Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

Does Spending Imply Wealth?

Imagine a person who is flashy in the way they spend their money — their cars, their clothes, and their meals. And now, think of someone who is a bit different — someone who orders a McDonald’s breakfast every day and never spends more than $5.

What meaning do you attach to these spending habits? Does one seem richer than the other? If so, which one? If you put this question to your friends, you might be surprised to find differences of opinion.

Some might think the big spender is wealthier, believing you must be wealthy to be able to spend a lot. Others may have the opposite view and insist that someone who spends more has less wealth because spending depletes wealth. Others might tell you that they have no idea because they don’t think there’s a strong relationship between wealth and spending habits.

The concept that I’m circling around is one that my colleagues Heather Barry Kappes, Joe Goldstone, and I have labeled “the belief that spending implies wealth.” In a paper in press at The Journal of Consumer Research, we explore the beliefs people hold about spending and what these beliefs mean for their spending habits.1

What Is the belief that spending implies wealth? Kappes spearheaded this project, which began with the idea that there’s a continuum of beliefs about what spending habits say about someone’s wealth. To determine where a person would stand on this continuum, in one of our studies, we surveyed a nationally representative group of 1,000 people. We asked them to indicate how much they agreed with statements like these:

▪ Spending a lot indicates that someone is wealthy.

▪ If someone isn’t spending much money, they probably don’t have much to spend.

▪ I think people who spend more are wealthier than people who spend less.

While the majority of respondents did not think spending was related to wealth, a third of our participants did. These beliefs were distinguishable from related concepts such as materialism, financial literacy, and self-control. In other words, the belief that spending implies wealth wasn’t interchangeable with other potentially similar concepts.

What Do These Beliefs Mean for Financial Habits? Though there are some negative associations that go along with being super-rich, most people would rather be rich than poor, a sentiment borne out in prior research.2 Because of that, we assume that people are more likely to behave the way that they believe the rich act (to the extent that their financial resources allow). Theoretically, people who have strong “spending implies wealth” beliefs should spend excessively as well.

In another study, we examined over 2 million banking transactions from more than 2,000 customers of a large bank in the United Kingdom. The bank customers’ responses to our questionnaire revealed that those who believe spending was related to wealth were also more likely to spend lavishly on things like jewelry and designer clothes.

We established this relationship independent of age, gender, and income factors that might predict spending habits. We also found that those who believe strongly that spending implies wealth were more financially vulnerable and experienced lower financial well-being than those who didn’t hold such beliefs. Of course, this link is just a correlation.

Can we influence attitudes about spending? In two other studies, we asked participants to read articles with headlines like “Big spenders are often wealthier” versus “Big spenders are often less wealthy.” We found the articles influenced spending intentions and actual behaviors. When we created stronger beliefs in the idea that spending implies wealth, research participants were less likely to want to invest or save and more likely to want to spend.

Taken together, this research shines a light on what might have been an overlooked aspect of financial attitudes and behavior. There’s no shortage of policy work — and work from financial advisors — that tries to educate consumers on how to wisely spend and save their money. Although there may be some value in doing so, it may also be prudent to attempt to modify beliefs about what spending means.

As it turns out, Warren Buffett goes to McDonald’s for breakfast every day and he never spends more than $5. We all have different relationships with money that are influenced by countless factors. But stopping to ask ourselves and our loved ones questions about the meaning of spending may prompt eye-opening discussions. It might even spur changes in our behavior.

Written by Hal Hershfield, Ph.D. Consultant to Avantis Investors. Hal is a Professor of Marketing and Behavioral Decision Making in the Anderson School of Management at the University of California, Los Angeles, and a consultant to Avantis Investors. His research asks, “How can we help move people from who they are now to who they’ll be in the future in a way that maximizes well-being?” Dr. Hershfield is a past podcast guest on Take the Long View with Matt Hall.

Endnotes 1Heather Barry Kappes, Joe J. Gladstone, and Hal E. Hershfield, “Beliefs about Whether Spending Implies Wealth,” Journal of Consumer Research 48, no. 1 (June 2021): 1-21. 2Suzanne R. Horwitz and John F. Dovidio, “The rich — love them or hate them? Divergent implicit and explicit attitudes toward the wealthy,” Group Processes & Intergroup Relations 20, no. 1 (January 2017): 3-31.

