Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

Navigating the Market Downturn: A Note to Our Clients

If the recent market turbulence has you feeling unsettled, you’re not alone. Whether you’re retired, still saving, or somewhere in between, it’s natural to feel the urge to “do something.” But moments like these are precisely why your portfolio was built with care and foresight.

If the recent market turbulence has you feeling unsettled, you’re not alone. Whether you’re retired, still saving, or somewhere in between, it’s natural to feel the urge to “do something.” But moments like these are precisely why your portfolio was built with care and foresight.

Here’s how we’re thinking about this moment—and how you can, too:

For Retirees and Near-Retirees:

Your portfolio includes years’ worth of conservative fixed income—intentionally. That cushion is what allows you to ride through downturns without needing to change your lifestyle or your plan. Stability was built in for exactly this reason.

For Accumulators (Still Saving):

If you’re still in growth mode, volatility has a silver lining. Down markets give you the chance to buy great businesses at lower prices—essentially investing in your future at a discount. It may not feel good in the moment, but it’s a long-term gift.

Understanding Volatility:

Markets rise over time—that’s the first truth. The second? They often fall along the way. Since 1990, the market has averaged a 10.5% annual return. But within each of those years, the average drop was 14%. Roughly every five years, we’ve seen a drop twice that size. This week isn’t a surprise—it’s part of the journey.

Why This Drop Feels Different:

This downturn stings because it’s policy-driven—our leaders’ decisions caused global turbulence. That makes it feel personal, even avoidable. But it’s not evidence that the system is broken. In fact, it’s proof that capitalism endures.

The Market Is Resilient:

Time and again, companies adapt. They grow earnings, find new efficiencies, and create value through war, recessions, political turmoil, and global crises. Your portfolio isn’t built for perfection—it’s built for reality and for the long arc of progress.

Our Approach:

You’ll never hear us say, “It’s time to go to cash.” That’s not a strategy—it’s a reaction. Our philosophy is rooted in evidence, patience, and discipline. It’s why we stay the course and take the long view.

As always, we’re here if you want to talk.

