With the Recent Events in Ukraine, Should I Make Changes to My Portfolio?

There is no downplaying the news coming from Ukraine and Russia. While Russia makes up a small percentage of the overall global stock market (less than .25% as of February 23), Russia and Ukraine both play considerable roles in producing and supplying commodities such as liquid natural gas, wheat, etc.

What does this mean for you as an investor?

The situation is currently evolving. We know that political leaders from the West condemned Russia’s actions and vowed significant sanctions in response. Markets reacted with increased volatility, and some stocks retreated.

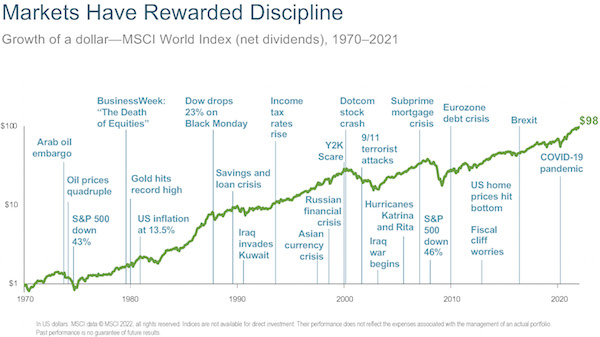

While no two historical events are the same, historical context is often helpful to put current events into context. The chart below illustrates the growth of a dollar invested in global equities alongside past crises. Think back to some of these events- it’s easy to remember how uncertain the future felt. Putting current events into this context helps us take the long view. The chart shows that markets rewarded disciplined investors for their grit. This chart is a good reminder of what it means when you invest for the long term, and the fortitude being demanded of us today.

Takeaways

- It is rarely advisable to mix emotions and investing.

History shows us that a critical ingredient of long-term investing success is having discipline in good times and in difficult periods. Markets have rewarded investors willing to tune out the noise and stick to their plan. So, we advise you to stick with yours. - Your systematic investing approach already adjusts to new information in real-time.

Investors in global equity portfolios inevitably face periods of geopolitical tensions. Sometimes these events lead to restrictions, sanctions, and other types of market disruptions. We cannot predict when these events will occur or exactly what form they will take. However, we can plan for them. We do this for you by managing your diversified portfolios and building flexibility into our investing process. - Staying invested is the winner’s game.

In good times and in bad. A recent report by Morningstar investigated how successful investors are when trying to time markets. Ultimately, the report concluded, “The failure of tactical asset allocation funds suggests investors should not only stay away from funds that follow tactical strategies, but they should also avoid making short-term shifts between asset classes in their own portfolios.” Why? Missing out on a couple of the best-performing days wipes out your returns. And, to time correctly, you must be right twice – both when to get out and when to get back in.* - Diversification is the only free lunch.

This quote attributed to Harry Markowitz as essential now as ever. We believe that the most effective way to mitigate the risk of unexpected events is through broad, global diversification and a flexible investment process. This philosophy allows you to ride the wave through any crisis, such as natural disasters, social unrest, and pandemics, limiting risky overexposure to any particular sector or market. - Take the long view.

We don’t believe that this time it’s different, but instead the apocalypse du jour. You can be confident in your approach, your plan, and your team. We are here for you.