Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

Wisdom of Crowds

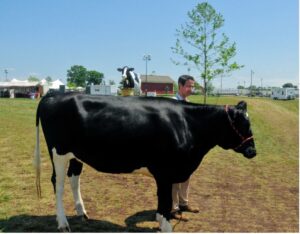

In the heart of a bustling county fair, an extraordinary experiment unfolded, showcasing the incredible power of collective intelligence. A seemingly whimsical challenge emerged: Guess the weight of a cow on display. What initially appeared as a playful game soon transformed into a stunning demonstration of the “wisdom of crowds.”

A diverse group of fairgoers, each with varying degrees of knowledge and intuition, were asked two simple questions: How much does this cow weigh? Do you have any experience with the weight of cows? The goal was to see if anyone in the crowd could guess the correct weight and if experts would be superior to the average individual.

A fascinating phenomenon began to unfold. Although individual estimates ranged wildly, the average of all these guesses astonishingly approached the actual weight of the cow. In the end, the average guess for the non-experts was 1,287 pounds compared to the actual weight of 1,355 pounds. A difference of only 68 pounds. A bigger surprise: the expert’s average guess was less accurate at 1,272 pounds, a difference of 83 pounds.

The genius of this collective average lay in its ability to filter out errors and biases inherent in individual guesses. High estimates countered low ones, and the middle-ground approximations formed a consensus that defied the odds. This experiment showcased the concept of the “wisdom of crowds” that a diverse group’s collective knowledge can outperform the insights of any individual expert.

Translating this concept to the realm of financial markets, where stocks are traded and their prices determined, demonstrates a similar effect. The market comprises countless participants, each with their own insights, analyses, and biases. When these factors converge, the resulting stock prices tend to reflect the most accurate estimate of a company’s value at a given point in time.

This phenomenon finds its backbone in the Efficient Market Hypothesis (EMH), which proposes that stock prices encapsulate all available information. Much like the cow guessing average, EMH posits that the combined insights of countless individuals lead to fair and accurate valuations, making it incredibly challenging to outguess the market consistently. Financial markets react to new information quickly, updating prices to reflect the most up-to-date information and risks fairly. Rather than trying to outguess market prices, causing turnover, high fees, and trading costs, one is better off accepting and using market prices to your advantage. Invest in global capitalism rather than trying to outguess it.

From guessing the weight of a cow to the intricate world of financial markets, the wisdom of crowds continues to shape our understanding of collective intelligence. Just as a diverse group of fairgoers could accurately estimate the cow’s weight, the multitude of participants in financial markets work together to create prices that reflect a collective estimate of a company’s value. The efficient market hypothesis stands as a testament to the power of this concept, reminding us that while individual expertise is valuable, the aggregated insights of many can often lead to more accurate and reliable outcomes. As we navigate the complexities of the modern world, embracing the wisdom of crowds can lead to better decision-making and a higher likelihood of financial success.

The Importance of Tracking Goals

One of my favorite parts of my job is talking to our clients about their goals. Sometimes their objectives are specifically related to money; at other times, not as much. Either way, understanding where clients want to go (their goals) allows us to help them get there (through careful planning).

One of my favorite parts of my job is talking to our clients about their goals. Sometimes their objectives are specifically related to money; at other times, not as much. Either way, understanding where clients want to go (their goals) allows us to help them get there (through careful planning).

In my family’s case, one goal we have set is to see our hometown St. Louis Cardinals play in a different city each summer. This is usually my favorite yearly trip. A few weeks ago, we had an opportunity to go to Chicago to see the Cardinals play the White Sox. We spent time on Michigan Avenue, Navy Pier, and other “tourist” spots. We were also fortunate to see our Cardinals pull out a 3-0 victory.

This year’s trip was especially memorable because we combined it with visiting some of our favorite long-time clients, Larry Baumann and Dana Brehm. While not from Chicago, Larry and Dana made it their goal years ago to have a place in Chicago. After they both retired, they realized that goal and have a beautiful home there.

Numerous studies have shown that making your goals known to others increases your odds of achieving them. We love doing our part in helping clients achieve their goals. And if you aren’t tracking your goals, please let us know. We’d be happy to help.

Independent Difference Campaign

I’m proud to be a part of the independent advisor community. In the most simplistic definition, independence means that our firm does not fall under a major brokerage firm, bank or trust company. We operate independently and work for you, not a corporation. This is a hugely important distinction because our model allows us to operate objectively.

I was recently invited to be a part of a national ad campaign supporting independent advisors around the country, and I was taped saying lines like:

I am a fiduciary, not just some of the time, but all of the time.

As a fiduciary, I promise to put your interest first. Always.

As a fiduciary, I promise to always act in the best interests of you and your family.

We believe these statements at our core and think every investor deserves to be served by someone who works solely for them, as their fiduciary. Reciting these lines came naturally and we’re honored to help support the broader community of advisors.

Stay tuned for more information on the campaign, who it’s associated with, and when it will air!