Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Matt Zenz

Recent Market Volatility

As of May 17th, the S&P 500 is down 14% year to date. Given the apparent negative economic outlook, many investors are concerned about their investments and what they should do. However, before descending down a worry spiral, pause and ask yourself: “Is this normal? Have I seen this before?”

During the 94 calendar years from 1928 to 2021, the US stock market had intra-year, double-digit declines 59 times. That’s almost two of every three years that the US Market experiences a double-digit decline. Yes, two-thirds of the time. So, we can conclude that a drop like the one we are currently seeing is a common event in the stock market. Not only common but good! Why? The reason investors are compensated with positive returns over time from investing in stocks, instead of cash or bonds, is because of the occasional period of negative returns. If there was no risk, investors would not get any reward for bearing that risk. Said differently, market downturns are features, not bugs.

Let’s dive deeper into those 59 years that had double-digit declines. Did the market recover or stay negative at the end of those years? In 58% of those 59 years, the market ended the year with a positive annual return despite the double-digit drop. 40% of those 59 years finished with a double-digit positive return!

What is the economic intuition behind why markets recover more often than not? Markets do a great job of factoring in both positive and negative news about companies and the economic outlook. Investors only invest in the market at current prices if they expect to earn a positive return. If everyone knew that the market would go down, no one would buy stocks at their current prices. Prices would simply fall until they hit a level that gave an investor a commensurate return for the risk they are willing to take. Today’s market prices reflect the current economic outlook. From here, markets might go up or down, but on average, market returns are expected to be positive over time.

That is precisely why we recommend that our clients stick with their well-thought-out investment plans rather than panic out of the market. The risks you may be worried about are already factored into stock prices. You are not alone in your fears, but that doesn’t mean you have to act on them. By selling now, you will miss out on the future positive expected return of stocks. We just can’t predict when those positive returns will happen.