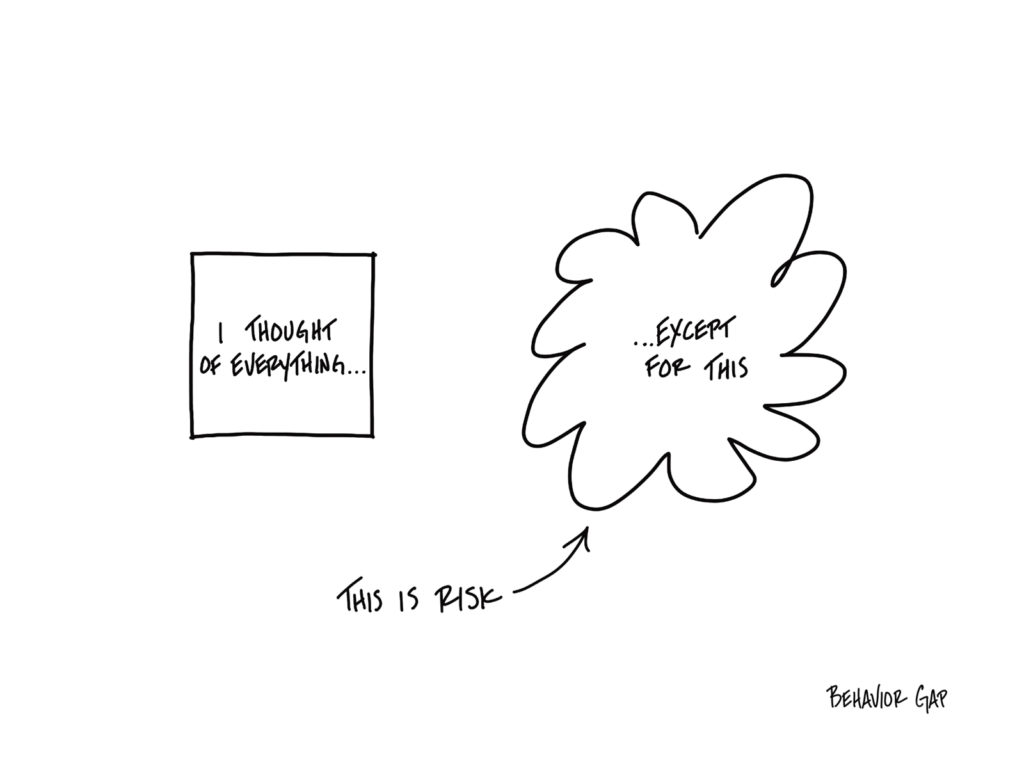

Risk is What’s Left Over

We are really good at managing risk by looking backward and preparing ourselves to handle a situation we’ve already seen. But we’re not very good at managing risk by looking forward and preparing ourselves for something we can’t even imagine.

The problem is, “something we can’t even imagine” is precisely what we need to be prepared for. Because risk is what’s left over after you think you’ve thought of everything.

It’s not the car you see coming that will kill you… it’s the one you don’t.

Bummer, right?

Let me be clear: This doesn’t mean you should cover yourself in bubble wrap and lock yourself in your house.

The point is simply to foster general resilience. You know—like an emergency fund.

And guess what, emergencies will happen. When they do, general resilience provides a margin of safety.

That’s what will protect you from the thing you never saw coming… not trying to predict the future and certainly not bubble wrap.

Rich vs. Wealthy

One of our favorite podcast guests, author Morgan Housel, wrote a piece about “rich” versus “wealthy.” We had to share the quote below that stands out to us.

I want to be rich, because I like nice stuff. But what I value far more is being wealthy, because I think independence is one of the only ways money can make you happier. The trick is realizing that the only way to maintain independence is if your appetite for stuff – including status – can be satiated. The goalpost has to stop moving; the expectations have to remain in check. Otherwise, money has a tendency to be a liability masquerading as an asset, controlling you more than you use it to live a better life.

For the full piece click here.

And if you can’t get enough of Morgan’s writing here’s more.