Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Nell Schiffer

We Told You to Tune Out the Noise—So Did the Wall Street Journal

Long before the Wall Street Journal picked it up, we were already tuned in.

Long before the Wall Street Journal picked it up, we were already tuned in.

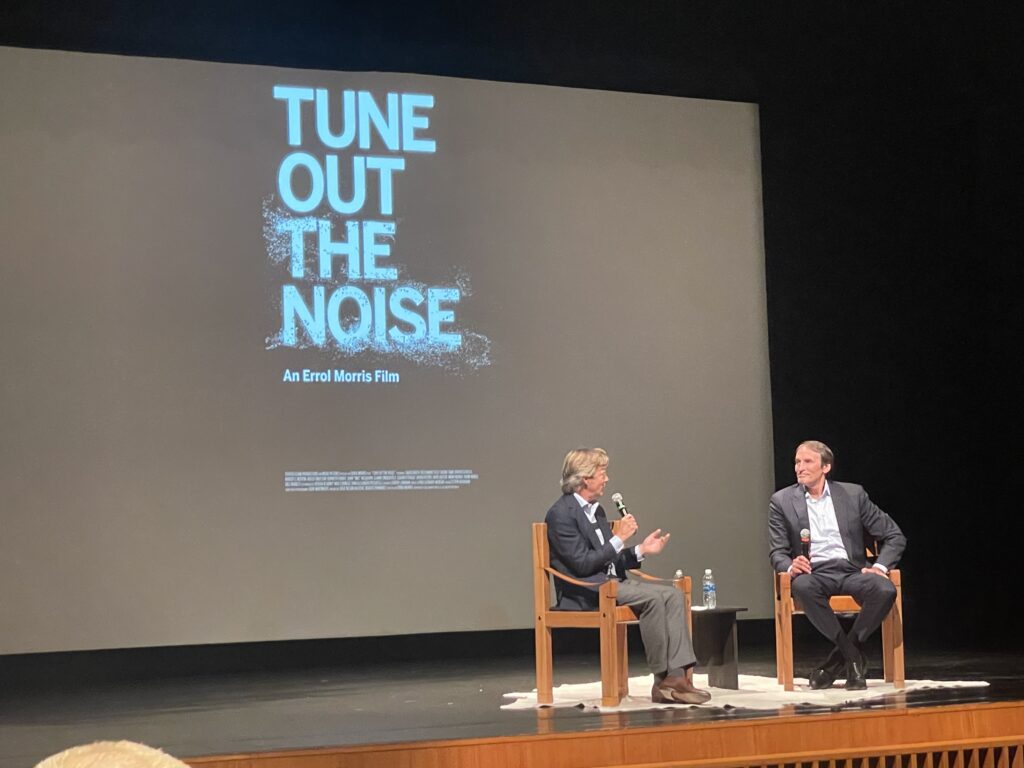

A year and a half ago, we hosted a private screening of Tune Out the Noise—a thoughtful, visually arresting short film that captures the essence of what we’ve been saying for years: successful investing isn’t about reacting to the news—it’s about rising above it.

The film, directed by Academy Award-winner Errol Morris and centered on the story of Dimensional Fund Advisors’ David Booth, is now getting the national spotlight. The WSJ recently featured the film and its message, which reinforces what we’ve long believed—and shared with our clients:

Ignore the noise. Focus on what matters. Stick to the plan.

We’re proud to have brought this film to our clients and friends well before it was newsworthy. That’s part of what we do—curate ideas, tools, and insights that help you stay the course, often before the rest of the world catches on.

Read the Wall Street Journal article:

Investing Documentary by Errol Morris Tells You to Do Nothing

Hey Hill, should my social security change how I invest?

At Hill Investment Group, we’ve found that when a few clients ask similar questions, many more likely share the same curiosity. To better serve you, we’ll periodically feature this “Hey Hill” segment in our newsletter, addressing common client questions and explaining our perspective. To submit questions for future newsletters, email us at service@hillinvestmentgroup.com.

Hey Hill, should my Social Security income change how I invest?

Many investors underestimate how significantly Social Security can impact their financial plans. Rather than viewing it merely as a government benefit, think of Social Security as what it truly is—a guaranteed, inflation-adjusted income stream, similar to a bond within your portfolio.

This means your actual fixed-income allocation may be higher than you’ve realized. As a result, incorporating Social Security into your planning can allow you to take on more investment risk than initially assumed, potentially enhancing your portfolio’s long-term growth.

Clients often ask us:

– Should I reduce my stock exposure as I near retirement?

– How much investment risk is appropriate?

– How should I factor Social Security into my overall investment strategy?

Reframing Social Security as a reliable income source can help you feel more confident maintaining a higher equity allocation, improving your portfolio’s potential for growth over time.

Want to discuss how this concept applies specifically to you?

We’re here to help. Reach out at service@hillinvestmentgroup.com.

A Legend Passes

The investing world recently lost one of its quiet pioneers, Mac McQuown. While his name may not be widely recognized outside our industry, his influence runs deep. A trailblazer in modern investing, Mac’s visionary contributions laid the groundwork for the strategies many investors benefit from today. As David Booth, Co-Founder of Dimensional Fund Advisors, aptly noted, Mac was a true transformer in the field. [Click the quote to read Dimensional’s tribute.]

“Catalyst” is the keyword. There are so many useful nuggets in the attached article in the Financial Times that you’ll be better off reading it. In a short space, you will learn the history of evidence-based investing, the first index fund (Mac’s creation), the birth of many future Nobel Laureates, and their impressive connection to Dimensional, Blackrock, and other global finance leaders.

If you want to know and understand the recipe you’re investing in when investing with Hill, this is one of the better shortcuts to taking the long view you’ll ever read.