Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Matt Zenz

The Bumpy Road

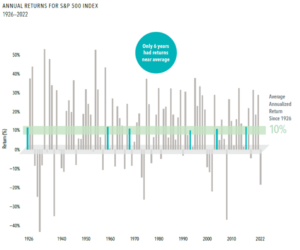

Historically, the US Equity market has returned about 10% annually to investors from 1926 – 2022. Due to this historical rate of return, many investors expect this level of return year over year. However, stock markets are highly volatile. Although the average is 10% per year, it is extremely rare for the market to be up 10% over any given year.

Since 1927, there have only been 6 years where the stock market returned between 8-12%. Thus, even though you should expect the market to give you a 10% return, you should expect the market over any given year to hardly ever give you a 10% return. It is this bumpy road that creates the risk in investing in equities, which is why you are compensated with the 10% annual average return. The key is to take the long view and not look at quarter-to-quarter or year-to-year returns.

People often panic when their expectations don’t match reality. Investors expect a 10% return every year, which will often not materialize. When the market goes down and does not match this 10% expectation, investors tend to panic. Changing your expectations on the range of outcomes of equities while keeping in mind the long-term average can help investors stick to their plan.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in managing a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Hill Investment Group may discuss and display charts, graphs, and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used alone to make investment decisions.

Hey Hill, how can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

Hey Hill, how can I think differently about the total return of my portfolio vs. focusing on income investing alone?

Throughout our working lives, we relied on our earned income to support our day-to-day expenses. Each year, we worked, earned a salary, and used that money to cover necessities such as food, housing, entertainment, and childcare. A consistent income stream provided us with a sense of security to fulfill our needs and save for retirement.

However, after retiring, the question arises: where will the income come from to sustain our lifestyle? While some may come from pensions or social security, these sources may not always be sufficient. As a result, investors often dip into their savings portfolio to supplement their income.

When considering how to invest their savings, investors tend to zero in on needing “income” to replace their salaries. They may have a funding gap and want to ensure their portfolio will yield a certain yearly income level through fixed-income or dividend-paying stocks. Although this approach is intuitive and may give retirees peace of mind, it does not maximize the odds of financial success. Why not?

Investment returns come from two places. Income (dividends and interest) and capital appreciation (prices going up). By focusing solely on income, you forgo the primary driver of returns: capital appreciation.

When you go to the store and buy new clothes, you don’t care if you pay with cash from your left pocket or your right pocket. Money is money, and the source is irrelevant. The same is true of investment returns. It does not matter whether those returns come from dividends or prices going up. What matters is the total amount of money you have. By focusing on income returns or just the money in your left pocket, you are not investing in the stocks or bonds with the highest expected total return. You are not maximizing the money you have across both your pockets. At the end of the year, this will leave you with less total savings.

Capital appreciation generally drives total returns much more than income. Additionally, capital appreciation receives favorable tax treatment. Gains from price increases are taxed at a lower rate than income. Thus, an investor would prefer their return come from capital appreciation vs. income because, after taxes, they will have more money to spend.

Therefore, rather than thinking about how much income my portfolio generates year by year, we encourage our clients to consider the total value of their investments and what that total level can sustain in terms of spending over a lifetime, understanding the ebbs and flows of the market. This approach maximizes our clients’ odds of achieving their financial goals.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

How to Handle Stock with Large Gains

Many investors face a difficult tradeoff at some point in their investing career. They have some stock that they want to sell, but it is at a large gain. They want to diversify or rebalance their portfolio but don’t want to pay the taxes associated with selling the position. Many of our clients face this dilemma either from stock positions they have accumulated from their employer over a career or old investment decisions that have lingered in individual stocks.

Unfortunately, there haven’t been good options to solve this issue. Historically, investors have tried using things like options or exchange funds, but these solutions are costly, tax-inefficient, and illiquid.

As wealth managers, we always look for that third door that can efficiently solve a client’s need. 351 conversions beautifully solve this issue. They are low-cost, have zero tax impact, and are liquid.

What is a 351 Conversion?

A 351 conversion or exchange refers to a section of the Internal Revenue Code that deals with corporate reorganizations. This code section allows for a tax-free exchange of securities into a newly created entity, such as an ETF, provided certain diversification rules are met. In other words, the Code allows individuals to exchange holdings of stocks or ETFs into a new ETF in a tax-free conversion with a carryover basis.

Why does this matter to me?

Any investor can seed (put money in at launch) an ETF with individual stock positions and immediately convert their investments from whatever they held to a fully diversified ETF tax-free. Your original cost basis carries over, but now, instead of holding a handful of individual stocks, you can hold a low-cost, diversified, transparent ETF that can rebalance itself and pursue higher returns without incurring capital gains.

What are the limitations?

“There must be a catch! This seems too good to be true. How do I get to go from concentrated stock positions to a diversified investment portfolio without paying taxes?” Yes, 351 conversions are highly effective tools for investors; however, there are several limitations as to when and how they are implemented.

First, the investments that an investor converts must be “diversified,” which means that investors cannot seed a new ETF solely with a single stock (e.g., Apple, Boeing, or Tesla). Specifically, the largest single position cannot exceed 25% of the contributed portfolio, and the five largest positions cannot exceed 50% of the contributed portfolio. While this may limit how much of an existing portfolio an investor can convert, an investor can combine individual stocks and additional ETFs to meet this criteria. Second, 351 conversions can only be done when an ETF first launches…not whenever an investor wants to.

Summary

A 351 conversion is a unique opportunity for investors to improve and diversify their investment portfolio without incurring current capital gains taxes. It allows investors to convert unwanted positions with significant capital gains into a diversified, tax-efficient, low-cost ETF in a non-taxable event.

Why should I care about 351 conversions? We want our clients and the investing community at large to benefit from a 351 conversion in the future, should it become available. Please stay tuned for more details as we prepare to do our own 351 conversion in the coming months!

If you have or know someone who has a low-basis stock portfolio or ETF that may benefit from better diversification but has hesitated to do so out of fear of incurring severe tax consequences, please reach out. A 351 conversion might be the right solution.

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser or tax professional before implementing any investment or tax strategy.