The Big Picture: Integrating all of your Assets at Hill

Integrating Your 401(k) into your Financial Plan

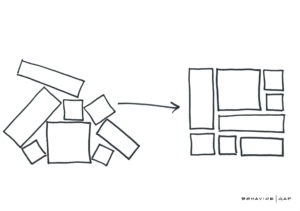

To have the best and most accurate picture of your financial situation, you must look at every asset (and liability). Did you know that you can integrate your 401(k), 403(b), 457, HSA, and variable annuity accounts into your overall plan? And get help managing the investments directly?

We have a new state-of-the-art system that allows for safe and compliant HIG advisor access to all of your accounts – taking the hassle, fiduciary responsibility, and management risk off your plate.

What does this mean for me?

- HIG taking fiduciary responsibility – upon setup, HIG takes on immediate responsibility for managing these assets.

- Combatting volatility with timely trading and rebalancing – ensuring your allocation is in line with your plan, no matter what’s happening in the markets.

- Investing in the right funds for you – full review of the cost and quality of available funds immediately upon setup, repeated quarterly.

- Tax efficiency through asset location – maximizing the value of these vehicles as an important part of your portfolio.

- Cost – the cost for this service is determined according to your regular fee schedule. See more details here.

Why it matters

These accounts shouldn’t be an orphaned part of your financial picture. Let us coach you more effectively and get the peace of mind knowing ALL of your assets are taken care of, no matter what.

Ready to set up your access to this service?

Schedule a call with me here. Setup takes no more than 15 minutes.