The Futility of Market Predictions: Why Evidence-Based Investing Wins

Why Predictions Fail: Insights from the Experts

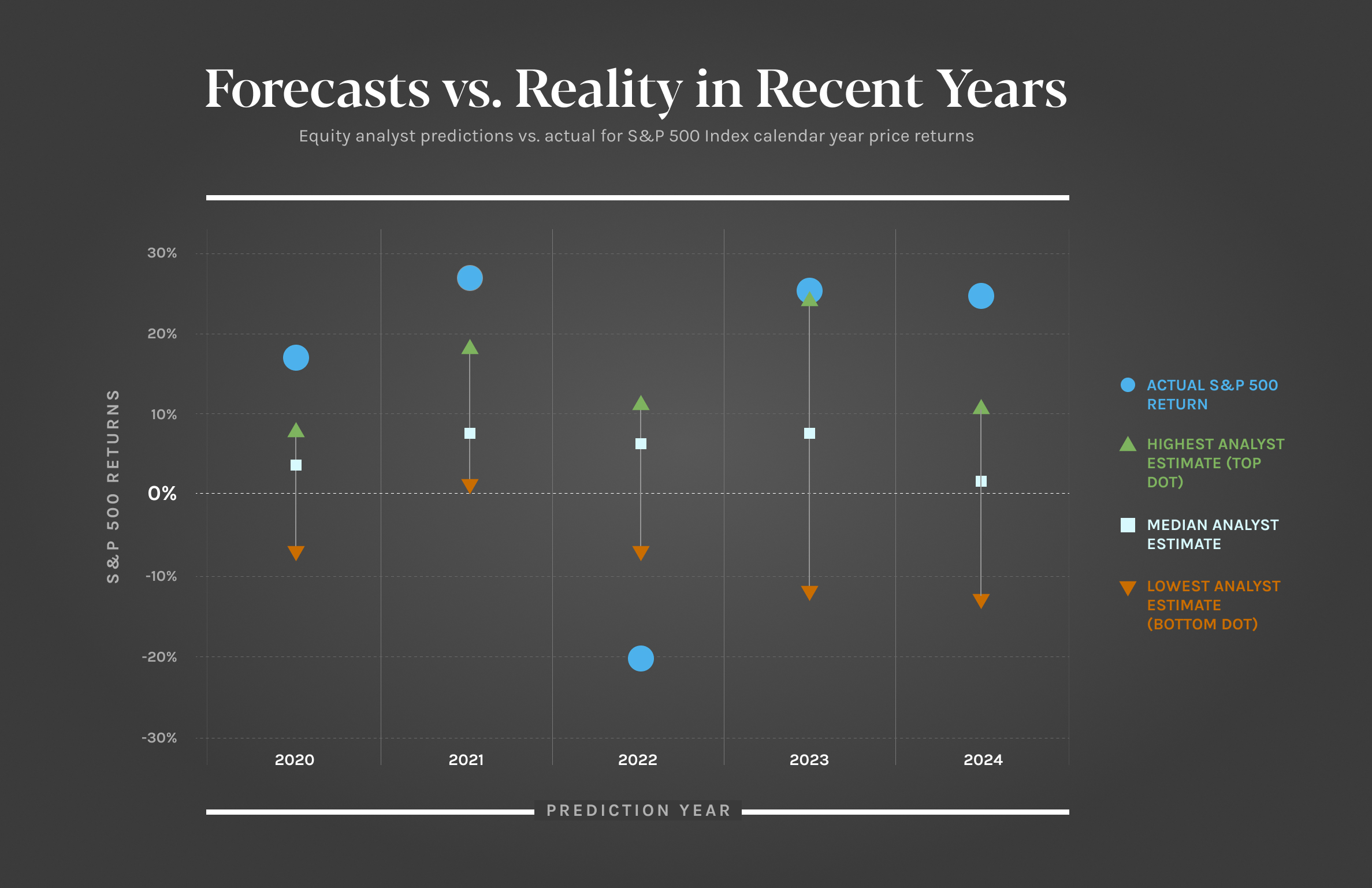

As the new year approaches, financial analysts, equity experts, and market commentators are quick to release their predictions for the year ahead. However, a closer look at their track record reveals a consistent truth: these predictions are almost always wrong. Our analysis of S&P 500 return estimates since 2020 underscores this point—actual annual returns have repeatedly fallen outside the range of the highest, median, and lowest forecasts. Even the most confident experts frequently miss the mark.

The Illusion of Predictability

Equity analysts devote significant time and resources to analyzing economic trends, running complex models, and projecting outcomes. Despite their efforts, their predictions rarely align with reality. Why? Because markets are inherently unpredictable. They are influenced by countless factors—some measurable and others entirely unforeseen. Attempting to predict annual market returns is akin to forecasting next year’s weather: unreliable at best.

Here’s another key insight: while the long-term average return of the S&P 500 is between 8% and 10% annually, the actual return in any given year rarely aligns with this average. Instead, annual returns often deviate significantly, reflecting the market’s inherent volatility.

What Should Investors Focus On?

If accurate market predictions are unattainable, how should investors approach the future? At Hill Investment Group, we take an evidence-based approach. Instead of relying on predictions, we emphasize planning, modeling, and focusing on what we know. Here are our guiding principles:

- Discipline Pays Off: On average, markets increase by approximately 4 basis points (0.04%)* daily. While this incremental growth may seem small, it compounds significantly over time. The key to capturing these gains is staying invested.

- Volatility Equals Opportunity: Market unpredictability isn’t a flaw; it’s an essential feature. The volatility we experience is the price of admission for long-term equity rewards. Rather than fearing market swings, we view them as an integral part of the investment journey.

