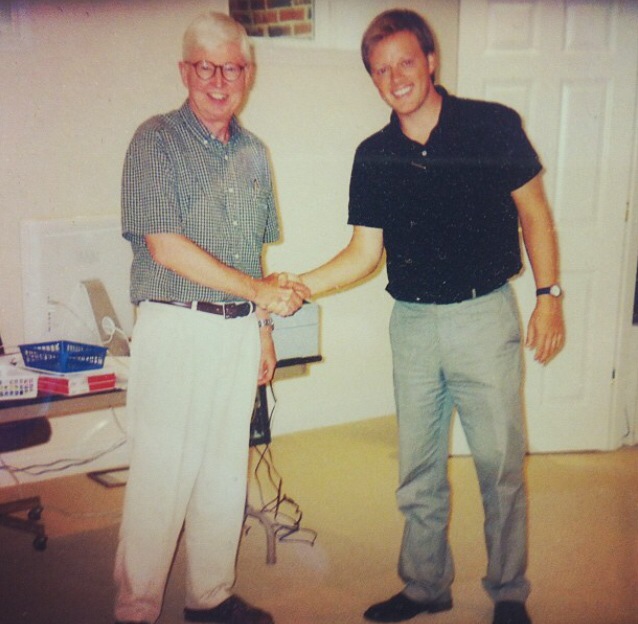

At Buckingham, I met Matt Hall, and after six years working together, we decided to start our own firm. Launching Hill Investment Group in 2005 allowed me to utilize everything I’d learned about both the evidence-based and emotional sides of investing. However, there were still important lessons ahead for me.

Like the best advisors, we always encourage our clients to focus on the long-term, not the market’s daily, weekly, or even yearly movements. Most people think “the long-term” means five or 10 years. However, as we discovered during the early days of Hill Investment Group, even a decade isn’t a significant amount of time in the grand scheme of a long-term investing strategy.

We couldn’t have known that we were launching our firm right in the middle of what’s now known as the “lost decade.” For the 10 years between 2000-2009, the S&P 500 had an annualized negative return of −0.95%*. Yes, the entire first decade of the 21st century netted a negative return as measured by the S&P 500.

The 2007-2008 financial crisis contributed to those poor results. An internationally diversified, evidence-based portfolio with exposure to small and value stocks helped our clients get through that period in great shape compared to investors focused on large-cap, U.S. stocks. What may be more important is what happened next: Between 2010 and 2019, all markets went on a sustained bull run, with the S&P 500 delivering a 13.6%* annualized return.

Talk about a huge swing over two consecutive decades. Even people who thought they were “long-term investors” might have reached the end of the lost decade thinking that their investment strategy wasn’t working and decided to change course. Doing so would have cost them dearly if they didn’t participate in the next decade’s rebound.

Lesson learned: The long-term is the rest of your life.

Sticking with a long-term investing plan requires discipline, including the discipline to weather a decade-long period of underperformance. Some people may focus on one goal or milestone to keep them on track, like wanting to retire at age 65. While that’s not a bad thing, the most successful investors are the ones who recognize that they’re working toward multiple financial goals—including significant expenditures during their working years like college costs and home improvements. To meet all these disparate goals, one must adopt a lifelong commitment to saving and investing through all market conditions. All of this is much easier with a trusted advisor…even better with a trusted team of advisors.

No one can accurately predict all the various things you might want to do with your savings 20, 30, or 40 years from now. Life throws all kinds of surprises our way. Some bad. Some fantastic. When you reach one long-term goal, new ones often magically emerge that become just as important to you. That’s why the real objective of one’s investment strategy should be to reach a point where there are opportunities to do almost anything you want for yourself, your family, and even for others.

I’ve witnessed how rewarding it can be for clients who embrace this approach. They’ve met the goals they set out to achieve for themselves with plenty left over to do some incredible things. Many of them are now supporting their grandchildren’s education or making charitable donations with their excess savings. One client’s wife was diagnosed with Alzheimer’s disease, inspiring him to provide major funding for Alzheimer’s research.

In other words, there will always be reasons to keep saving and investing. As long as you make good decisions based on what you can control, let the markets do what they’re going to do, and avoid meddling with your portfolio, you will likely have a lifetime to enjoy the results.

Improving your own investment experience

It’s easier than ever to start investing. You just need some money and a brokerage account or an app on your phone. The question is: will you be a gambler or an investor. There’s a huge difference.

