Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Matt Zenz

New Feature: “Hey Hill, how can I…”

Addressing Common Client Questions

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that many more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. The goal is to address what’s top of mind for our clients. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

This month, we’ll debut our first frequently asked question:

“Hey Hill, how can I secure a high rate of return for my cash savings?”

Understanding Cash Savings:

Every investor has to hold on to some amount of cash. We all have daily bills and expenses, something big we’re saving for, or just want something set aside for emergencies. This is money you want to keep safe. As you’ve likely noticed, cash sitting in your bank account earns very little and it may feel like you’re missing out on potential earnings. The great news? You have options at your fingertips, that we can help you take advantage of.

Why does this matter? Ensuring cash is managed effectively is one of the best ways we can help you “pick up the pennies” of extra return around the edges of your portfolio.

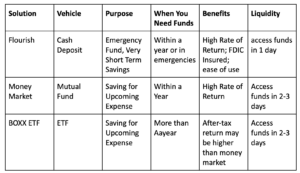

For earning a return on cash, we recommend three options, tailored to your specific situation:

- Money Market Funds

Money market funds invest in highly liquid, short-term debt instruments like US Treasury bills. These funds offer high liquidity and very low risk, making them a secure option. Investors in money market funds can expect a positive return, currently around 5%, matching the returns on short-term US government debt. We recommend money market funds for cash you plan to use within the next year. We can manage this investment for you, ensuring your cash earns the highest return with minimal risk.

- BOXX ETF

BOXX is an ETF providing money market-like returns but in an ETF format. This means returns are reflected in the increasing price of the ETF rather than as income. Since capital gains are taxed at a lower rate than income, holding BOXX for over a year could significantly enhance your after-tax return.

We recommend BOXX for cash that you plan to hold for more than a year. We can manage this investment and monitor the holding period to maximize your after-tax return.

- Flourish – New Service Announcement!

We are excited to introduce Flourish, a new service for Hill Investment Group clients. Flourish removes the hassle of hunting for the highest savings account rate by partnering with over a dozen FDIC-member program banks to ensure you always receive the highest savings rate. Flourish links to your personal checking or business account and offers money market-like returns and up to $10 million in FDIC insurance. This all comes with no fees or minimums and a clean, user-friendly interface.

We recommend Flourish as your high-yield savings account solution for cash held in personal accounts. We can help you set up Flourish to talk to your personal accounts hassle-free so you know you are getting the most out of your cash at all times.

We’ll be rolling out this service over the coming months, but if you are curious to dive deeper – Check out this 5-minute video. If you’re eager to start using Flourish now, email us, and we’ll send you an invite so you can start benefiting immediately.

We’re here to ensure your cash works as hard as you do. Let us help you maximize your returns with minimal risk.

Summary

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Picking Up Pennies – Volume 7

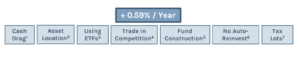

Welcome to the final installment of Picking Up Pennies. Last month, we discussed how understanding the concept of tax lots can optimize an investor’s tax consequences and even create a tax asset via active tax loss harvesting. Over the last six months, we have discussed different strategies we employ to increase returns, reduce costs, and minimize taxes. This final article will summarize the impact of these small decisions on your investment portfolio.

- Volume 1 – Keep Cash Balances Low (Better Chance for Higher Returns)

- Volume 2 – Asset Location (Reduces Taxes)

- Volume 3 – Using ETFs (Reduces Taxes)

- Volume 4 – Trading ETFs in Competition (Reduces Trading Costs)

- Volume 5 – Number of Funds and Not Auto-Reinvesting Dividends (Reduces Trading Costs)

- Volume 6 – Tax Lots and Tax Loss Harvesting (Reduces Taxes)

- Volume 7 – Summary (Total Impact)

Determining the exact impact of each decision is difficult as each strategy will impact every investor differently. For this analysis, we used what we think is a typical investor.

– Allocation is 60% Stocks and 40% Bonds

– Half of the money is in a taxable account, half is in an IRA

– Portfolio turnover is 10%/year

– 25% income tax rate, 15% capital gains tax rate

While the impact of some strategies may be more pronounced than others, it’s important to remember that every penny counts. When you add up all these strategies, you’ll see a significant difference in your investment outcomes. Specifically, about 0.59% per year or 59 basis points in financial industry jargon, which we prefer to avoid. Remember, all else being equal, the higher your tax rate, the more significant your net savings.

As discussed throughout the series, implementing these strategies is more than a one-size-fits-all approach. Each investor and family is unique, and tailoring these strategies to your needs takes time and effort. Our personalized approach is a testament to our commitment to your financial success.

In the first installment, I mentioned that I often ask other money managers how they implement these solutions. Most of the time, the response is, “We are not doing X because… it is too much work, clients don’t know the difference, the benefit is small, etc.” All of these answers are correct except one. It does take a lot of work…clients don’t normally notice the difference…but the benefit is NOT small. When you add all this up, it makes a meaningful difference. As your fiduciary, our obligation is to seek the best solutions we can find for our clients…no matter what.

