Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Education

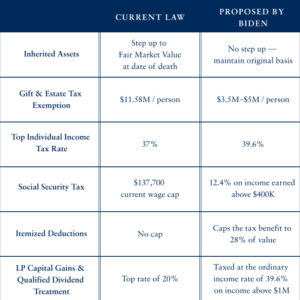

What Joe Biden’s Tax Plan Means for You

With Democratic Presidential candidate Joe Biden recently releasing his proposed tax plan, we thought it would be good to compare what Biden is proposing to our current tax law. Here is a simple side-by-side comparison of some of the major differences. What does this mean for clients of Hill Investment Group? At this point, not much. While Biden’s proposed plan is certainly different from current law, and in some cases significantly different, we are planning for the future, but aren’t making any changes to clients’ plans (at least not yet). As always, if you have specific questions about your specific situation, please call or email us to set up a time to talk.

Better Inflation Protector – Gold or Stocks?

“Gold is stupid. But selling stocks to buy gold is beyond stupid; it’s historically insane.”

While we would be hard-pressed to call anyone stupid, we do share in the general sentiments of author and speaker, Nick Murray: that the recent gold rush may be over-extended and not the most logical move for investors playing the long game.

Let us share some context to help explain.

Fiscal and monetary policies that were enacted this year as a result of the COVID-19 pandemic have sparked a growing concern with how these large amounts of debt will ultimately be repaid. A rise in tax rates is certainly possible, but a more prominent fear we hear among investors is an uptick in inflationary pressure. This is leaving many to seek a safe haven beyond the traditional stock market.

This year alone gold has seen an increase of 30%, but as recency bias would show us, many seem to have forgotten the dismal performance of the 80s and 90s. During this 20-year stretch gold had returned -2.8% per year while inflation rose at a steady 4%. Not much of an inflation hedge especially when compared to the S&P 500 Index that returned almost 18% per year over the same period. When we look at even longer periods of time we find that by participating in the stock market an investor would have earned almost 3 times as much as gold.* How’s that for an inflation hedge?

Maybe Nick’s words are a little harsh for some, but you can see why we’re not ready to abandon our philosophy for the hot investment du jour.

*From January 1970 – June 2020

#1 New Release in Investing Books

The next book about money we plan to read is The Psychology of Money – Timeless lessons on wealth, greed, and happiness. It is scheduled to be released on September 8th and is getting the buzziest reviews we have heard about any finance book in 2020. It’s authored by Morgan Housel, who readers of this email will recognize. Housel uses 19 short stories to explore the way people make financial decisions. “Important decisions are often made at the dinner table, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together.”

“It’s one of the best and most original finance books in years.”