Becoming a good investor isn’t easy. Many people struggle through experiences like the ones I’ve had myself over the past 50 years and never find a way to move past the stress and anxiety that they feel.

My hope is that these stories help you see how changing your attitude toward investing and the approach you follow can truly improve your quality of life. After all, that’s why people invest in the first place—to make their lives, and the lives of others, better. That’s the most important “return” you can achieve.

If you’ve followed along this far and are not a client already, I have one question:

How can we help you? Click here if you’d like to set up a time to talk.

*Returns data from https://ycharts.com/indicators/sp_500_total_return_annual. Past performance is not indicative of future performance. Principal value and investment return will fluctuate. There are no implied guarantees or assurances that the target returns will be achieved or objectives will be met. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal. The values used were obtained from sources believed to be reliable.

Embracing the Evidence at Anheuser-Busch – Mid 1980s

This is the latest in a series of posts from Rick. To see prior entries click here.

Although the emotional roller coaster led me to leave the brokerage firm, I definitely wasn’t ready to give up on a financial career. After sending out hundreds of resumes, I eventually saw a job posting in the Wharton alumni newsletter for a position in the Treasury group at Anheuser-Busch in St. Louis, Missouri. I sent my resume and cover letter and was surprised to find myself called in quickly for an interview. As good fortune (and solid preparation) would have it, I earned a job as a financial analyst at the world’s largest brewer at their headquarters. It was such a good fit for me that I stayed with Anheuser-Busch for 25 years, eventually working my way up to Assistant Treasurer.

During my time there, a group within our section was charged with figuring out how to “fix” Anheuser-Busch’s pension fund. It had been underperforming its benchmarks for several years, despite having a highly rated (and expensive) institutional investment consultant whose primary job was to pick the “best” U.S. and international investment managers. Per the consultant’s recommendations, the pension plan routinely cycled in new managers who had delivered great, recent, historical performance. However, it always seemed to be the case that once Anheuser-Busch invested money with the new managers, their performance failed to beat their benchmarks. Hence, the problem we needed to fix.

The head of the team studying this problem sat in the office right next to me. I was always curious about the pension committee’s work because I remained a dedicated personal investor. I still bought individual stocks, but I had learned my diversification lesson well enough to also hold some mutual funds. In addition, I kept up with Barron’s and the Wall Street Journal and would often sit in on presentations from various economists and other experts forecasting economic and market data.

I was as shocked as anyone when the team delivered its report: After an exhaustive study, this internal group recognized that no investment manager could consistently beat the market benchmarks, and it was very expensive to keep trying. What was even more surprising was that the Pension Committee agreed immediately. They fired the consultant, ditched the active investment managers, and reinvested all of the plan’s money into index funds. (And remember…a corporate pension fund doesn’t pay taxes. If an individual investor had followed the same approach, the results would be even worse after taxes!)

After the initial shock wore off, I became a little skeptical of the Pension Committee’s decision. I truly believed that my education and the time I spent researching investments must have created opportunities to earn higher expected returns than a simple index fund. So, I said to my friend in the office next door, “Hey, please show me your evidence!”

He gave me the report, and the evidence turned out to be strong…overwhelming in fact. I realized I was in the same boat as the pension plan—spending way too much time and money trying to find the right mix of investments to beat the market. I sold all my stocks and active funds and put my savings into index funds.

My whole life changed after I did that. Besides earning higher returns with this new approach, I gained back all the time I’d spent reading financial publications, listening to financial presentations, and spending my weekends poring over my portfolio’s performance. I calculated how much time I saved: 240 hours a year—the equivalent of 6 weeks annually!

Lesson Learned: No investment professional can reliably and repeatably outguess the market.

We now understand that the market reflects all known information about a stock, based on the millions of transactions that occur every second. It’s dangerous (and inaccurate unless you have illegal, inside information) to assume that you, or any other investors, know something that every other market participant doesn’t. In other words, no one is smarter than the aggregate knowledge of everyone currently invested in the market, and an investor shouldn’t pay more for fund managers who claim they can beat millions of other participants who have determined a stock’s fair price.

