Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: A piece we love

#1 New Release in Investing Books

The next book about money we plan to read is The Psychology of Money – Timeless lessons on wealth, greed, and happiness. It is scheduled to be released on September 8th and is getting the buzziest reviews we have heard about any finance book in 2020. It’s authored by Morgan Housel, who readers of this email will recognize. Housel uses 19 short stories to explore the way people make financial decisions. “Important decisions are often made at the dinner table, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together.”

“It’s one of the best and most original finance books in years.”

Immitation is Flattery

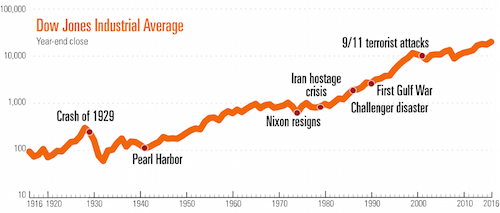

“Bad news and ill omens can make the market appear riskier than many investors would prefer,” wrote Vanguard in their recently published lessons on their website. “But if you take the long view, things might not seem so bad.” We love that Vanguard, the second-largest mutual fund company on the planet, used our trademarked phrase. Obviously, we agree.

5 Steps for Dealing With a Scary Market

The New York Times Sketch Guy, Columnist, and Take the Longview podcast guest Carl Richards, is one of the best in the world at connecting money and emotion. His unique ability is boiling down ideas to their essence so that everyone can relate. In a recent piece, he does it again, clearly outlining a 5-step guide to making it through the ups and downs of the financial market. Check it out here.