Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Philosophy

When the Market Screams. We Still Whisper.

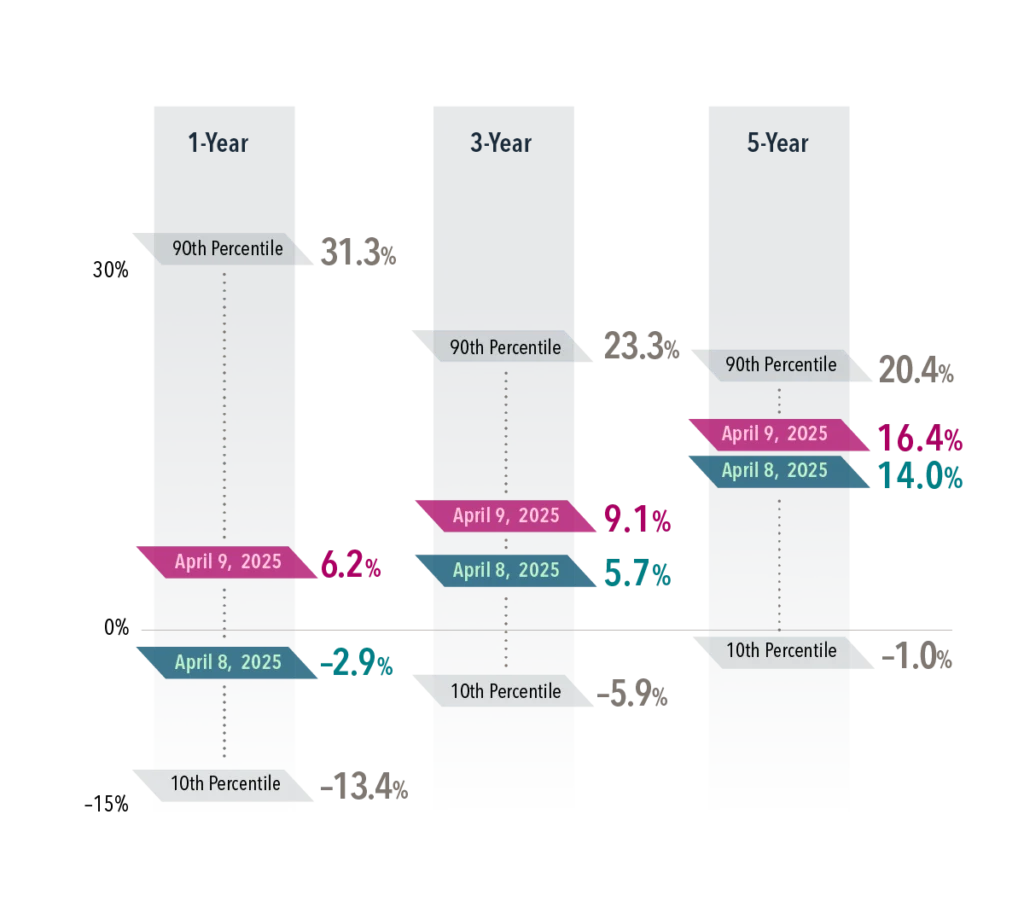

Markets cranked up the drama in April—with back-to-back days that whipsawed the S&P 500 in both directions. It was a powerful reminder of how misleading short-term moves can be. This piece from Dimensional breaks down the numbers and underscores a lesson we live by: Taking the long view isn’t just smart—it’s essential.

Navigating the Market Downturn: A Note to Our Clients

If the recent market turbulence has you feeling unsettled, you’re not alone. Whether you’re retired, still saving, or somewhere in between, it’s natural to feel the urge to “do something.” But moments like these are precisely why your portfolio was built with care and foresight.

If the recent market turbulence has you feeling unsettled, you’re not alone. Whether you’re retired, still saving, or somewhere in between, it’s natural to feel the urge to “do something.” But moments like these are precisely why your portfolio was built with care and foresight.

Here’s how we’re thinking about this moment—and how you can, too:

For Retirees and Near-Retirees:

Your portfolio includes years’ worth of conservative fixed income—intentionally. That cushion is what allows you to ride through downturns without needing to change your lifestyle or your plan. Stability was built in for exactly this reason.

