Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: A piece we love

Embracing the Long View: Insights from the “Acquired” Podcast and Its Alignment with Hill Investment Group’s Philosophy

During the summer months, we often recommend books we are reading in the offices of Hill Investment Group. This year, we decided to steer you to a podcast we enjoy; some episodes are almost as long as an audiobook. If you’re reading this, you, like us, believe in the power of a long-term perspective, continuous learning, and evidence-based decision-making. These core principles guide our investment strategies and resonate with the themes explored in the extraordinary podcast “Acquired.”

What is “Acquired”?

“Acquired” is a highly regarded podcast that dives into the stories behind some of history’s most significant companies and acquisitions. Hosts Ben Gilbert and David Rosenthal provide in-depth analyses of how these companies were built, the strategic decisions they made, and the challenges they overcame. Each episode offers valuable insights into the entrepreneurial and business world, making it a must-listen for anyone interested in understanding the dynamics of successful companies.

Themes from “Acquired” that Resonate with Hill Investment Group

- Long-Term Perspective:

Episode Highlight: In the episode covering Amazon, “Acquired” explores Jeff Bezos’ long-term vision and his relentless focus on customer experience, illustrating how patience and strategic planning can lead to enduring success.

Hill’s Approach: Similarly, we at Hill Investment Group emphasize the importance of taking the long view. We believe patient, disciplined investing, guided by enduring principles rather than short-term market trends, is key to building sustainable wealth.

- Evidence-Based Decisions:

Episode Highlight: The episode on Whole Foods’ acquisition by Amazon underscores the significance of data-driven decisions. Bezos’ use of extensive market research and analytics to guide Amazon’s strategies reflects the power of evidence-based decision-making.

Hill’s Approach: Our investment strategies are grounded in Nobel Prize-winning academic research, ensuring our clients benefit from the most reliable financial principles.

- Resilience and Adaptability:

Episode Highlight: The story of Apple’s turnaround under Steve Jobs, as discussed on “Acquired,” showcases the company’s ability to innovate and adapt in the face of adversity.

Hill’s Approach: We prepare our clients to navigate market volatility through diversified portfolios and robust financial planning, helping them stay resilient and focused on their long-term goals.

- Continuous Learning:

Episode Highlight: Each “Acquired” episode is a business history and strategy masterclass that provides listeners with knowledge and insights.

Hill’s Approach: We believe in lifelong learning and continuous improvement. Our team regularly engages with the latest industry developments to ensure we provide our clients with the best possible advice and service.

We encourage you to explore the “Acquired” podcast to gain deeper insights into the principles that drive successful businesses. Let’s continue to embrace the long view, grounded in evidence-based principles and enriched by continuous learning.

Take the long view,

The Hill Investment Group Team

Our favorite episodes include Starbucks, Hermes, Porsche, Costco, and Nike.

—

Feel free to listen to “Acquired” and join us in exploring the fascinating stories behind the world’s most successful companies.

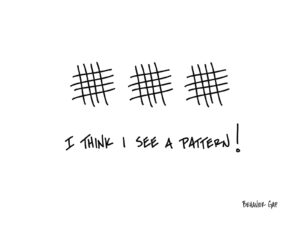

The Only Investing Pattern That Matters Is Behavioral

That’s the thing about most patterns—they don’t predict the future; they just describe the past.

We’re so good at recognizing patterns that we often see them where they don’t even exist.

One of my favorite examples of this is some research done by David J. Leinweber at Caltech. Apparently, he figured out how to predict the stock market using just three variables:

1- Butter production in the United States and Bangladesh.

2- Sheep populations in the United States and Bangladesh.

3- Cheese production in the United States.

Amazing! Right?

It turns out these three variables predicted 99% of the stock market’s movement!

#TimeToStartAHedgeFund.

Just one problem: The joke’s on us.

While well-intentioned, the constant pursuit of patterns is one of the big behavioral mistakes we make time and again. We look for patterns. And guess what, they absolutely exist. Right up until you try to invest your money based on the pattern. Then *Poof!* They vanish into thin air.

We think if something happened a certain way in the past, then it will surely continue into the future. We start to believe—we desperately want to believe—that this pattern will have predictive value.

But it doesn’t. And that’s the thing about most patterns—they don’t predict the future, they just describe the past.

While some of these silly data mining tricks might be interesting to talk about, they don’t actually help us.

Turns out the only thing that does help when it comes to investing success is good behavior. Day in, day out, year after year.

Now that’s a pattern I can endorse.

-Carl Richards (friend of HIG)

A Few Thoughts on Spending Money

Morgan Housel has always been thought-provoking, including his recent piece, “A Few Thoughts on Spending Money.” The title is apt because he shares his thoughts, wide-ranging perspective, and excellent questions about money and how to think about it. Stated differently, Morgan doesn’t provide specific answers or recommendations about money. Instead, he encourages a mental exercise to discover what money and wealth mean to you. However, instead of doing that exercise alone, if you’re a Hill client, we’d love to engage in such a dialogue with you…and your family…if you’re open to it. Call us or schedule a time here!