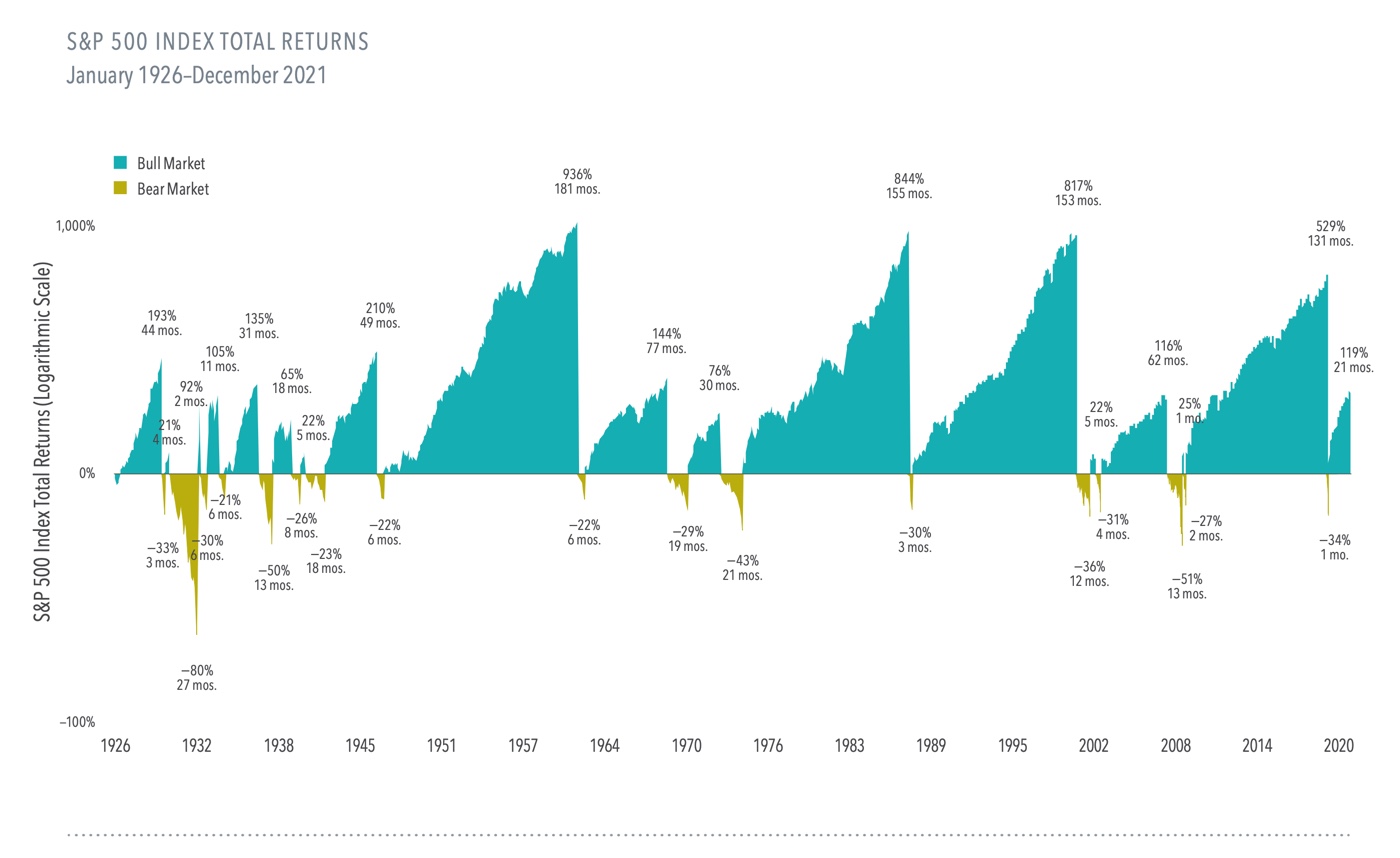

When you look at nearly a century of bull and bear markets, the good times have outshined the bad. While we don’t know how long a bear market will last, staying invested ensures that you capture the bull markets when they do arrive again.

Details Are Part of Our Difference

As our clients know, we seek to eke out every last basis point of potential return for you. So, while we balance the ideal combination of factors to achieve the highest odds of excess return, we also seek to minimize all costs, expenses, and taxes which eat into an investor’s net return. There are a couple of ways this plays out:

Evaluating Asset Managers

When evaluating asset managers, we scrutinize their trading practices to implement their strategies cost-effectively. If they don’t have reasonable trading procedures, their trading costs will be higher and, ultimately, lower the return of your investment.

Reducing Trading Fees

Just like our fund managers, we want to make sure that we are trading cost-effectively to be good stewards of your hard-earned capital. The most recent step in this effort was transitioning much of our recommended portfolio from mutual funds to ETFs, mainly to eliminate fees for trading mutual funds.

At Hill Investment Group, we are not satisfied with just better; we are always working towards finding the best solution we can find for you. The change from mutual funds to ETFs is a savings win, but we were eager to take it one step further.

Eliminating Hidden Costs

You may not know that ETFs have their own unique hidden trading costs. Like stocks, ETFs trade with a bid-ask spread. That means that, for example, market makers may buy an ETF at $9.99 and sell it to another investor for $10.01. The market maker earns a nice $0.02 profit/share, and the buyer and seller pay the cost.

We wanted to make this better. So, for ETF trades of over a certain size, rather than trade on the exchange with a limited short-term supply, we deal directly with the banks. We get the banks to compete for our business and bid against each other. This can shrink and nearly eliminate the market maker’s profit. This competition and direct access yield better prices than we could otherwise get on the exchange.

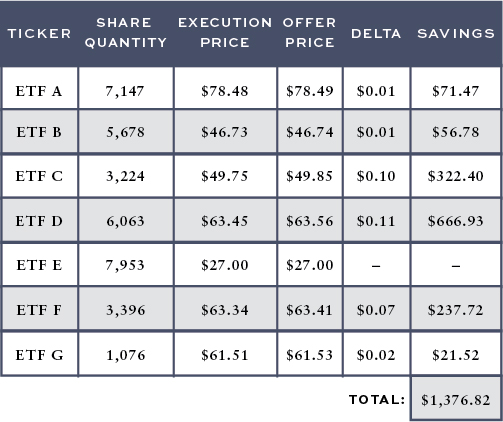

For example, we recently rebalanced one of our clients’ portfolios which resulted in purchases of various ETFs. The table above outlines the ETFs we bought, the price we would have gotten if we went to the market (Offer Price), and the price we executed at (Execution Price).

