Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Buddy Reisinger

Swifty vs. Sethy

The charismatic character in the photo above is a marketing genius and a provocative thinker. His name is Seth Godin. Long-time friends know that I’m a Seth Godin Superfan. Call me a “Sethy.” Much of his writing reflects his strong belief in taking the long view.

The charismatic character in the photo above is a marketing genius and a provocative thinker. His name is Seth Godin. Long-time friends know that I’m a Seth Godin Superfan. Call me a “Sethy.” Much of his writing reflects his strong belief in taking the long view.

Seth often says, “People like us do things like this” when fellow tribe members connect their values with how they live their lives. In particular, Seth sounds like us…clients, team members, and other evidence-based investors in this recent post. See if you agree.

If you don’t quite get the connection and want to learn more, let’s talk! Set up a call or meeting here.

John Oliver on Jim Cramer

https://youtu.be/VAfGa5fsOm4

Whether you’re a client, friend, fellow advisor, or future client, if you’ve followed our thinking for more than a few months, you already know that we have a timeless investment philosophy: own global capitalism in a highly diversified (thousands of stocks), low-cost, tax-efficient manner rather than trying to select individual stocks or managers. Hill and our clients are investors. Jim Cramer and stock pickers are gamblers. A corollary is: remain invested all the time…good times and bad; don’t try to time the market. This brief and hilarious John Oliver video highlights the poster child of stock picking, CNBC’s Jim Cramer, and some of his “amazing” stock picks along with their results.

Let’s talk if you’re an investor and not yet a client!

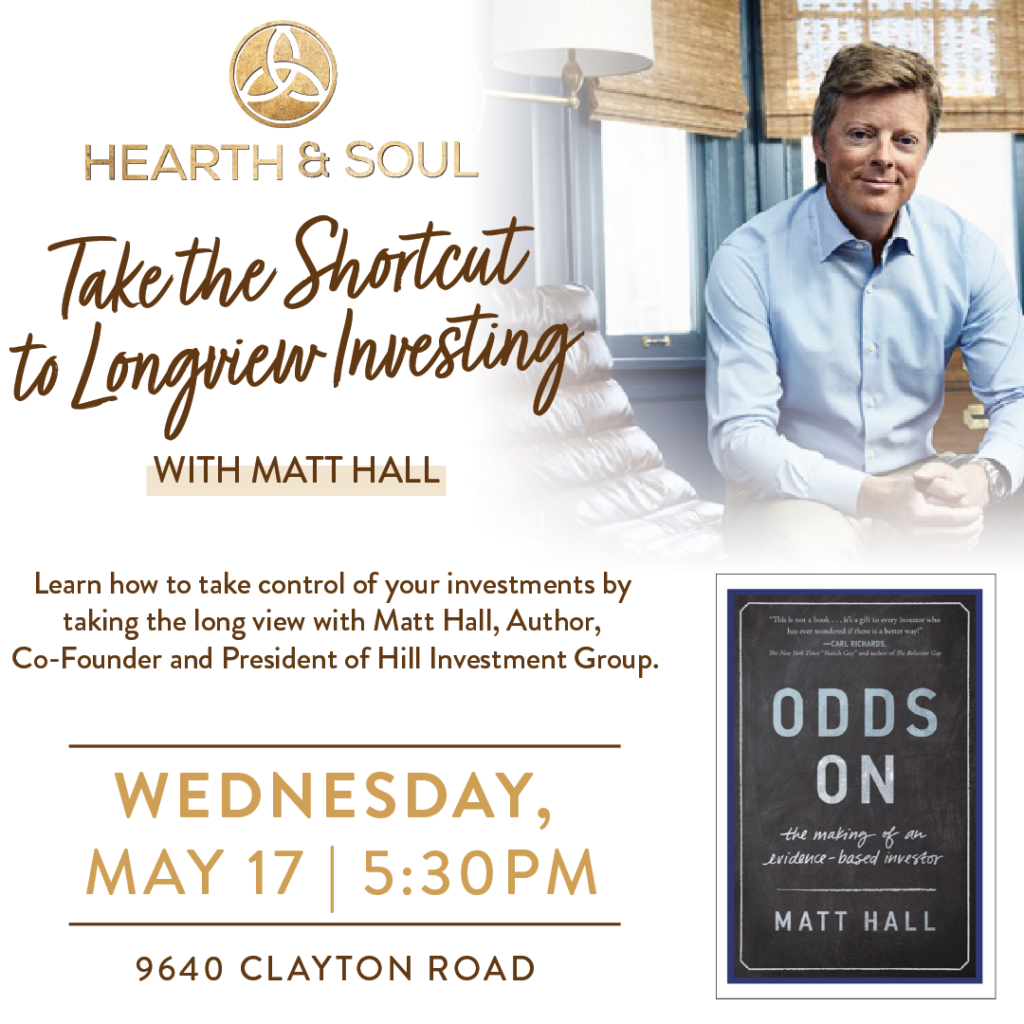

You’re Invited to a Special Event

We love it when good people and good ideas come together. Consider joining us on May 17th at Hearth & Soul for an event focused on financial education with our Matt Hall. If you have yet to hear, Hearth and Soul is the vision of the businesswoman, mom, volunteer, and friend Susie Busch Transou. Susie’s love of hospitality, blended with the desire to enrich the lives of others, has come together to make Hearth and Soul a special place in St. Louis.

And as long-time clients and friends know, Matt Hall’s book Odds On came out seven years ago and is still making waves. The book has taken Matt from the Netherlands (Odds On has been converted to Dutch) all the way to North Dakota (where Matt spoke to a university investment group). Matt’s unique ability will be on full display during this event as he boils down the lessons learned over his successful career, helping others improve their odds of success.

Add the Hearth & Soul with Matt Hall Event to your Apple Calendar