Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Author: Buddy Reisinger

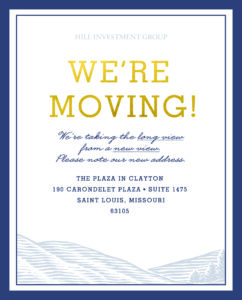

It’s Official…We’ve Moved!

As you read this, the global headquarters of Hill Investment Group has officially relocated to our new home at Carondelet Plaza in Clayton…less than two blocks away from our old home for more than 18 years. While only a few hundred yards away, the difference in the two spaces is dramatic because our landlord has taken the long view to outfit the building with dramatically better parking for our visitors, a wonderful common area, and state-of-the-art technology that will all support your overall client experience! Stay tuned for open house dates later this year. If you can’t wait, come on by! We’d love to show you around.

So long! Farewell! Until Next Time…

Earlier this month, the St. Louis HIG Team and a few alums gathered to celebrate Rick Hill and the next chapter in his life. The group shared some amazing stories, and, as always, Rick shared some heartfelt memories about his journey from Wharton to Anheuser-Busch and his entrepreneurial start-up, Hill Investment Group, with Matt, which he began in his 60s, when most people retire to the beach or golf course.

For those who’ve had the privilege to know Rick for decades, Rick has had snow-white hair since his 30s. So, we all donned the Silver Fox’s locks for this fun photo.

Rick, they broke the mold with you; however, the entire HIG team will carry on your vision and values for decades to come. It’s all in the spirit of Taking The Long View and doing what’s right for our clients. Every day.

Rick…there’s always a seat at the bar where everyone knows your name…Cheers!

Honoring Rick Hill’s Legacy

With Rick Hill officially retiring this month, it is high time to tell you about a special award we created in his honor. Since day one, Rick’s values and actions have been fundamental to our firm’s success. We announced the award at our annual holiday party in 2023 and are taking note of teammates living our firm’s values throughout 2024. To honor Rick’s legacy, the leadership team will give the Rick Hill Award each year (along with financial recognition) to the team member who best exemplifies living these values throughout the prior year.

As always, whenever you have an interaction with any of our team members that you believe reflects Rick’s and our values, please email Matt Hall directly. You are the best judge!