These benefits are all the small details in your investment implementation. This series does not even include the bigger items that add even more value, like asset allocation, quarterly rebalancing, behavioral coaching, spending strategy, and a low-fee diversified investing strategy. Add it all together and compound these advantages over time, and now you’ve got something to be proud of now and in the long view!

1 Assumes the average investor holds 8% cash across uninvested cash and cash held in funds (5% + 3%). HIG holds 1% cash (0.7% + 0.3%). 60/40 portfolio returns 4% above cash. Impact = 30 bps

2 Assumes 5% bond returns and 10% equity returns. Impact = 20 bps

3 Assumes 3% annual capital gain distributions. Impact = 5 bps

4 Assumes savings of 2 cents per share traded. Impact = 1 bp

5 Assumes 20% additional fund turnover. 0.1% round-trip trading costs. Impact = 2 bps

6 Assumes 4% distributions and 0.1% higher trading costs. Impact = 1 bp

7 Tax benefits would depend on specific market conditions. Impact assumed to be zero for this analysis.

Picking Up Pennies – Volume 6

Welcome to the sixth installment of Picking Up Pennies. Last month, we discussed reducing how often we trade by constructing holistic portfolios with fewer funds and not auto-reinvesting the dividends from those funds. We want to control trading and use the dividends to rebalance the portfolio as needed. Reducing trading reduces trading costs and taxes owed. Although trading often realizes taxes, there are methods of reducing taxes when you trade. This month, we will discuss how we minimize taxes when we trade and why we sometimes trade intentionally to reduce your tax burden.

- Volume 1 – Keep Cash Balances Low (Better Chance for Higher Returns)

- Volume 2 – Asset Location (Reduces Taxes)

- Volume 3 – Using ETFs (Reduces Taxes)

- Volume 4 – Trading ETFs in Competition (Reduces Trading Costs)

- Volume 5 – Number of Funds and Not Auto-Reinvesting Dividends (Reduces Trading Costs)

- Volume 6 – Tax Lots and Tax Loss Harvesting (Reduces Taxes)

- Volume 7 – Summary (Total Impact)

Tax Lots

Whenever you sell an investment, you hold the power to decide which “tax lot” to sell. A tax lot refers to a specific security purchase at a particular price and time. If you bought one share of Apple stock yearly for ten years, you would have ten different tax lots for Apple. One lot for each time you bought Apple. Each year, when you buy Apple, you buy the stock at a different price. This means that the gain and subsequent tax bill for each share of Apple will be different. When you sell one of those ten shares of Apple you own, you have the authority to decide which share of Apple to sell, as each one has a different tax consequence.

The default at most custodians/investment platforms is First-in-First-out (FIFO). When you sell one share, they assume you will want to sell the oldest share you bought. Often, this is not a tax-optimal strategy. Instead, the optimal approach is to choose the share with the lowest tax burden.

Figuring out which lot has the lowest tax burden is not always straightforward. You need to factor in things like wash sales and long vs short-term capital gain treatment. While we will not dive deep into capital gain tax law in this post, rest assured, whenever we trade, we analyze the tax burden of every lot across every investment you have to minimize the tax impact to you. This allows you to keep more of your invested money and earn a higher after-tax return.

Tax Loss Harvesting

Another key advantage of focusing on individual tax lots is that it allows us to implement tax loss harvesting effectively. Tax loss harvesting involves strategically selling investments that have experienced losses. Since trading is costly, we are generally not searching for trades to place daily. We believe in taking the long view and holding diversified low-cost investments. However, every day, we look at every tax lot in your portfolio for opportunities to harvest losses. By selling individual tax lots at a loss, we can create and bank a tax asset for you: a tax loss. These losses can offset gains from other trades, allow us to rebalance the portfolio without a tax hit, or offset up to $3,000 of income each year. This strategy allows us to reduce your tax bill and realign your portfolio toward your long-term investment objectives.

Whenever we sell a position for tax loss harvesting, we immediately buy a different approved investment to ensure that you remain fully invested as your Investment Policy Statement would direct. We don’t want you to miss out on market returns to realize a tax loss. Most of the time, we will buy a security with a similar exposure to what we just sold to avoid “wash sale” rules, which, if violated, would negate the benefit of creating the loss in the first place. However, that is not always the case. We don’t want a blind tax loss harvesting strategy that does the same thing for everyone. We want to buy whatever asset class is the most underweight. Thus, each client and their situation will be treated uniquely based on their circumstances.

We optimize our trading based on prior considerations and consultation with each client’s tax advisor so that we know and understand the parameters we should trade in. Further, by leveraging the insights gained from examining individual tax lots and implementing tax loss harvesting, investors can navigate the complexities of the tax landscape while maximizing their after-tax investment returns. We’re committed to treating each client uniquely and executing this strategy daily to pick up as many pennies as possible for our clients.

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.