- Control What You Can: Instead of trying to predict market movements, we focus on what is within our control—creating robust financial plans, building resilient portfolios, and adhering to evidence-based investment strategies.

- Patience Is Crucial: History has shown that markets recover from turbulence and achieve new highs over time. Staying patient and avoiding knee-jerk reactions to short-term fluctuations is essential for long-term success.

The Takeaway

The data is clear: expert predictions are unreliable. This is why we avoid basing our strategies on forecasts and instead focus on enduring principles that withstand market volatility. Here’s what we know:

- While markets are unpredictable, disciplined investors are consistently rewarded over the long term.

- The average return is positive, even though individual annual returns vary widely.

- Long-term success comes from thoughtful planning, patience, and maintaining perspective.

At Hill Investment Group, we embrace the uncertainty of the market and focus on guiding our clients toward their financial goals. By staying committed to an evidence-based philosophy, we help our clients navigate the inevitable ups and downs while positioning them for long-term success.

The next time you hear an expert confidently predict the market’s direction, remember to take it with a grain of salt. Markets may be unpredictable, but with the right strategy and mindset, they remain one of the most powerful tools for building enduring wealth.

*10% on average per year for equity returns divided by 252 trading days per year on average equates to .04%, or 4 basis points, of growth per trading day.

Hey Hill, how can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com.

Hey Hill, What Should I Be Thinking About as 2025 Approaches?

As we approach the new year, now is the perfect time to reflect on your financial picture and look ahead to 2025. At Hill Investment Group, we encourage you to rely on us for all things financial — whether it’s optimizing your portfolio, navigating new opportunities, or planning for life’s big transitions. Here are a few key considerations as we gear up for the new year:

Introducing the Longview Advantage ETF

We’re excited to launch the Longview Advantage ETF (ticker: EBI) in early 2025 and transition Hill clients to it tax-free. Designed as a low-cost, market-wide investment solution, EBI will bring more efficiency to your portfolio. Think of it as the next evolution of Taking the Long View: the same evidence-based investment philosophy with the added benefits of reduced fees and greater tax efficiency.

This is a big step forward for Hill clients, and we are excited to integrate it into portfolios for your benefit

Automate Your Savings for Long-Term Growth

If you don’t already have an automatic savings plan in place, now is the time to consider one. These plans allow you to make regular contributions to your portfolio effortlessly, taking advantage of dollar-cost averaging and the power of compounding. Over time, contributions can snowball into meaningful wealth. Talk to your advisor about how to set one up — it’s one of the easiest ways to make real process toward your financial goals.

Review Employer Benefits for 2025

A new year brings updates to retirement contribution limits and other employer benefits:

- 401(k): $23,500 (up from $23,000)

- Catch-Up Contributions (50+): an additional $7,500 (or $11,250 for ages 60–63)

- ROTH and Traditional IRA: $7,000 (consistent with 2024)

- Catch-Up Contributions (50+): an additional $1,000

It’s also a great time to review your medical benefits and insurance options. If you have access to an HSA or FSA, increasing your contributions can help you maximize tax savings. Unsure of your next step? Your Hill advisor can help you evaluate your options and ensure you’re making the most of these opportunities.

Prepare for Life’s Big Moments

Are there big milestones on the horizon for 2025? Maybe you’re sending a child to college, planning a major purchase, retiring, or updating your estate plan. These life events deserve thoughtful planning, and our team is here to guide you every step of the way.

Share the Gift of Thoughtful Financial Guidance

Do you know someone who might benefit from personalized financial advice? Whether it’s a friend navigating a big life transition, a family member seeking smarter investment strategies, or someone simply unsure of where to start, we’re here to help.

Sharing our name or a copy of Odds On is an easy way to introduce them to Taking the Long View. If you have someone in mind, let us know — we’d love to meet them.

Let’s make 2025 your best financial year yet. If you’d like to explore any of these ideas, reach out or book a time here. We’re here to help.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Consult with a qualified financial adviser before implementing any investment or financial planning strategy.