Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

Rick’s Story…All Together Now

As dedicated readers know, over recent months we’ve published “chapters” of Rick Hill’s 50-plus years in the finance industry, and many of you have asked, “Can we get Rick’s entire story all in one place?” The answer is a resounding “of course!” So here it is…all together…Wharton Business School through founding Hill Investment Group. Stay tuned. Rick isn’t finished adding to his lessons.

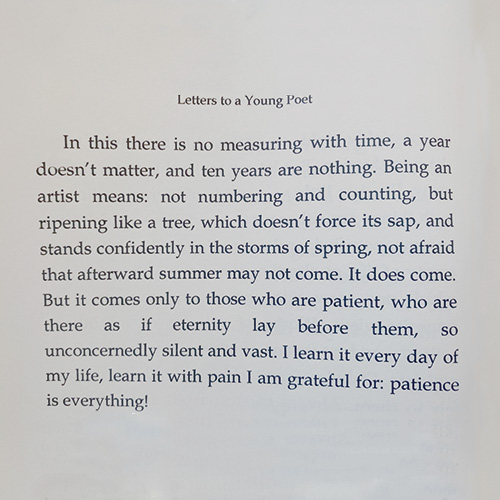

The Poetry of the Long View

How long exactly is the long view? We found the perfect quote from Letters to a Young Poet to help answer that question.

“Ten years are nothing.” You will often hear the team at HIG use this exact phrase. When we say ten years are nothing, we mean that even ten years’ worth of data can be noise. If you look at the last ten years of data alone, you will see the ups and downs of crazy S&P 500 performance.

“Stands confidently in the storms of spring, not afraid that afterward summer may not come.” This line resonates with us because HIG clients have confidence, even in tumultuous times, knowing that taking the long view is the closest thing to certainty in investing. The longer into the future you go, the closer you get to 100% certainty of a positive return.

“Summer…comes only to those who are patient, who are there as if eternity lay before them.” Our clients will tell you that the long view is “longer than your lifetime” because we help them plan for the legacy they will leave that will continue on with those who aren’t even born yet.

“Patience is everything.” We continue to help our clients remain patient and look to the future when they will reap the benefits of remaining steadfast in their long view efforts.

Things Helped By Worry

Worry is a terrible strategy for solving problems.

But I have a confession to make: for a very long time, it was the only one I knew.

For example, each time I wrote a column for The New York Times, I was worried my editor would say, “Sorry, Carl, this just isn’t very good, I’m afraid that is the end of the Sketch Guy.” And then I would have to crawl under a rock, never to be heard from again.

I would bring my worries to my business partner (AKA wife). I would go on and on about, “What are we going to do if this happens?!” And when she seemed totally calm, I would say, “Aren’t you worried?!”

Because she’s generally unflappable, she would say, “I could be, if you want me to be, but I don’t see how it would help.”

It might feel like worrying helps. But as Shantideva put it:

“If you can solve your problem, then what is the need of worrying? If you can’t solve it, then what is the use of worrying?”

Worrying endlessly about something that may or may not happen in the future doesn’t help. But making a plan for what to do if that thing comes to pass does.

So now, when I catch myself starting to worry—which is often—I try to sit down and make a plan. And then I take that plan, file it away, and stop thinking about it.

That’s it. I don’t need to worry about that scenario anymore, because I have a plan.

Next time you find yourself in one of those cycles of worry, remember what Shantideva said. Action is a strategy, worry is not. So make a plan, put it away for safekeeping, and get back to work.