Conclusion: Details Matter

In just one day, using this trading strategy, we saved this client over $1,300 in trading costs. This one example is just one of many ways we fight for every basis point —the details matter and are part of the HIG difference.

Past results are not indicative of future results, or all client results. There are no implied guarantees or assurances that your target returns or cost savings will be the same as the example shown. Future returns or cost savings may differ significantly from the past due to many different factors. Investments involve risk and the possibility of loss of principal. The values and performance numbers represented in this report do not reflect management fees. The values used in this report were obtained from third-party sources believed to be reliable. Savings numbers were calculated by HIG using the data provided.

With the Recent Events in Ukraine, Should I Make Changes to My Portfolio?

There is no downplaying the news coming from Ukraine and Russia. While Russia makes up a small percentage of the overall global stock market (less than .25% as of February 23), Russia and Ukraine both play considerable roles in producing and supplying commodities such as liquid natural gas, wheat, etc.

What does this mean for you as an investor?

The situation is currently evolving. We know that political leaders from the West condemned Russia’s actions and vowed significant sanctions in response. Markets reacted with increased volatility, and some stocks retreated.

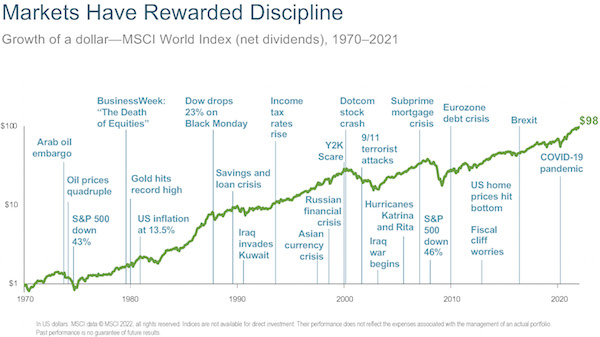

While no two historical events are the same, historical context is often helpful to put current events into context. The chart below illustrates the growth of a dollar invested in global equities alongside past crises. Think back to some of these events- it’s easy to remember how uncertain the future felt. Putting current events into this context helps us take the long view. The chart shows that markets rewarded disciplined investors for their grit. This chart is a good reminder of what it means when you invest for the long term, and the fortitude being demanded of us today.

Takeaways

- It is rarely advisable to mix emotions and investing.

History shows us that a critical ingredient of long-term investing success is having discipline in good times and in difficult periods. Markets have rewarded investors willing to tune out the noise and stick to their plan. So, we advise you to stick with yours. - Your systematic investing approach already adjusts to new information in real-time.

Investors in global equity portfolios inevitably face periods of geopolitical tensions. Sometimes these events lead to restrictions, sanctions, and other types of market disruptions. We cannot predict when these events will occur or exactly what form they will take. However, we can plan for them. We do this for you by managing your diversified portfolios and building flexibility into our investing process. - Staying invested is the winner’s game.

In good times and in bad. A recent report by Morningstar investigated how successful investors are when trying to time markets. Ultimately, the report concluded, “The failure of tactical asset allocation funds suggests investors should not only stay away from funds that follow tactical strategies, but they should also avoid making short-term shifts between asset classes in their own portfolios.” Why? Missing out on a couple of the best-performing days wipes out your returns. And, to time correctly, you must be right twice – both when to get out and when to get back in.* - Diversification is the only free lunch.

This quote attributed to Harry Markowitz as essential now as ever. We believe that the most effective way to mitigate the risk of unexpected events is through broad, global diversification and a flexible investment process. This philosophy allows you to ride the wave through any crisis, such as natural disasters, social unrest, and pandemics, limiting risky overexposure to any particular sector or market. - Take the long view.

We don’t believe that this time it’s different, but instead the apocalypse du jour. You can be confident in your approach, your plan, and your team. We are here for you.