One must be humble to admit that you can’t beat the market. It’s especially hard for people who are very smart and successful in other areas of their lives who, often, mistakenly translate excellence and success to the wild world of investing one’s life savings. True investors must accept that their skills and knowledge in one area don’t help at all when it comes to investing. We know this because studies show again and again that most individual investors tend to earn lower returns than even what the market would indicate they should earn because of poor investment choices, bad timing of their trades, and the fees they pay.

The good news is that you don’t have to give up on investment success when you admit that you likely won’t be able to consistently outguess, or time, the market. In fact, by recognizing this fact, you’re actually taking control…of your investing, your decision-making, your life, and your emotions. You gain back all the time you used to spend thinking about investments and managing your portfolio so you can focus on the more important things in your life, like your family, your work, and having fun.

I was fortunate to realize this back in the 1980s simply because Anheuser-Busch was way ahead of the curve in adopting index funds. Today’s investors have advantages that we didn’t have back then—namely, a wide selection of evidence-based investment options that are better than plain-vanilla index funds.

In my opinion, freedom comes through adopting evidence-based investing. Freedom from worrying about getting in at the right time, while also increasing one’s odds of higher expected returns over the long term. These investment options are based on mountains of evidence about specific characteristics of groups of stocks (known as factors) that offer higher expected long-term returns. We apply these same principles for our clients at Hill Investment Group. We have developed a diversified portfolio that seeks to give investors better odds of earning higher returns than they might achieve either through index funds or actively managed funds. In addition, due to continued competition and mounting evidence of the success of such an approach, costs continue to go down.

My First Market Decline – 1969

I still have vivid memories of my first market decline when I was working as a stockbroker. For the first two years of my career, nearly everything I recommended was going up. I was proud of the value I thought I was providing to my clients and impressed with how smart I was.

By 1969, the Dow Jones Industrial Average was getting close to an all-time high of 1,000. Then it started to decline and just kept going down. It eventually dropped almost 40%.

The situation hit me hard. I felt so bad about the losses my clients were experiencing that I couldn’t sleep and had stomach problems. To make things worse, a lot of my early clients were friends of my parents. When I would go home for a visit, I would call ahead and ask my parents to move their car out of the garage so I could park there and close the door behind me. I didn’t want my parents’ neighbors to know I was home because I couldn’t face questions about why their stocks were doing so poorly. I really didn’t know what to say because I didn’t have an answer. It was during this period that I spent one afternoon hiding out in the movie theater watching a Clint Eastwood triple feature!

Eventually, I went to my manager and asked for advice: What can I do? What should I say? He was surprised by my questions and responded bluntly with, “Keep trading stocks.” That was my job, after all. We were brokers, not financial advisors. We were paid to trade stocks because trading created revenue for our firm whether the stocks went up or down in our clients’ accounts.

Then he added something that turned out to be good advice for me. He said that if the market decline was bothering me that much, I should quit my job and go work in a bank trust department. He was right. I wasn’t interested in selling stocks to help a firm make money whether or not my clients won or lost..I left my brokerage job shortly thereafter.

Obviously, I’ve experienced many more market downturns since that fateful time…because that’s simply what the market does. We just can’t accurately predict when. In fact, there have been 10 times when the market declined more than 20% in the past 50 years—with the two most recent happening in 2007-2009 (down 55%) with the financial crisis and in March 2020 (down 35% in 21 days) with the COVID-19 pandemic.

Lesson Learned: Expect that the market will decline and ignore it when it does.

History shows that market declines are inevitable—higher equity returns wouldn’t be possible without the risk of occasional downturns. Also, market declines are temporary. When you remember these two facts, you’re less likely to let your emotions get in the way of your long-term investing strategy. After all, a loss isn’t a loss until you sell your position.

Of course, ignoring market downturns is easier said than done. I admit that I still feel anxious during these periods, and I know that many investors experience the same sleeplessness and pit-in-the-stomach sensations I felt back in 1969. Today, though, I’m not afraid to face my clients when the markets are bad.

Instead, I like to initiate calls during these rough periods just to ask how they’re feeling and to give them better advice than I could have 50 years ago. Instead of recommending new stock trades, I tell them to do nothing – except the occasional rebalance. This downturn, like others before it, will pass.

Also, I’ve learned, and communicated to all that will listen…especially our clients…to focus on what you can control. The market is not controllable. Your investing philosophy, asset allocation, and personal spending and savings are in your control. Focus your attention, energy, and actions there. And leave the rest to us.