For Accumulators (Still Saving):

If you’re still in growth mode, volatility has a silver lining. Down markets give you the chance to buy great businesses at lower prices—essentially investing in your future at a discount. It may not feel good in the moment, but it’s a long-term gift.

Understanding Volatility:

Markets rise over time—that’s the first truth. The second? They often fall along the way. Since 1990, the market has averaged a 10.5% annual return. But within each of those years, the average drop was 14%. Roughly every five years, we’ve seen a drop twice that size. This week isn’t a surprise—it’s part of the journey.

Why This Drop Feels Different:

This downturn stings because it’s policy-driven—our leaders’ decisions caused global turbulence. That makes it feel personal, even avoidable. But it’s not evidence that the system is broken. In fact, it’s proof that capitalism endures.

The Market Is Resilient:

Time and again, companies adapt. They grow earnings, find new efficiencies, and create value through war, recessions, political turmoil, and global crises. Your portfolio isn’t built for perfection—it’s built for reality and for the long arc of progress.

Our Approach:

You’ll never hear us say, “It’s time to go to cash.” That’s not a strategy—it’s a reaction. Our philosophy is rooted in evidence, patience, and discipline. It’s why we stay the course and take the long view.

As always, we’re here if you want to talk.

The Futility of Market Predictions: Why Evidence-Based Investing Wins

Why Predictions Fail: Insights from the Experts

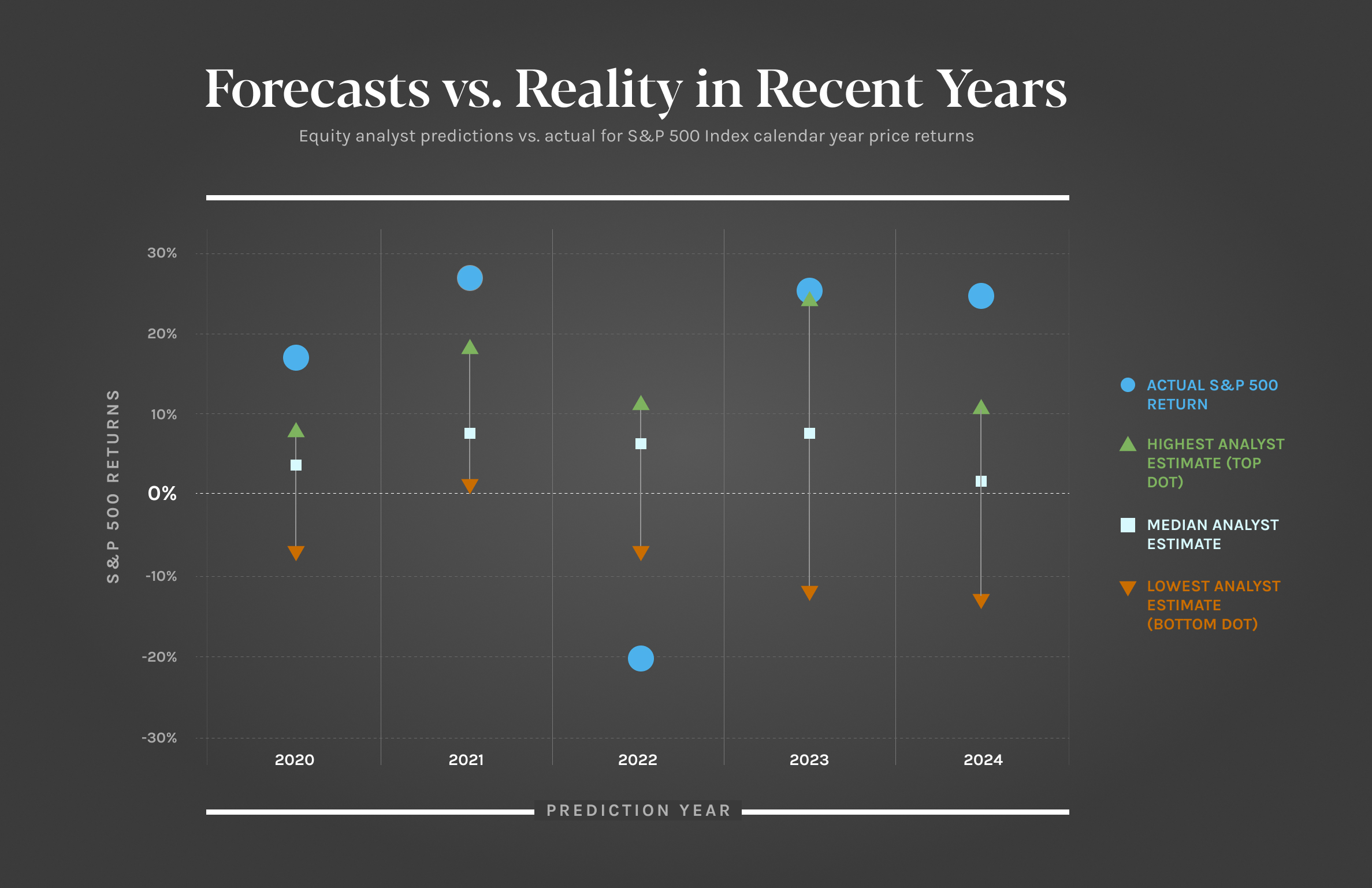

As the new year approaches, financial analysts, equity experts, and market commentators are quick to release their predictions for the year ahead. However, a closer look at their track record reveals a consistent truth: these predictions are almost always wrong. Our analysis of S&P 500 return estimates since 2020 underscores this point—actual annual returns have repeatedly fallen outside the range of the highest, median, and lowest forecasts. Even the most confident experts frequently miss the mark.

The Illusion of Predictability

Equity analysts devote significant time and resources to analyzing economic trends, running complex models, and projecting outcomes. Despite their efforts, their predictions rarely align with reality. Why? Because markets are inherently unpredictable. They are influenced by countless factors—some measurable and others entirely unforeseen. Attempting to predict annual market returns is akin to forecasting next year’s weather: unreliable at best.

