Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: A piece we love

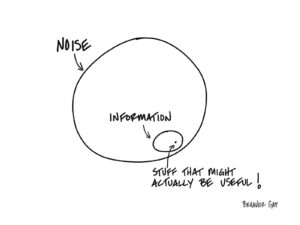

Noise Info Wisdom

Do me a favor.

Try to remember a time when you read or heard something about money in the news, you acted on it, and then, with the benefit of hindsight, you were glad you did.

This could include any number of things: the latest IPO, bear markets, bull markets, mergers, market collapses.

Go ahead, I’ll wait. Close your eyes and think about it.

I’ve done this experiment hundreds of times around the world, and I’ve only had one person come up with a valid example. It was news about a change in the tax law.

That’s it.

Isn’t that interesting?

Think of all the financial pornography out there, think of all the dental offices that have CNBC playing in the background, think of the USA Today Money section. Almost all of it is noise. Almost none of it is actionable.

Sure, every once in a while, there is this little teeny tiny speck of information that might be useful. But you sure have to wade through a lot of garbage to get to it.

This leads to one obvious question: Why are we paying attention to the noise in the first place?

It might be fun, if you’re into that kind of thing. You know, like going to the circus. But most likely, it’s just a waste of time.

What if, instead of obsessing over the news, you used that time to work on that list you have…

You know, “The List.” The one that has all the really important things you actually want to do with your time.

Doesn’t that sound so much better than spending another hour watching the news?

Aligning Your Health and Investing Plans

I’m a long-time fan and follower of both Dr. Peter Attia, a Stanford and John Hopkins-trained physician focused on “healthspan,” and the investment philosophy of David Booth, Co-Founder and Chairman of Dimensional, our core investment partner. Both Attia and Booth espouse our “take the long view” philosophy that is at the core of what we, and our clients, believe is the optimal path forward. That’s great news…because the longer you live, the more important it is to have an investment plan and portfolio that outlives you, and hopefully those you love. Enjoy David Booth’s 1-pager on the parallels between these two important plans and how they apply to your own life, including:

- No one-size-fits-all solution,

- No quick fixes, i.e., “take the long view” and

- It is better to prevent problems rather than fix them later.

Swifty vs. Sethy

The charismatic character in the photo above is a marketing genius and a provocative thinker. His name is Seth Godin. Long-time friends know that I’m a Seth Godin Superfan. Call me a “Sethy.” Much of his writing reflects his strong belief in taking the long view.

The charismatic character in the photo above is a marketing genius and a provocative thinker. His name is Seth Godin. Long-time friends know that I’m a Seth Godin Superfan. Call me a “Sethy.” Much of his writing reflects his strong belief in taking the long view.

Seth often says, “People like us do things like this” when fellow tribe members connect their values with how they live their lives. In particular, Seth sounds like us…clients, team members, and other evidence-based investors in this recent post. See if you agree.

If you don’t quite get the connection and want to learn more, let’s talk! Set up a call or meeting here.