Here’s another key insight: while the long-term average return of the S&P 500 is between 8% and 10% annually, the actual return in any given year rarely aligns with this average. Instead, annual returns often deviate significantly, reflecting the market’s inherent volatility.

What Should Investors Focus On?

If accurate market predictions are unattainable, how should investors approach the future? At Hill Investment Group, we take an evidence-based approach. Instead of relying on predictions, we emphasize planning, modeling, and focusing on what we know. Here are our guiding principles:

- Discipline Pays Off: On average, markets increase by approximately 4 basis points (0.04%)* daily. While this incremental growth may seem small, it compounds significantly over time. The key to capturing these gains is staying invested.

- Volatility Equals Opportunity: Market unpredictability isn’t a flaw; it’s an essential feature. The volatility we experience is the price of admission for long-term equity rewards. Rather than fearing market swings, we view them as an integral part of the investment journey.

- Control What You Can: Instead of trying to predict market movements, we focus on what is within our control—creating robust financial plans, building resilient portfolios, and adhering to evidence-based investment strategies.

- Patience Is Crucial: History has shown that markets recover from turbulence and achieve new highs over time. Staying patient and avoiding knee-jerk reactions to short-term fluctuations is essential for long-term success.

The Takeaway

The data is clear: expert predictions are unreliable. This is why we avoid basing our strategies on forecasts and instead focus on enduring principles that withstand market volatility. Here’s what we know:

- While markets are unpredictable, disciplined investors are consistently rewarded over the long term.

- The average return is positive, even though individual annual returns vary widely.

- Long-term success comes from thoughtful planning, patience, and maintaining perspective.

At Hill Investment Group, we embrace the uncertainty of the market and focus on guiding our clients toward their financial goals. By staying committed to an evidence-based philosophy, we help our clients navigate the inevitable ups and downs while positioning them for long-term success.

The next time you hear an expert confidently predict the market’s direction, remember to take it with a grain of salt. Markets may be unpredictable, but with the right strategy and mindset, they remain one of the most powerful tools for building enduring wealth.

*10% on average per year for equity returns divided by 252 trading days per year on average equates to .04%, or 4 basis points, of growth per trading day.